Private equity companies are generally not very visible in the public eye, as they acquire, revamp, and offload companies. Nevertheless, when a negative situation occurs, they can be the center of attention—but not necessarily in a way they prefer.

Baymark Partners, a private equity firm located in Dallas, filed a lawsuit in court which alleged that the company had masterminded fraudulent business activities which had caused harm both to the creditors and the stakeholders of the business.

Not only the lawsuit against Baymark Partners charges the company with a wide spectrum of criminal activities, such as fraud and racketeering, but it also raises a question of how private equity’s complex financial engineering can get tangled with the law.

In this article, I will talk about the following things:

- What is Baymark Partners?

- What are the major allegations in the Baymark Partners lawsuit?

- Court proceedings in the Baymark Partners lawsuit.

- How has the lawsuit impacted stakeholders?

- What are the Baymark Partners lawsuit updates?

Additionally, I will also talk about some of the broader implications this lawsuit has. Therefore, if these are some of the things that you want to know, keep on reading this blog till the end…

What Is Baymark Partners And How Do They Work?

Baymark Partners describes itself as a growth-oriented private equity firm focusing on lower to middle-market companies. As JD Supra reported in 2022, the firm typically invests in businesses with $2 million to $20 million in EBITDA across various industries, including:

- Healthcare.

- Business services.

- Distribution.

- Technology.

- E-commerce.

The firm’s model is to:

- acquire controlling stakes.

- Help management expand operations.

- Create value for eventual resale.

For instance, Baymark and HCAP Partners invested in DFW Neuropathy, a Texas-based healthcare provider.

While the firm markets itself as a supportive growth partner, its name became entangled in controversy when a lawsuit accused it and affiliated executives of fraudulent practices.

What Is The Baymark Partners Lawsuit About?

The legal dispute began in May 2021, when D&T Partners LLC (successor to ACET Venture Partners) and ACET Global, LLC filed a complaint in the U.S. District Court for the Northern District of Texas, Dallas Division. According to the documents available at Freeman Law, the case was styled D&T Partners, LLC v. Baymark Partners, LP et al..

The plaintiffs claimed Baymark and its executives orchestrated a scheme to transfer assets away from ACET Global—a company in which they had invested—into a new entity called Windspeed Trading LLC.

According to the complaint, this maneuver was designed to sidestep creditors and avoid paying debts owed to D&T Partners.

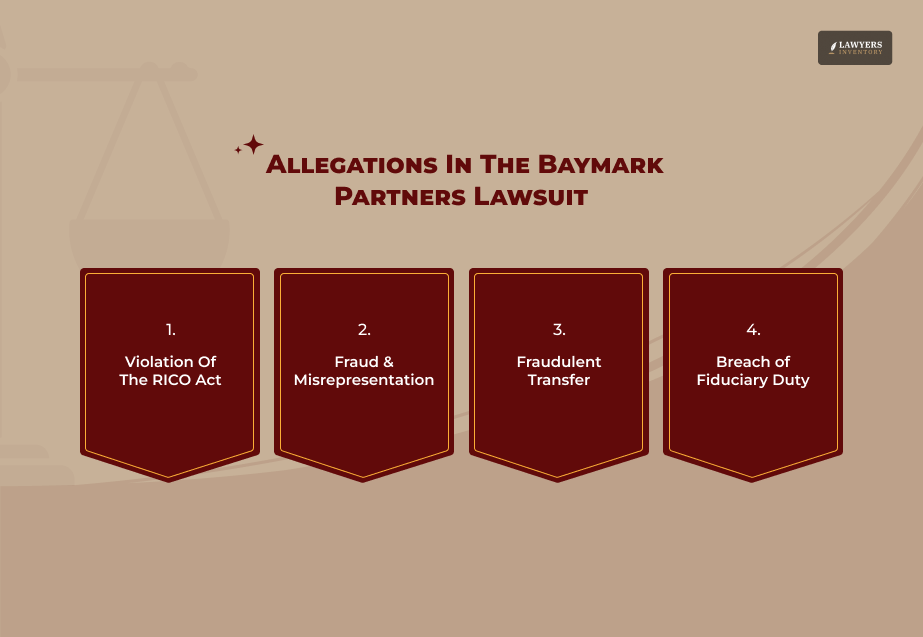

What Are The Major Allegations In The Baymark Partners Lawsuit?

The allegations against Baymark were extensive, involving both statutory and common-law claims:

- RICO (Racketeer Influenced and Corrupt Organizations Act): Justia reports that plaintiffs alleged a pattern of racketeering activity, including mail and wire fraud, bankruptcy fraud, and obstruction of justice.

- Fraud & Misrepresentation: Baymark executives were accused of making false statements and backdating documents to mislead creditors and other parties.

- Fraudulent Transfer: Under the Texas Uniform Fraudulent Transfer Act, plaintiffs claimed assets of ACET Global were shifted to Windspeed Trading to shield them from creditor claims.

- Breach of Fiduciary Duty & Conspiracy: The complaint alleged that executives owed fiduciary duties to ACET and its investors but instead acted in bad faith to enrich themselves and related entities.

The defendants included both Baymark entities (Baymark Partners LP, Baymark Management LLC, Baymark ACET Holdco LLC) and individual executives (David Hook, Tony Ludlow, Matthew Denegre, William Szeto, Marc Cole, and others). Justia mentions that additional parties such as Super G Capital, SG Credit Partners, and the law firm Hallett & Perrin were also named.

What Are The Legal Developments In The Baymark Partners Lawsuit?

The case moved through several important stages:

- Initial filings & default attempt: Plaintiffs initially sought default judgment against Baymark Partners LP for failing to respond. However, the court denied this after finding that Baymark Partners LP’s certificate of partnership had been canceled in 2012, meaning it legally no longer existed..

- Dismissals: In October 2022, the court dismissed the RICO claims with prejudice (meaning they cannot be refiled) and dismissed the state-law claims (fraud, breach of fiduciary duty, etc.) for lack of jurisdiction.

- Appeal: Plaintiffs appealed to the Fifth Circuit Court of Appeals. In 2024, the appellate court affirmed that the alleged theft scheme did not meet the legal requirements of a RICO claim. This essentially upheld the dismissal .

Therefore, while the lawsuit was filed and litigated, the most serious federal claims did not survive in court.

How Did The Baymark Partners Lawsuit Impact The Stakeholders?

Even though much of the case was dismissed, the allegations and litigation process had ripple effects:

- Investors & Creditors: D&T Partners, the plaintiff, argued that millions were lost due to Baymark’s alleged maneuvers. Besides, other creditors may see this as a cautionary tale about protecting interests when private equity firms are involved.

- Portfolio Companies: Allegations of fraudulent transfers could raise concerns for companies associated with Baymark, affecting confidence in management practices.

- Executives: The named individuals faced reputational harm. Even without liability being proven in court, association with such serious claims can impact careers.

- Industry Watchers: For the broader private equity space, this case reinforced the importance of transparency and the risks of complex shell-entity structures.

Read Also: What Is The Vintage Broncos Ford Lawsuit About?

What Was The Public And Media Response To The Lawsuit?

The case had legal thinking people and specialized press in its scope. Such outlets as LawGaze gave a gist of the suit, mentioning the plaintiff’s complaint of the fraudulent scheme, CoC mismanagement, and breach of fiduciary duty.

The lawyers predicted that courts are very sceptical when they deal with RICO business disputes. This particular dismissal really gives a hint as to the court being very reluctant in extending RICO to those cases which are basically commercial or creditor disputes.

Opposition to the case was mostly centered on secrecy in private equity funds, a few saying that more stringent regulation and the implementation of disclosure standards may be required.

Current Status Of The Case: What Is The Baymark Partners Lawsuit Update?

The RICO counts have been dismissed with prejudice, and the state law claims were dismissed without prejudice as of 2025. This means that the plaintiffs might still be able to bring the claims to the state court.

Nevertheless, as FindLaw put it, there is no significant new filing since the Fifth Circuit’s dismissals of the case.

Actually, there are no RICO active federal Baymark Partners cases at this moment, but legal exposure might still be possible if plaintiffs choose to file state claims.

Read Also: Why Is Juul Facing A Class Action Lawsuit?

What Are The Broader Implications Of The Lawsuit?

This lawsuit carries broader lessons:

- For private equity firms: Transparency in financial dealings and entity structuring is critical. Using shell entities or shifting assets can spark serious legal challenges.

- For creditors and investors: Protecting rights through contracts, security interests, and monitoring is essential.

- For regulators and courts: The case highlights ongoing debates about how far RICO should apply in business disputes. Courts continue to signal that they will not allow RICO to substitute for more traditional fraud or contract claims.

Is Baymark Partners going through a legal case? Absolutely—they have been sued significantly with allegations that included:

- Fraud.

- RICO violations.

- Fiduciary breaches.

The US courts rejected the suit, and the decision was confirmed by the appeals court.

Although the company was acquitted of RICO charges, the accusations at the core of the matter expose intricate private equity transactions to unfold in such a manner to end up in court.

This is a lesson that investors, companies, and regulators should learn from the Baymark Partners case. It points out that the use of financial engineering without disclosure can result in both reputational and legal risks.

0 Reply

No comments yet.