Branded as the “Centennial State,” Colorado has become popular as a travel and employment destination. Its diversified population has been drawn by its breathtaking natural beauty, energetic cities, and expanding economy. However, it would help if you became informed about the Colorado employment law before transferring.

By being aware of these regulations, you may safeguard your rights, guarantee just remuneration, and steer clear of possible problems at work.

Understanding the laws of the road will significantly ease your move to Colorado, regardless of your experience level or reason for seeking a career change.

Colorado employment law protects workers’ rights and fosters a just and equitable workplace. They cover everything from minimum wage and overtime restrictions to prohibitions against discrimination and harassment.

By becoming knowledgeable about Colorado employment rules, you may make well-informed decisions about your job and guarantee a smooth transfer to the Centennial State.

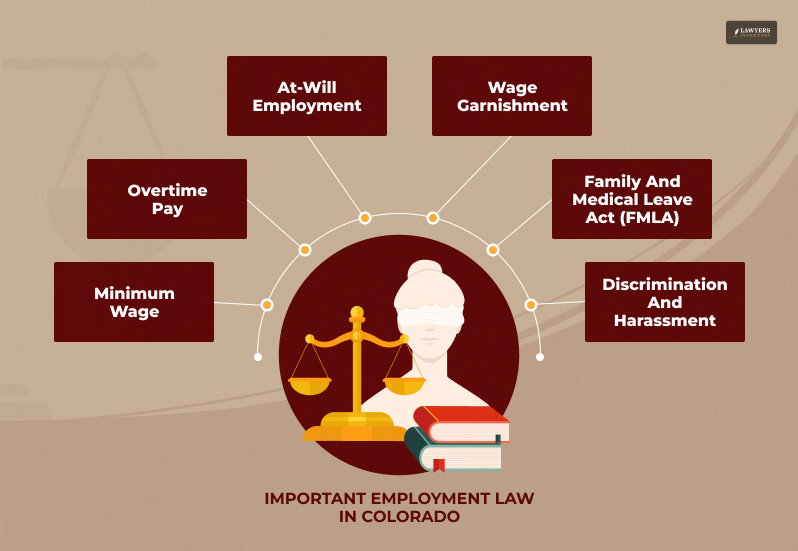

Understanding Colorado’s Key Employment Law

Colorado has worker’s compensation, overtime, discrimination, and minimum pay legislation.

The minimum wage in the state is greater than the federal minimum. Generally, overtime compensation is granted to workers working more than 40 hours weekly.

Workers’ compensation, anti-discrimination and anti-harassment regulations, and at-will employment are further significant legal frameworks.

So, let’s get started comprehending these laws without further ado:

Minimum Wage

Colorado has a higher minimum wage rate than the federal minimum wage. This means that employers in the state need to pay their employees at least a certain amount per hour, even for entry-level jobs.

The current minimum wage rate in Colorado is $14.42 per hour. However, it’s important to note that this rate can change over time. The Colorado General Assembly may increase the minimum wage periodically, so it’s always a good idea to check for any updates.

There are also some exemptions to the minimum wage law in Colorado. For example, certain types of workers, such as tipped employees and agricultural workers, may be exempt from the minimum wage requirement under certain conditions. For instance, tipped employees’ minimum wage is $11.40 per hour.

Overtime Pay

In Colorado, employees generally get overtime pay if they work over 40 hours. However, there are two main categories of employees: exempt and non-exempt.

Exempt employees are not eligible for overtime pay. These employees typically earn a salary of at least $684.50 per week and perform primarily managerial, executive, or professional duties.

Non-exempt employees are eligible for overtime pay. These employees typically earn an hourly wage and perform tasks that do not qualify as primarily managerial, executive, or professional.

To calculate overtime pay, employers must pay non-exempt employees at 1.5 times their regular hourly rate for all hours worked over 40 in a workweek.

There are some exceptions to the overtime pay requirement, such as for certain types of employees who work in agriculture or transportation. If you’re unsure whether you qualify for an exception, it’s best to consult with an attorney.

At-Will Employment

Colorado, like Florida employment law, generally follows an at-will employment doctrine, which means that employers can terminate an employee’s employment at any time, for any reason (that is not illegal), and without warning. Similarly, employees can quit their jobs at any time without giving notice.

However, there are some exceptions to the at-will employment doctrine in Colorado. For instance, an employer cannot terminate an employee for:

- Illegal reasons: This includes discrimination based on protected characteristics such as race, religion, sex, age, disability, or national origin.

- Violating public policy: This includes refusing to commit an illegal act or reporting a violation of the law.

- Breaching an implied contract: If there is an implied contract between the employer and the employee, the employer may not terminate the employee without cause.

It’s important to note that these exceptions are complex and may vary depending on the specific circumstances. If you believe your employment was terminated illegally, it’s best to consult an attorney to discuss your options.

Wage Garnishment

Wage garnishment is a legal process that allows creditors to collect debts by taking a portion of an employee’s wages.

However, Colorado law limits wage garnishment to protect employees from excessive financial hardship.

Generally, creditors can garnish 25% of an employee’s disposable earnings, the amount of wages remaining after certain deductions, such as taxes and mandatory retirement contributions.

Additionally, the law protects certain types of wages from garnishment, including:

- Child support: Child support payments take priority over other types of debt.

- Spousal support: Spousal support payments are also protected from garnishment.

- Disability benefits: Disability benefits are generally exempt from garnishment.

- Social Security benefits: Social Security benefits are typically protected from garnishment.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees up to 12 weeks of unpaid leave per year for specific family and medical reasons.

Employees may also qualify for additional leave through the state’s Colorado Family Medical Leave Insurance (CFMLI) program.

To be eligible for FMLA leave, employees must have worked for their employer for at least 12 months and have worked at least 1,250 hours during the previous 12 months.

Eligible employees may take FMLA leave for the following reasons:

- Serious health condition: The employee’s serious health condition prevents them from performing their duties.

- Family member’s serious health condition: The severe health condition of a spouse, child, parent, or same-sex domestic partner.

- Birth of a child: To care for a newborn child.

- Adoption or foster care placement of a child: To care for a newly adopted or fostered child.

- Military leave: For specific military-related reasons.

In addition to FMLA leave, Colorado employees may also be eligible for additional leave through CFMLI. This state-funded program provides up to 12 weeks of partially paid leave for eligible employees who need to take time off to care for themselves or a family member due to a severe health condition.

Discrimination and Harassment

Colorado law prohibits discrimination and harassment in the workplace based on protected characteristics, which include:

- Race

- Religion

- Sex (including gender identity and sexual orientation)

- Age (if over 40)

- Disability

- National origin

- Marital status

- Genetic information

Prohibited conduct includes:

- Discriminatory treatment: This can involve hiring, firing, promotion, demotion, or other employment decisions based on a protected characteristic.

- Harassment: This can include unwelcome advances, offensive jokes, or other conduct that creates a hostile work environment.

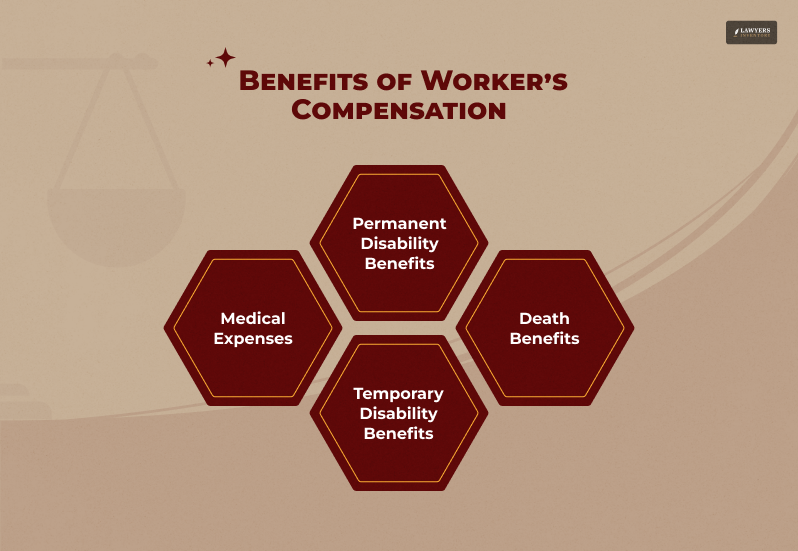

Worker’s Compensation

Worker’s compensation is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. In Colorado, most employers need to carry worker’s compensation insurance.

To be eligible for worker’s compensation benefits, employees must prove that their injury or illness arose from and during their employment. This means the injury or illness must have occurred while the employee performed their duties.

If an employee is eligible for worker’s compensation, they may be entitled to the following benefits:

- Medical expenses: The insurance will typically cover the cost of medical treatment related to the injury or illness.

- Temporary disability benefits: These benefits provide income replacement. At the same time, the employee cannot work due to their injury or disease.

- Permanent disability benefits: If an employee’s injury or disease results in a permanent disability, they may be eligible for permanent disability benefits.

- Death benefits: In the event of a work-related death, the employee’s dependents may be eligible for death benefits.

Unemployment Benefits

Unemployment benefits are available to eligible workers who have lost their jobs through no fault. In Colorado, the unemployment insurance program is administered by the Colorado Department of Labor and Employment.

To be eligible for unemployment benefits, individuals must meet specific criteria, including:

- Being unemployed: The individual must have lost their job due to circumstances beyond their control, such as a layoff, reduction in force, or wrongful termination.

- Having sufficient work history: The individual must have worked a certain number of weeks and earned a minimum wage in the past year.

- Being actively seeking work: The individual must be actively seeking new employment.

If an individual meets these eligibility requirements, they may be entitled to receive weekly unemployment benefits while they are actively searching for a new job. The amount of benefits received will depend on the individual’s previous earnings.

Individuals can file for unemployment benefits in Colorado online through the Colorado Department of Labor and Employment website. The individual may have the right to appeal the decision if a claim is denied.

Independent Contractors

While Colorado follows at-will employment principles, understanding the distinction between employees and independent contractors is crucial. Misclassifying workers can lead to significant legal and financial consequences.

The IRS has specific guidelines for determining whether a worker is an employee or an independent contractor. Factors considered include:

- Control: Does the employer control the worker’s hours, location, and work methods?

- Ownership: Does the worker provide their tools and materials?

- Profit or loss: Can the worker make a profit or loss based on their work?

Suppose a worker is misclassified as an independent contractor. In that case, the employer may be liable for unpaid taxes, benefits, and overtime pay.

Unionization

Employees’ rights to organize unions and participate in collective bargaining are protected under Colorado law.

Workers are free to form a union without their employer’s intervention. After forming, a union has the power to bargain on behalf of its members with the employer to get improved pay, benefits, and working conditions.

To agree on terms and conditions of employment, the union and the employer negotiate during the collective bargaining process. Arbitration or mediation may be used if the parties are unable to agree.

Workplace Safety

Colorado employers are legally obligated to provide their employees with a safe and healthy workplace.

The Occupational Safety and Health Administration (OSHA) sets workplace safety and health standards.

Employers must comply with these standards, which cover a wide range of issues, including:

- Hazard Identification and Control: Employers must identify and address potential hazards in the workplace.

- Emergency Preparedness: Employers must have plans in place for responding to emergencies.

- Personal Protective Equipment (PPE): Employers must provide appropriate PPE to employees when necessary.

- Training: Employers must train employees on workplace safety and health issues.

Employees injured or ill due to unsafe working conditions may be entitled to worker’s compensation benefits. Additionally, OSHA may investigate the incident and take enforcement action against the employer.

Know Before You Go!

I hope this blog has provided an overview of crucial Colorado employment law, including minimum wage, overtime pay, at-will employment, discrimination and harassment protections, worker’s compensation, and more.

By familiarizing yourself with these laws, you can make informed career decisions and navigate potential workplace issues.

Suppose you have specific questions or concerns about your employment rights. In that case, I would highly recommend consulting with an attorney specializing in Colorado employment law.

An attorney can provide personalized guidance and help you understand your rights and options.

By learning about Colorado employment law, you can protect your rights, ensure fair treatment, and build a successful career in the Centennial State.

Read More...

- 5 Qualities To Look For When Hiring An Employment Lawyer

- Tips To Secure Your Employment Rights With The Best Lawyer?

- Having an Employment Law Attorney is a Blessing During THESE Times!

0 Reply

No comments yet.