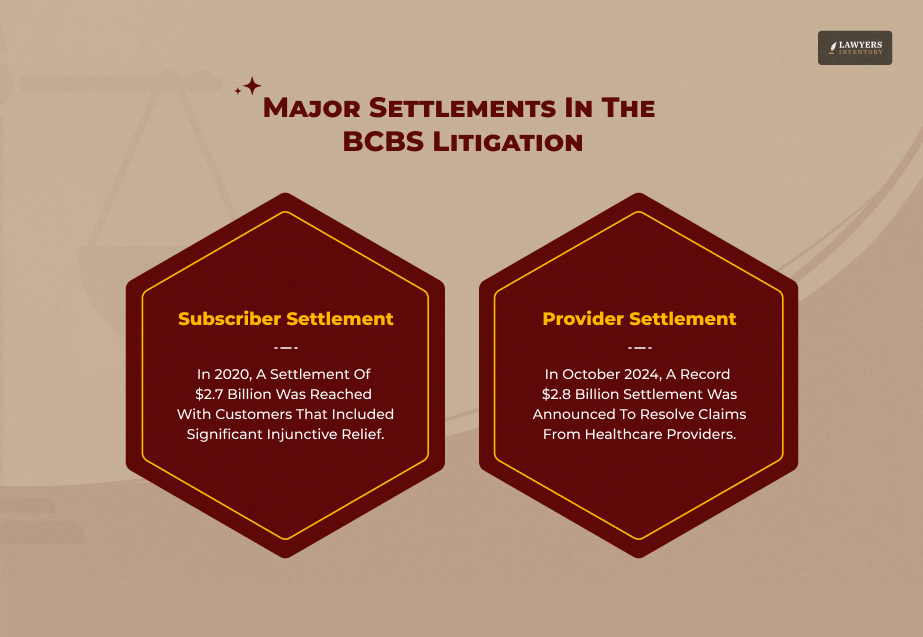

The BCBS settlement is one of the largest healthcare antitrust class actions in U.S. history. Blue Cross Blue Shield agreed to pay as much as $2.8 billion to resolve claims related to anticompetitive practices. This record settlement not only affects all healthcare providers but also individuals and employers who paid premiums as part of a separate yet concurrent settlement.

Whether the individual is a medical provider who treated BCBS patients or a policyholder, understanding how the BCBS settlement works is key to getting your share of the funds. This comprehensive guide reviews eligibility rules, the process, and estimated payments.

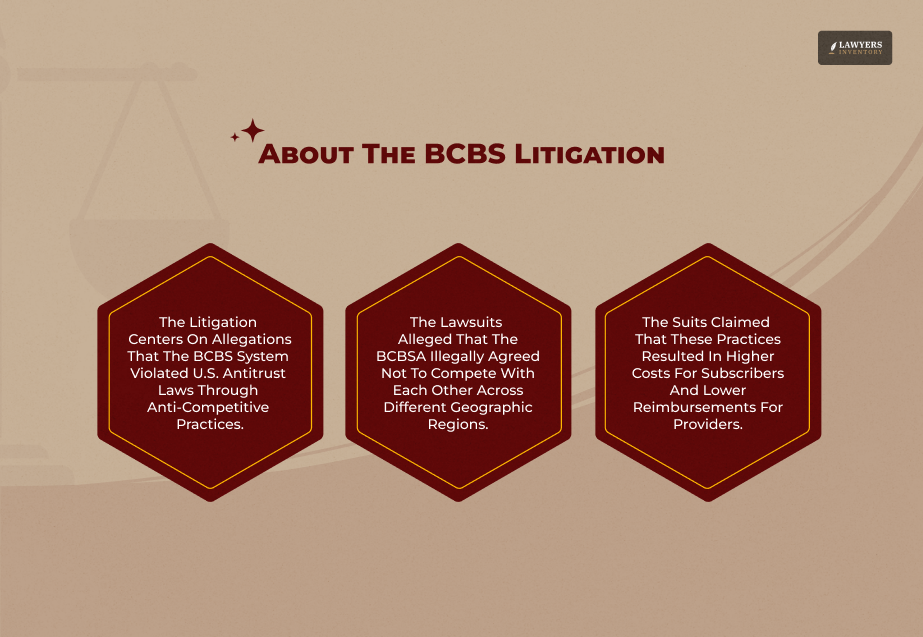

What Happened And Why: Background Of The BCBS Litigation

The BCBS settlement has its roots in an antitrust class action lawsuit. Filed more than a decade ago, that litigation was based on allegations of anticompetitive practices.

The Allegation – What Providers Said

The complaints alleged that the independent Blue Cross Blue Shield plans conspired to divide up the U.S. health insurance market among themselves. By agreeing to operate only within specific service territories belonging exclusively to each, the plans allegedly eliminated competition.

Result

This supposed lack of competition then enabled the BCBS plans to keep the provider reimbursement rates low.

The Claim

The providers claimed that they had to accept lower payments because they did not have any meaningful alternative for their patients covered under a BCBS plan.

Timeline of the Case

The case ran for years. Here are the key dates related to the final BCBS settlement:

a. Original Filing– The first claims go back to 2012.

b. Settlement Agreement– A final settlement agreement was proposed in 2024.

c. Final Approval– In 2025, a U.S. Judge granted approval for the $2.8 billion BCBS settlement.

Scope: Who Could Be Included

There are two different classes, or groups, affected by the final BCBS settlement, namely, the Provider Class and the Subscriber Class.

Provider Class

This means all hospitals, physicians, group practices, and other healthcare facilities that rendered services to the BCBS-insured patients during the claim period.

Subscriber Class

This was an earlier, separate settlement that included individuals and employers who paid premiums for BCBS health insurance plans.

Terms Of Settlement – Cash, Reforms, And Who Gets What

The settlement includes monetary relief, in addition to significant operational reforms for the insurance company, Blue Cross Blue Shield.

Monetary Relief – The $2.8 Billion Fund Breakdown

The total settlement fund allotted for the resolution of the provider claims is approximately $2.8 billion. This huge amount is apportioned as follows:

Healthcare Facilities

Of this amount, about $1.78 billion will go to hospitals and health-care facilities.

Medical Professionals

Of this, nearly $152 million is designated for individual physicians and group practices.

Legal Fees

A big chunk goes towards attorney fees and administrative costs.

Injunctive & Operational Reforms

Beyond the money, significant changes in how the plans operate are required by the BCBS settlement. This is often referred to as “injunctive relief.”

Market Competition

BCBS plans must allow some of their products to be offered outside of their traditional exclusive territories.

Transparency

Reforms aim at enhancing transparency in the claims-processing and reimbursement cycle.

BlueCard Program

Changes are required in the BlueCard program that processes claims for members who are traveling outside the home area of their BCBS plan to ensure business practices going forward are conducive to competition.

There are two categories of eligibility to receive money from the BCBS settlement, each with its own timeframe:

Provider Class (Active Claims)

Who is covered? Healthcare providers, a category that includes any hospitals, doctors, and clinics that provide treatment, equipment, or supplies.

Relevant Dates

Services must have been provided between July 24, 2008, and October 4, 2024.

Status

Claim filing was active, but the deadline to submit the claim was July 29, 2025. Claims are currently being processed for payment.

Subscriber Class (Claims Closed)

Individuals, and their employers, who paid premiums for certain BCBS health insurance plans–fully insured and self-funded.

Relevant Dates

Coverage or payments must have been in effect between February 7, 2008, and October 16, 2020 (with a shorter period for self-funded plans).

Status

The deadline to file claims under this part of the settlement was in November 2021. Payments have been, or are being, made, but no new claims can be filed.

How to Claim – Eligibility, Deadlines, and Process

Any claim under the BCBS Settlement must be filed in a timely manner with proper documentation.

Provider Claims – Key Parameters

You might be eligible for the BCBS settlement if you are a healthcare provider, which includes hospitals, physician groups, and individual practitioners billed a BCBS plan for services provided during the defined time period.

Exclusions

Those providers wholly owned or controlled by a BCBS plan are typically exempt.

Documentation

You will need to have on hand certain information, including your Tax Identification Number (TIN/EIN) and your billed and allowed amounts for all BCBS-insured patients. This is according to the Hospital Council, as per Settlement Agreement.

Critical Deadlines & Important Dates

There is an Opt-Out Deadline. Providers who wanted to sue on their own had to opt out on or before March 4, 2025.

Claim Filing Deadline (Provider Class)

July 29, 2025 This is the last date to file your claim. You must submit your claim using the official Blue Cross Blue Shield Settlement – Claim Notice by this date.

Step-by-Step Claim Submission Guidance

To file your claim for the BCBS settlement, you can do the following:

1. Visit the Official Settlement Website

This is the only authorized website for filing claims by claimants.

2. Login to the Online Portal

Use your unique Claim ID that was provided in your official notice, or register using your TIN/EIN.

3. Review Pre-Populated Data

The administrators can pre-populate some of your billing data. Take a minute to review it for accuracy.

4. Upload Supporting Documentation

Please submit all records necessary to confirm services and billed amounts for the period covered.

5. Submit Before the Deadline

Complete the process no later than July 29, 2025, so that your claim will be considered under the BCBS settlement.

Read Also: What Is The Spectrum Cable Deceptive Billing Class Action About?

What You Might Expect – Returns And Realistic Expectations

The big question on everyone’s mind right now is how much the actual per-person payout amount from the Blue Cross Blue Shield Settlement is.

How Payment Amounts Are Calculated

For the provider, the payment amount is not fixed. It depends upon many variables:

- Billed Amounts– Your share of the fund will be in proportion to the “allowed amounts” you billed for BCBS-insured patients during the claim period.

- Total Claims– The total number of claims a claimant files will determine the final figure. Payment per individual will increase if fewer claims are brought forward.

Realistic Payment Timing

It takes time because of the large volume of claims being distributed in the settlement of BCBS.

- Verification– Claims administrators shall compare every submission against the BCBS records.

- Timing– Although the settlement is approved, most are likely to see their payments in late 2025 or even early 2026. As pointed out in The Boro & Towne News, be patient, yet track your claim status.

Common Pitfalls And Reasons For Denial

The most common reasons for denial are failure to clearly document the services performed.

- Missed Deadline – Any claim received after the July 29, 2025, deadline will be deemed untimely and rejected.

- Subscriber Settlement– What About Individuals and Employers?

There had previously been a separate settlement of about $2.67 billion for the Subscriber Class.

Who Qualified

According to Open Class Actions, individuals and employers who paid premiums for fully-insured BCBS plans during the period of February 7, 2008, to October 16, 2020.

Status

These claims are no longer open; their deadline has long since passed- November 5, 2021. You might have been contacted with a notice or payment for your share of the BCBS settlement funds, as long as you qualified and filed. You should be checking your email as well as your regular mail for Blue Cross Blue Shield settlement checks.

Read Also: Credit One Bank Class Action Lawsuit- Eligibility And Claiming Your Share

Industry & Regulatory Impacts

The size of the BCBS settlement certainly puts all major insurance carriers on notice.

Impact On BCBS And Other Insurers

The reforms in operations require BCBS plans to revise some of their restrictive contracting practices. Doing so may foster more competition and flexibility in the insurance market, which could provide providers with more negotiating power.

Broader Antitrust Implications

The significant precedent of the litigation that succeeded in the BCBS settlement means large conglomerates in health care are not immune to antitrust challenges.

Other providers and consumers may bring claims against large insurers in the future.

Frequently Asked Questions (FAQs):

We’ve compiled answers to the most common questions about the BCBS settlement and what that means for you. We iron out details, including who qualifies and how payouts work.

Ans. This BCBS settlement is a $2.8 billion antitrust class action settlement. It was filed against Blue Cross Blue Shield plans for allegedly carving up the insurance market into non-competing territories, which lessened competition and thus resulted in lower reimbursement rates for health care providers.

Ans. It will depend on the total fund amount and your allowed amounts billed to BCBS plans during the eligible period. No fixed amount has been determined, and the final settlement amount per person will vary in the Blue Cross Blue Shield settlement based on your specific claim data and the total number of valid claims received.

Ans. No. As with large class action settlements, the Blue Cross Blue Shield Association does not admit the allegations of anticompetitive conduct. They have agreed to the settlement to put an end to the long and costly litigation.

The BCBS settlement is a landmark in health care antitrust law that compensates thousands of providers for their losses. See if you qualify, take action before the July 29, 2025, deadline, and preserve your right to compensation.

0 Reply

No comments yet.