Have you ever heard of a financial institution involved in more lawsuits than a reality TV star? Well, buckle up because we’re about to dive into the murky world of Global Lending Services.

It’s a company that promises to be a financial lifeline for several individuals and businesses but has been tangled in a web of legal battles.

Consider a scenario where a tiny company owner wants to grow but needs more funds to do so. When they apply for a loan through Global Lending Services, they are entangled in an intricate arrangement that includes excessive interest rates and unstated costs.

Or maybe a dealership discovers that Global Lending Services is involved in dishonest business practices that could damage its reputation after striking a profitable contract with the company.

These are only a handful of the legal problems that may arise while using global lending services. I’ll review frequent mistakes, share observations from actual cases, and provide helpful guidance to assist you in getting around the legal system in this blog.

So, whether you’re a business owner, a dealership representative, or a consumer interested in understanding financial services, this article will help you!

Understanding Global Lending Services: A Financial Lifeline or a Legal Nightmare?

So, what exactly is Global Lending Services? Think of it as a financial middleman. They connect businesses with various lenders, offering various financial opportunities. Need a loan to expand your operations? They’ve got you covered.

Looking for equipment financing? They can help with that, too. Global Lending Services is a one-stop shop for businesses seeking capital.

But here’s the thing: while they offer a valuable service, the road to financial freedom can sometimes be paved with legal challenges. It’s like those reality TV shows where everything seems perfect initially, but then the drama unfolds. Unfortunately, Global Lending Services hasn’t been immune to its fair share of controversies.

Usually, who uses Global Lending Services? The answer is a range of companies, from start-ups to well-established multinationals.

If you’re a small business having trouble obtaining typical bank loans, Global Lending Services may appear like a ray of hope.

Similarly, dealerships frequently collaborate with them to provide their clients with financing choices. However, it’s crucial to proceed cautiously when pursuing these financial prospects.

Legal problems can suddenly surface in the loan industry, which can be complex. The story of Global Lending Services serves as a warning for companies looking for financial support, as it involves everything from contract disputes to fraud claims.

Common Legal Issues in Global Lending Services

The Global Lending Services world can be full of challenges, especially when talking about legal issues.

The journey to find support through money is sometimes unfortunate, as it is a place overrun with pitfalls. I shall consider a few common legal issues when dealing with this financial institution.

Contract Disputes

In fact, contract disputes may be the main reason businesses face the biggest embarrassment.

Clients often find themselves in hot waters with the courts as they fight over conditions and the breach of contract that they think has been committed.

Such conflicts can carry on for a long time, be very expensive, and seriously harm a company’s reputation.

Loan Fraud

Of course, loan fraud is also a major concern. And guess what? There are literally tons of examples of this kind.

Thus, none could be more convincing than the one that presents individuals or companies that have been cheated and lost their property to a thief using the Loan as his weapon during the process of granting the Loan through Global Lending Services.

Such activities can be from identity theft up to false claims about loan terms being secrets.

Consumer Protection Laws

Consumer protection laws are also very important in the connection between Global Lending Services and its clients.

These laws shield consumers from such things as unfair treatment, dishonest advertisements, and excessively high rates of interest.

In case of violation of such laws, this can lead to the institution taking a legal action and facing financial consequences that are not small.

Debt Collection Practices

In conclusion, debt collection methods may also lead to legal issues. Global Lending Services might have to recover overdue debts just as any other lender would.

On the other hand, the collection must be carried out in accordance with certain laws, for instance, the Fair Debt Collection Practices Act (FDCPA).

Non-compliance with the FDCPA can cause legal actions and high penalties.

Dealerships and Global Lending Services

Dealerships and financial institutions often find themselves in a symbiotic relationship, with each benefiting from the other’s services.

One such partnership frequently involves dealerships working with companies like Global Lending Services to provide financing options to their customers.

Financing Arrangements and Legal Disputes

Customers frequently have the choice to finance their car purchase when they buy it from a dealership.

The dealership can then collaborate with Global Lending Services to provide favorable terms and rates for lending to its clients.

Both the dealership and Global Lending Services may profit from this agreement, enabling the dealership to sell more cars and supply Global Lending Services with consistent loan applications.

Legal issues, though, can also arise in this partnership. There may be disagreements about commissions, refunds, and consumer fraud.

Dealerships and Global Lending Services could not agree on the compensation dealerships earn for each loan granted.

Conflicts may also arise over either company’s incentives or refunds to clients.

Consumer Protection Laws in Dealership

Consumer protection laws also significantly influence the relationship between dealerships and Global Lending Services.

These laws protect consumers from unfair or deceptive practices, such as lemon laws, odometer fraud, and deceptive sales practices.

Both parties must comply with these laws when a dealership works with a financial institution like Global Lending Services.

Latest Lawsuits of Global Lending Services

Like I mentioned earlier, legal drama in the finance world? Totally normal. Lenders and borrowers don’t always see eye to eye—and when they clash, it often plays out in court.

Two recent cases involving Global Lending Services (GLS) are perfect examples: Arels Patushi v. GLS and Butler v. GLS. Let’s break down what happened in each one.

Arels Patushi v. Global Lending Services (GLS)

This one kicked off in the Connecticut District Court and centered around a breach of contract. It all stemmed from a car loan deal that didn’t exactly go smoothly.

The Case:

Patushi bought a car from BMW of North Haven. He signed an installment contract to finance it, which eventually got handed over to Global Lending Services. Everything should’ve been straightforward, right? But nope—Patushi claimed GLS didn’t stick to their side of the deal and ended up filing a lawsuit.

The Dispute:

GLS had a different take. They pointed to a clause in the contract—a mandatory arbitration clause.

Basically, that meant any disagreements had to be sorted out through arbitration instead of a court battle. GLS asked the judge to press pause on the lawsuit and send the whole thing to arbitration.

The Court’s Decision:

The judge agreed with GLS. The lawsuit got put on ice while both sides headed to arbitration to figure things out privately. No big dramatic courtroom showdown—just behind-the-scenes negotiations (at least for now).

Implications:

So, why should anyone care? Well, this case is a reminder that those small-print contract clauses matter—a lot. Arbitration clauses, especially, can change how a dispute plays out.

If you’re signing anything with a lender, make sure you read everything. Otherwise, you could end up stuck in a legal process you didn’t even realize you agreed to.

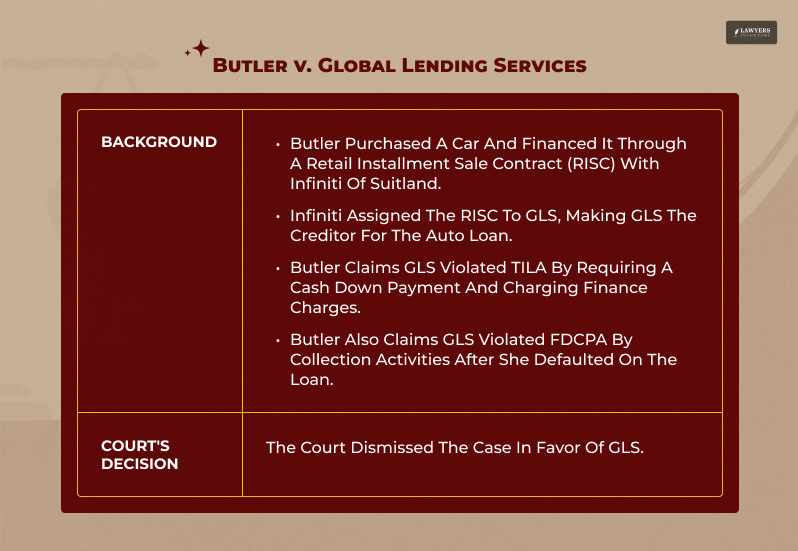

Butler v. Global Lending Services

Now, this second lawsuit was brought by Georgia Robinson Butler. She took Global Lending Services to court, accusing them of violating both the Truth in Lending Act (TILA) and the Fair Debt Collection Practices Act (FDCPA). That’s a serious one-two punch.

The Case:

Butler had bought a car and financed it through Infiniti of Suitland. She signed a retail installment sale contract (RISC), which then got passed off to GLS. That made GLS the new lender in charge of her loan.

Butler said GLS stepped out of line. She claimed they required a hefty cash down payment and tacked on finance charges that were way too high. On top of that, she said their debt collection tactics broke federal law.

The Dispute:

GLS wasn’t having it. They defended the down payment as totally legal and said the finance charges were disclosed properly under TILA rules. Plus, they pushed back on the FDCPA part—saying they weren’t technically “debt collectors” because they were collecting a loan they already owned, not one they bought.

The Court’s Decision:

GLS won. The court tossed out Butler’s claims. It ruled that GLS didn’t count as a “debt collector” under the FDCPA, and Butler hadn’t shown enough evidence to prove GLS violated TILA. In other words, case closed.

Implications:

This ruling has ripple effects too. It reinforces just how important it is to understand the fine print in loan contracts—especially the parts about costs and repayment.

It also shows how tricky these consumer protection cases can get. Just because something feels unfair doesn’t always mean it crosses the legal line.

Note: Both of these cases underline one key thing: when it comes to borrowing money or financing something like a car, details matter. Whether it’s an arbitration clause or a finance charge, you’ve got to read the contract like your wallet depends on it—because it does.

Car Financing and Dealership: Legal Implications You Should Keep in Mind!

Financing a car purchase is frequently an important step. Many dealerships collaborate with financial organizations such as Global Lending Services to give their consumers appealing lending choices.

However, this process might be laden with legal difficulties that buyers should know. One prevalent problem is dishonest sales tactics.

Dealerships may employ deceptive techniques to persuade clients to buy cars they don’t require or can’t afford. Legal issues and financial hardship may result from this.

Odometer fraud is another possible issue. Odometers can be tampered with by some dishonest dealerships to make cars appear to have fewer miles than they have. This could greatly increase the car’s value and necessitate expensive repairs.

Additionally, lemon laws protect consumers who purchase defective vehicles. If a vehicle repeatedly breaks down or has significant defects, consumers may be entitled to a refund or replacement under these laws.

Which Lawyer Will Help You With Such a Case?

If you find yourself in a legal conflict with Global Lending Services, dealerships, or loans, make sure you get the help of a competent lawyer.

Below are some types of lawyers who can help you:

- Consumer protection attorney: These lawyers protect consumers’ rights and are knowledgeable in turning legal problems which are caused by lending practices into a success story.

- Business attorney: A business attorney can give you the best advice if you are a business owner and you have legal issues with loans or financing agreements.

- Contract attorney: If a contract has been broken in your dispute, a contract attorney will help you understand your rights and negotiate a good settlement.

When it comes to choosing a lawyer, it is important that you keep several factors in mind. These include their:

- Experience with similar cases.

- Reputation and track record.

- Fee structure.

Additionally, it is a great idea to meet with various attorneys to determine your best match.

Legal Tips for Businesses Using Global Lending Services

Your business is vital to you, so you have to make sure that its interests are protected when dealing with Global Lending Services or any other financial institution.

You must try to keep in mind the following advice:

Check Contracts Carefully

Read all terms and conditions carefully before you sign any loan agreement. Make sure you understand the interest rates, fees, repayment terms, and other necessary information.

Remain Informed About Regulations

Be on top of all relevant local, state, and federal laws and regulations regarding lending practices. This way, you can make sure you are compliant with all applicable laws.

Different Ways To Solve Conflicts

In the event of a disagreement, I would really advise you to resort to other options such as arbitration or mediation. Such solutions will usually be more efficient and will cost less than if one goes through the court.

Read More:

- Frank Azar Law Firm Can Help You With THESE Cases

- Ethical Dilemma Examples You MUST Learn From in Everyday Life

- How Alan Jackson, After Cuddling with Client, Proved Justice is Blinded

0 Reply

No comments yet.