Today’s topic: If I make $1,000 a week how much child support do I pay?

Child support is a crucial aspect of family law. It is geared towards ensuring that children have the financial resources they need after their parents separate or divorce.

Besides, determining the amount of child support that the non-custodial parent is obliged to pay is a process that varies significantly from one state to another. It is influenced by variations in the cost of life, income, and legal frameworks.

In this blog, we will be breaking down the following things:

- The importance of $1,000/week income for child support.

- Models that courts use for calculating child support.

- What is the amount that you will owe?

- Additional factors that determine the child support amount.

- State-by-state discretion and what it means.

Therefore, if these are a few things that you want to know, keep on reading this blog till the end…

Why “$1,000/week” Matters: Understanding Income For Child Support

When parents Google “If I make $1,000 a week how much child support do I pay?”, what they’re really looking for is how courts convert weekly wages into the income numbers used in official child support guidelines. And understanding that conversion is crucial.

Most states do not use weekly income when determining support.

Instead, they rely on monthly or annual income in their worksheets. Therefore, if you earn $1,000 per week, courts typically convert that into monthly income using a standard calculation:

$1,000 × 52 ÷ 12 = $4,333/month (or about $52,000/year)

This converted number serves as the baseline for child support worksheets across the U.S.

What Counts As “Income” For Child Support?

Child support guidelines almost always look at gross income, defined broadly. For instance, according to family law resources such as IvyGrahamLaw.com and Cordell & Cordell, courts usually include:

- Wages & salary.

- Overtime, if it’s regular or expected.

- Bonuses and commissions.

- Self-employment income.

- Freelance or gig work.

- Investment income (interest, dividends, capital gains).

- Rental income.

- Unemployment benefits.

- Workers’ compensation.

- Social Security benefits.

- Employer benefits (in some states).

Courts may even “impute income” if they believe a parent is underemployed by choice.

Therefore, understanding your true gross income is the foundation for all further child support calculations.

The Two Main Models For Calculating Child Support In The U.S.

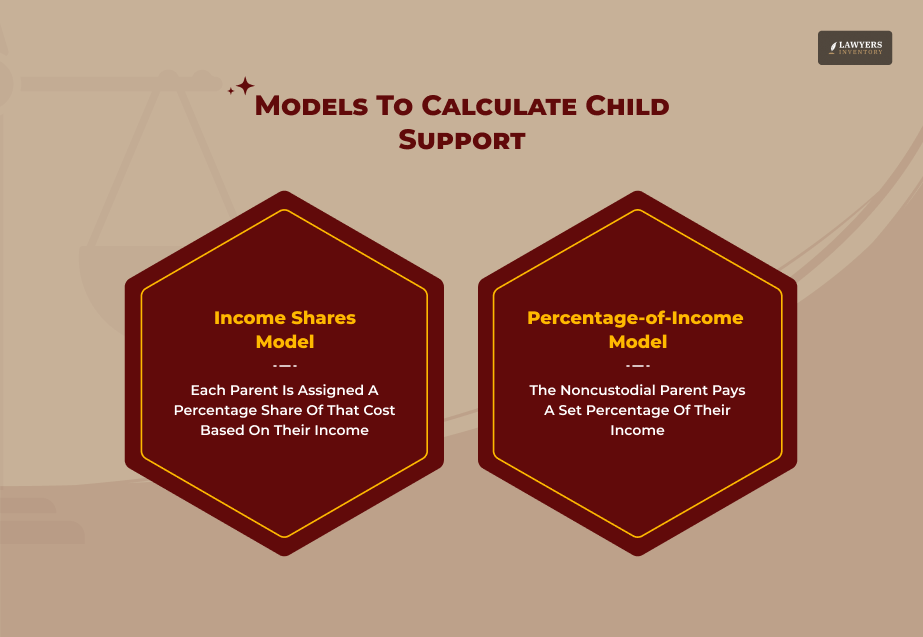

There is no single national formula. States use two main models (with variations), and each leads to different support outcomes.

1. Income Shares Model

Firstly, the Income Shares Model is the most widely used approach in the U.S. Nearly 40 states rely on it. Furthermore, sources like Cordell & Cordell and the Maryland People’s Law Library explain that this model aims to recreate what parents would have contributed if they lived together.

Rationale Behind The Model

- Both parents’ incomes are combined.

- The model estimates the total cost of raising the child.

- Each parent is assigned a percentage share of that cost based on their income.

- The noncustodial parent usually pays their share as child support.

Basic Steps

- Determine both parents’ gross monthly incomes.

- Combine the incomes.

- Find the state guideline chart amount for the number of children.

- Calculate each parent’s percentage share of total income.

- Apply that percentage to the guideline cost.

For example, if you earn $4,333/month and the other parent earns $2,000/month:

- Combined income = $6,333

- Your share = 68%

- If the guideline says one child costs $900/month, you would pay 68% of $900 = $612/month, or about $141/week.

2. Percentage-Of-Income Model

Secondly, there is the Percentage-of-Income Model. It is much simpler. For instance, the noncustodial parent pays a set percentage of their income. Additionally, the American Bar Association, ITW Law, and other public family law sources describe this model.

For instance, some states use flat percentages (like Wisconsin). On the other hand, others use varying percentages based on income ranges.

Common Example Percentages

(These are public examples referenced by resources like ITW Law and AmazeLaw; exact rates differ by state.)

- 1 child: 15%–20%

- 2 children: 20%–25%

- 3 children: 25%–30%

Please note: These numbers are illustrative only—your state may use much lower or higher percentages.

What You Might Owe: Sample Estimates For $1,000/Week Income

Below is a simple example table showing hypothetical support amounts for someone earning $1,000/week (about $4,333/month).

However, please remember that these are estimates, not state-specific results.

Sample Child Support Estimates

| Model & Scenario | Estimated Weekly Support |

| Percentage model – 1 child at 15% | $150/week |

| Percentage model – 1 child at 20% | $200/week |

| Percentage model – 2 children at 25% | $250/week |

| Percentage model – 3 children at 30% | $300/week |

| Income Shares Model (1 child)average range | $170–$250/week |

| Income Shares (2 children)average | $260–$350/week |

Why Results Vary

Support depends heavily on:

- The other parent’s income.

- State guideline formulas.

- Adjustments for insurance, childcare, and extraordinary expenses.

- Parenting time (overnights).

- Existing obligations (other children or alimony).

Read Also: Can I Take My Child Out Of State If There Is No Custody Order?

Additional Factors For Child Support Amount With A $1,000/Week Income

Apart from the basic guideline that we have already mentioned, there are several factors that determine your child support amount. Yes, even if you have a $1,000/week income.

For instance, here are a few that you need to know about:

1. Healthcare & Insurance Premiums

Firstly, family-law firms like BV Family Law and MCHP LLC note that many states:

- Give a credit to the parent paying the child’s health insurance.

- Or adjust support based on the cost of premiums.

Therefore, if you pay $200/month in premiums for the child, you may receive a corresponding reduction in your child support share.

2. Childcare / Daycare / Work-Related Costs

Secondly, according to MCHP LLC, courts typically add childcare costs required for the parent to work. For instance, common examples:

- Daycare so the custodial parent can work.

- After-school programs.

- Babysitting required for employment.

Besides, these costs are usually prorated based on income percentages.

3. Special Needs, Medical Costs, Education, Extracurriculars

Thirdly, courts commonly categorize these as extraordinary expenses. For instance, these include:

- Ongoing medical treatments.

- Therapy.

- Private school or tutoring.

- Expensive extracurriculars (sports, music, etc.).

These are typically added to the guideline amount and divided proportionally.

4. Custody & Parenting Time

Shared custody can significantly reduce support. Sources such as Terzich & Ort LLP and the Maryland People’s Law Library explain:

- More overnights = potential support reduction.

- Truly 50/50 custody may drastically lower payments.

- Some states use a “parenting time adjustment”

5. Existing Support Obligations (Other Children, Alimony)

Finally, resources like Jones Auger and the Maryland People’s Law Library note that guidelines often account for:

- Child support paid for children from other relationships.

- Alimony paid or received.

- Legal obligations that reduce spendable income.

These can affect your guideline amount significantly.

Read Also: How to Get Full Custody of a Child as a Mother? [According to Experts]

Why Results Vary So Much: State-by-State Differences & Court Discretion

Every U.S. state sets its own guidelines.

For instance, sources like Pinkston Law Group and California Courts show major differences:

- Some states rely heavily on income shares.

- Others use percentages.

- Some use hybrids or tiered systems.

- Others apply caps on high incomes.

- Some consider only net income, others gross.

Court Discretion

Family law sources like MCHP LLC emphasize that judges can deviate from guidelines for:

- Low income.

- Extremely high income.

- Special medical needs.

- Travel costs for visitation.

- Unusual work-related expenses.

Support Orders Can Be Modified

According to Cordell & Cordell and the American Bar Association, child support can be changed if:

- Income changes.

- Parenting time changes.

- The child needs change.

- You lose a job.

- You have additional children.

How To Estimate Your Own: If I Make $1,000 A Week How Much Child Support Do I Pay?

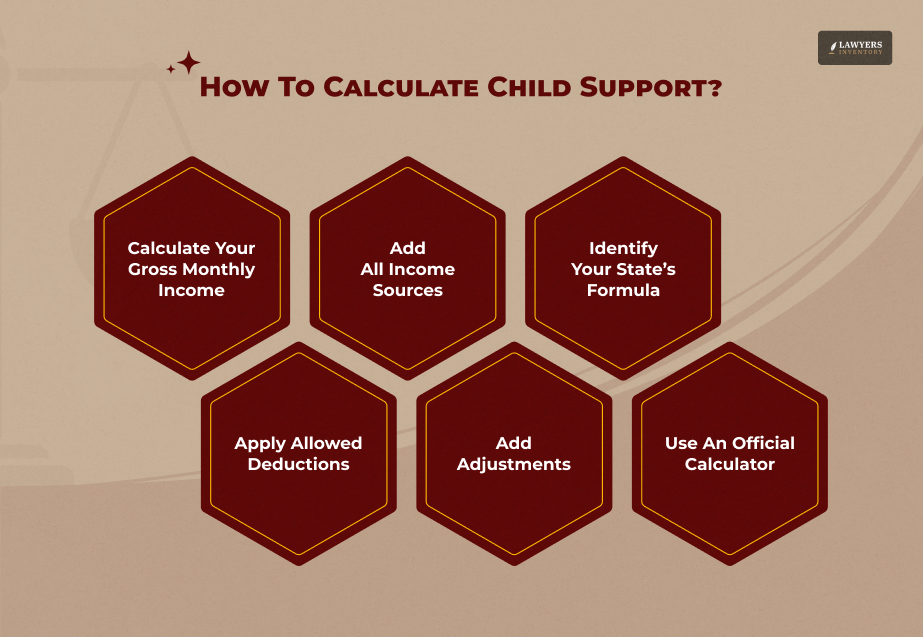

Here’s a simplified step-by-step guide anyone can use.

Step 1: Calculate Your Gross Monthly Income

Firstly, convert weekly income:

Weekly income × 52 ÷ 12 = Monthly income

For $1,000/week: $4,333/month

Step 2: Add All Income Sources

Secondly, it is important that you add all your other sources of income. For instance, you need to include:

- Bonuses.

- Overtime.

- Gig work.

- Investment income.

- Employer benefits.

- Rental income.

- Social Security benefits.

Step 3: Apply Allowed Deductions (State-Specific)

Thirdly, you need to go ahead and apply for forms of deductions. For example, this may include:

- Taxes (if your state uses net income).

- Mandatory retirement contributions.

- Health insurance for the child.

- Existing support obligations.

Step 4: Identify Your State’s Formula

Use:

- Income shares formula, if applicable

- Percentage-of-income formula, if applicable

- Hybrid formula (in some states)

Step 5: Add Adjustments

Include:

- Premiums for child health insurance

- Childcare costs

- Medical, special needs, educational expenses

- Parenting time adjustments

Step 6: Use An Official Calculator

Finally, it is important that you use an official calculator. For instance, sources like LegalMatch and the Maryland People’s Law Library recommend using state calculators, many of which are available online from:

- State child support agencies.

- Department of Human Services.

- Family courts.

- State bar associations.

Basically, you need to always rely on official calculators, not generic online ones.

Common Pitfalls & Misconceptions

To protect yourself legally and financially, avoid these errors:

- Confusing gross and net income: Some states require net income (after taxes). Others use gross.

- Forgetting about non-wage income: Freelance, investments, rental income — all usually count.

- Ignoring add-on expenses: Childcare, insurance, and medical costs can significantly change the guideline amount.

- Assuming the same formula applies everywhere: Each state is different. Some vary by county.

- Relying on old or generic “percentage calculators”: Most are outdated and do not follow state guidelines.

Expert Tips & Best Practices (For Parents Paying Or Receiving Support)

Here are some of the tips that experts advise on when it comes to paying or receiving child support:

- Keep detailed records of all income: wages, side jobs, tips, bonuses, and benefits.

- Maintain receipts for medical bills, childcare, activities, and school expenses.

- Use official calculators, not generic estimates.

- Reassess regularly, especially after job changes or parenting time changes.

- Document communication with the co-parent.

- Collaborate on extraordinary expenses when possible to avoid litigation.

In conclusion, the finances of both the parents, the kids’ count, and the custody situation are what determine the amount of child support. At the core, the idea is that the kid should have the same level of living after the divorce of the parents.

The money required for the children’s education, healthcare, and other supplementary needs may also be included in the calculations, besides the money each parent can give.

0 Reply

No comments yet.