Today we talk about Generational Equity Reviews. Hiring the proper M&A advisor is arguably the most important decision a business owner will ever make when it comes to selling his or her company.

Among the leading firms specializing in lower middle market M&A, Generational Equity, commonly referred to as Generational Group, is often considered by potential sellers.

This report equips the reader with an impartial, fact-based review of the company, synthesizing employee feedback platforms, public complaints, legal filings, and the essential criteria of any exit planning assessment.

We will show you how to compare Generational Equity’s services against industry norms, detail its fees, and provide a critical checklist for vetting any M&A advisor under consideration.

Generational Equity Reviews: Should You Trust Generational Equity?

Generational Equity is a highly active M&A firm with one of the largest presences in the lower middle market space.

Their multi-phase, comprehensive process to sell a business is well-documented, and they maintain an A+ rating with the Better Business Bureau [BBB].

This indicates a strong responsiveness to customer complaints.

Additionally, Glassdoor and Indeed show mixed-to-positive overall ratings from employees of the company, indicating mixed internal culture and job satisfaction.

However, Generational Equity Reviews teach us that business owners should approach any M&A firm with due diligence. Key considerations will include verifying their specific track record for your industry, understanding their success fee structure, and noting their history.

GE was involved in a notable data breach notice in 2023, a critical point for any seller handling sensitive PII.

Generational Equity Reviews – Recommendation

For smaller business owners-under $1M EBITDA, be sure to closely benchmark the fee structure of GE versus boutique brokers. For larger companies-$1–50M revenue-Generational Equity should be considered a strong candidate.

However, you will want to use the vetting checklist provided in this guide to validate the claims-particularly in data security and specific transaction experience.

Generational Equity Reviews – What Is Generational Equity? What Services Do They Offer?

In Generational Equity Reviews, Generational Equity is part of the Generational Group – an M&A advisory and exit planning firm review specialist for privately held companies.

Their core focus is on the sell side, helping owners prepare, value, market, and ultimately sell their businesses to the best buyer for the best price.

As per authentic reviews, Generational Equity generally offers a four-phase, proprietary process.

1. Preparation/Valuation

Initial assessment and determination of the value of the business using accepted methodologies.

2. Marketing

Preparation of the Confidential Information Memorandum, or offering memorandum, and commencing marketing to their proprietary buyer network.

3. Negotiation

Managing buyers’ discussions, LOIs, and due diligence.

4. Closing

Finalizing the Purchase Agreement and overseeing the closing process.

Their offerings compete squarely with regional investment banks and national business brokerages but bring a differentiated level of scale and focus on comprehensive exit strategy planning.

Typical client profile & industries served.

Generational Equity focuses principally on the lower middle market M&A space.

Revenue Bands

Typically, between $2 million and $250 million.

Industries

Highly diversified from manufacturing, technology, healthcare services to business services, distribution, and logistics.

Geography

Mainly U.S.- and Canadian-based companies.

What Generational Equity Reviews Say – Employee Perspective, Client Testimonials & Independent Complaints?

In sum, the overall reputation of Generational Equity is quite complex, divided between internal employee experiences, company-published success stories, and external public complaints.

Employee Perspective

Feedback on platforms like Glassdoor and Indeed shows a common pattern for high-growth, commission-driven firms.

Generational Equity Reviews scores are generally mid-range, with frequent praise for the fast-paced environment and learning opportunities. These are balanced by common Generational Equity complaints regarding management, long hours, and high turnover typical of a high-volume sales structure.

Comparable scores often reflect gender and diversity metrics and are generally neutral.

Client Testimonials – Company-published

The official website of Generational Group hosts an impressive number of detailed case studies and positive reviews about Generational Equity, showcasing successful exits with positive outcomes for owners. These should be considered as marketing collateral and verified with independent references.

Generational Equity Reviews – Independent Complaints (BBB, Reddit)

The profile in the Better Business Bureau is strong because of the responsiveness by the company.

However, there does exist a pattern of consumer complaints, often around the initial valuation/retainer phase. This is just an indication of how all contracts must be meticulously looked at before signature.

Known Legal/ Regulatory Issues & 2023 Data Breach

The very first thing to consider in research into the Generational Equity Reviews is the data security incident in 2023.

In February 2023, Generational Equity experienced a data security incident that caused a data breach notice filed with state regulators such as the Massachusetts Attorney General. Reports from various firms detail that this breach has exposed the sensitive personal and financial information of at least 2,200 individuals.

Practical Consequences For Sellers – Generational Equity Reviews

Security of data is the most important part for a business owner in the M&A process. The data shared typically covers detailed financial records, customer PII, and proprietary information.

What to do if you were affected or are considering using the firm:

1. Monitor Credit

Ideally, subscribe to the credit monitoring services right away, especially if you received an official notice from the company.

2. Breach Notice Review

Read the official notice by the regulator to understand exactly what kind of data has been compromised.

3. Ask about Remediation

Ask specifically what security measures the firm has implemented since the breach in 2023 in order to protect future client data rooms.

4. Consult Legal Counsel

If your data was involved, consult a legal professional who has dealt with data breach litigation.

Read Also: The USAA Data Breach Settlement- Your Guide To Claims And Compensation

Generational Equity vs Boutique M&A Advisors: Generational Equity Reviews Comparison

When considering any firm, one has to look beyond the testimonials and drill deeper into certain key operational metrics. Large-scale operations for Generational Equity mean wide buyer networks, but this normally comes with a less customized approach than some of the smaller, high-touch boutique advisors.

Deal Size Typical Focus

Generational Equity focuses on the Lower-Middle Market, primarily with businesses ranging from $2M to $250M in revenue.

Boutique M&A Firms, typically focus on the larger Middle Market ($10M to $500M) or specialize deeply in a niche industry.

Fee Structure

Generational Equity usually employs a Retainer fee (prepaid/monthly) in addition to a Tiered Success Fee at close.

Boutique M&A Firms are usually structured as Success Fee only or a much smaller nominal retainer fee.

Process And Personalization

Generational Equity operates a high-volume, standardized process. This implies efficiency but at the same time feels less customized to the owner.

Boutique M&A Firms will provide high-touch, tailored service, thereby investing more time and detailed research in select client objectives.

Buyer Network Strategy

Generational Equity Reviews uses an enormous, proprietary, and wide database of financial and strategic buyers.

Boutique M&A Firms focus on very specialized, industry-specific outreach usually to a much smaller but highly relevant set of buyers.

Data Security & Compliance In Generational Equity Reviews

In Generational Equity Reviews, data security is paramount, but all the post-2023 remediation attempts must be independently verified by Sellers because of the known data breach.

For Boutique M&A Firms, security standards vary greatly. You should require proof of current security protocols, regardless of the firm’s size.

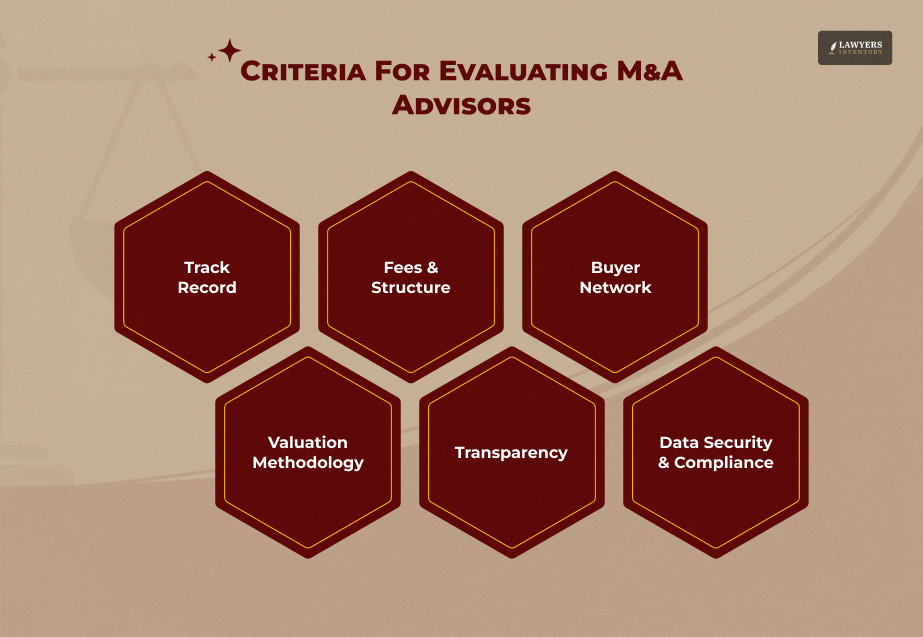

Evaluation Criteria (Listing Of Parameters To Include)

When comparing reviews of M&A advisors, keep the following criteria in mind to set an evidence-based framework for considering Generational Equity or any other option:

1. Track Record

Ask for verified deals closed, including quantity and size ranges. Ask what percentage of sellers achieved their target price or better.

2. Fees & Structure

Determine if the retainer is credited against the final success fee (%), with an understanding of any fee breakpoints, including a reduced percentage for higher transaction values.

3. Buyer Network

Determine how proprietary the buyer network is versus simply leveraging public listing services; proprietary access can drive higher multiples.

4. Valuation Methodology

Ask for an independent, transparent process for valuation based on industry comps; understand how the exact EBITDA multiple is calculated.

5. Transparency

Request a sample of their offering memorandum – redacted. Understand the quality. Be sure to review their non-disclosure agreement practices prior to signing.

6. Data Security & Compliance

Request proof of recent third-party security audits; also, enquire in detail about their data breach history and actions taken toward remediation.

7. References & Verifiable Case Studies

Request three client references for recently closed transactions in your specific industry.

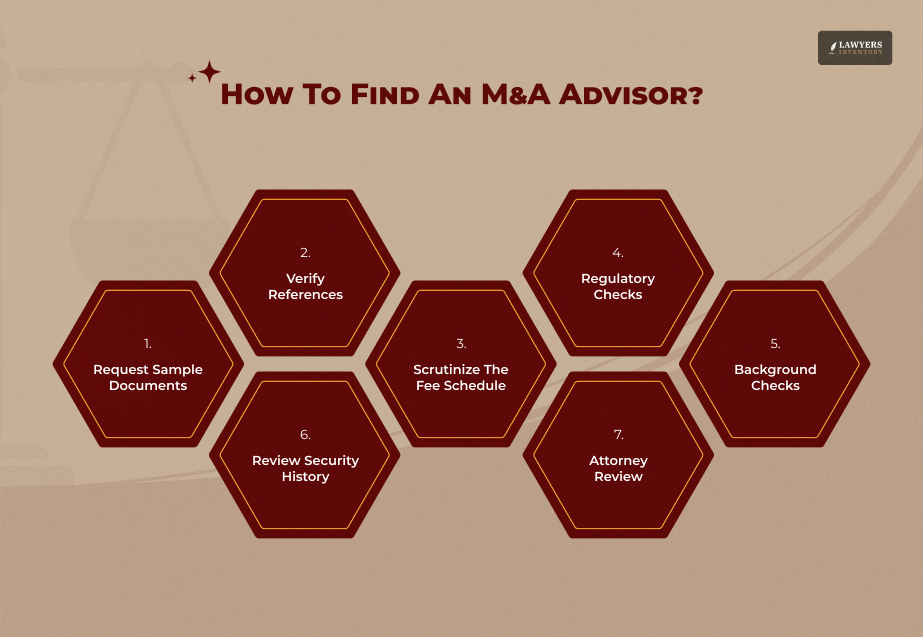

Step-By-Step: How To Vet Any M&A Advisor Practical Checklist

Use this actionable checklist before entering an agreement with Generational Equity or any other exit planning firm:

1. Request Sample Documents

This includes a request for a redacted sample CIM and a copy of the standard confidentiality agreement.

2. Verify References

Insist on contacting three clients whose transactions closed in the last 12–24 months; ask them about the timeline and final price relative to the initial valuation services.

3. Scrutinize the Fee Schedule

Request the fee schedule in writing. Know when the retainer is owed and what specific services it will cover.

4. Conduct Regulatory/Background Checks

Check the firm’s profile with the Better Business Bureau [BBB] and review state and federal financial regulator filings.

5. Review Security History

Specifically ask about the 2023 Generational Equity data breach and provide documentation that reflects current data encryption and security practices in place, according to Massachusetts.gov.

6. Attorney Review

Have your attorney who has experience with M&A transactions review the engagement letter before signing.

Pricing, Timing & What To Expect In A Typical Engagement

The typical fees of Generational Equity track most closely with the most common model in the industry: an upfront retainer payment with a success fee, which is a percentage of the eventual transaction price.

Retainer

This includes initial valuation, financial preparation, and production of marketing materials. Retainers can vary greatly and are normally non-refundable.

Success Fee

As it is the main fee, it typically comprises a tiered percentage of the deal value and varies from 5% to 15% in the lower middle market. It usually decreases according to the deal size.

Timeline

With all things considered, an average engagement, from initial exit planning through closing, could take anywhere from 6-18 months based on the project’s intricacies and/or market dynamics.

Read Also: AT&T Data Breach: What Affected Customers of This $13 Million Class Action Should Know

Generational Equity Reviews – Red Flags & Safety Guidance

Watch out for these Generational Group reviews red flags when dealing with any M&A advisor:

High-Pressure Sales

Any advisor who asks you to sign immediately, or any other high-pressure sales techniques.

Unrealistic Valuations

Sale price promises that are much higher than would be substantiated by an independent third-party valuation report.

No Verifiable Closed Deals

Not willing to provide recent, verifiable client references in your industry.

Unresolved Complaints/Breaches

A history of unresolved complaints or, in the case of GE, an inadequate explanation of data breach remediation.

Expert Tips & Best Practices For Sellers

A successful sale is all about preparation and vigilance.

Get An Independent Valuation First

Invest in an independent valuation report before talking to any advisor. This provides a baseline and makes it harder for high-pressure firms to anchor you on to an unrealistic price.

Escrow

You may want to consider insisting that part of the purchase price be put in escrow with a neutral third party for protection against post-closing claims.

Negotiate Fee Cliffs

If the advisor proposes a success fee, negotiate a lower percentage-a “cliff”-if the sale price exceeds a specific threshold.

Utilize a Transaction Lawyer

Your regular corporate counsel may not be sufficient; engage an attorney with extensive experience in M&A Purchase Agreements.

Audit Your Data Room

Make sure all sensitive data – for example, PII and customer lists – is encrypted and that access is tracked rigorously, prior to sharing with any buyer.

Alternatives

Other reputable advisers and follow-up actions While Generational Equity offers a large-scale, structured approach, alternatives might be a better fit depending on the size of your revenue and industry.

Boutique M&A Advisors

Usually highly specialized-for instance, only tech or only healthcare-offering a very high-touch service.

Regional Investment Banks

Typically reserved for larger deals, often $50M+, with very advanced modelling.

Business Brokers

Generally better suited for smaller main street businesses, under $2M valuation, with lower fee structures.

Frequently Asked Questions (FAQs):

Now, we’re going to be answering some of your most frequently asked questions.

While their internal marketing process may be quick, the actual sales process, from engagement through closing, generally ranges between 9 to 18 months. This is greatly dependent upon factors that an advisor has little control over, such as buyer due diligence, availability of financing, or regulatory approvals.

Generational Equity maintains a very large proprietary database of financial and strategic buyers. While that constitutes a major strength, depending on the specific or niche business, they will be utilizing broader marketing channels to ensure maximum exposure and competition are attained, which is critical in realizing the highest EBITDA multiples.

Other than simple testimonials, ask for three redacted one-page summaries of recent Purchase Agreements in your industry. Focus on verifiable data points, including the final multiple achieved, the original listing price, and specific closing date. If they refuse, that could be a red flag.

0 Reply

No comments yet.