“Do you pay taxes on lawsuit settlements?” If you have recently been a part of a lawsuit, this is probably something you have been thinking about.

Most people heave a sigh of relief once they win a lawsuit and get compensation in the form of a settlement. They usually believe that once they pay the money to their attorneys, the rest is for them to keep.

However, that might not be the case. And that’s because the law states that any form of monetary income irrespective of the source, is taxable.

So, does that mean your lawsuit settlement amount falls under tax? Yes, it does. But there is so much more that you need to know when trying to understand lawsuits and their taxes.

Hi. In today’s blog, that is exactly what I will be talking about. So, if you want to avoid making certain mistakes when dealing with lawsuit taxes or want to know how to minimize the same, you have reached the right place. So, keep reading this blog until the end, and thank me later!

Lawsuits and Taxability: Do You Pay Taxes on Lawsuit Settlements?

Understanding the tax implications can be confusing when you receive a lawsuit settlement. Generally, the IRS treats most lawsuit settlements as taxable income. However, there are significant exceptions, especially for personal injury cases.

Generally speaking, compensation for physical injuries or illness is not taxed. This implies that you typically won’t have to pay taxes on money granted for emotional distress, pain and suffering, or injury-related medical costs.

It is important to remember that punitive damages are taxed since they are given to punish the criminal rather than to repay the victim.

Furthermore, a portion of your settlement can be taxable if you previously deducted medical costs associated with your accident and later received payment for those same costs.

As a result, it’s a good idea to maintain thorough records of all the deductions you have already made.

Lawsuit Settlement and Tax Amount: Are There Any Exemptions?

When it comes to lawsuit settlements, understanding which types are exempt from taxes is essential. Understanding these exemptions can help you better manage your finances after a settlement.

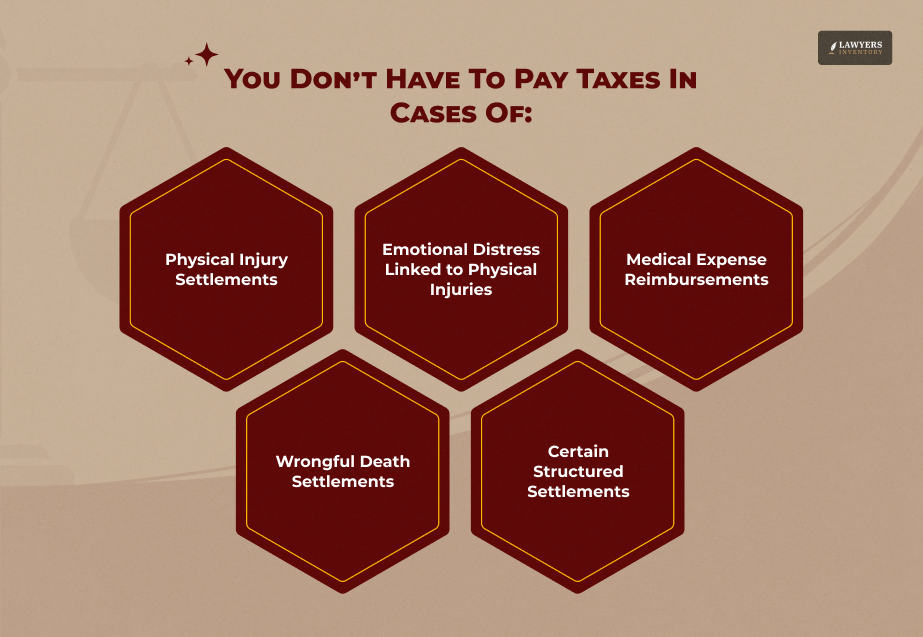

Here are the main categories of settlements that typically do not incur tax liabilities:

1. Physical Injury Settlements

Compensation for physical injuries or sickness is generally tax-free.

This includes amounts awarded for medical expenses, pain and suffering, and lost wages directly related to the injury.

The IRS specifies that these must involve observable bodily harm to qualify for the tax exemption.

2. Emotional Distress Linked to Physical Injuries

If emotional distress damages are awarded as a result of a physical injury, those funds are also non-taxable. However, this exemption applies only if the emotional distress is directly connected to the physical harm suffered.

3. Medical Expense Reimbursements

Settlements that reimburse medical expenses for physical injuries are not taxable, provided you haven’t previously deducted these expenses from your taxes. If you did claim a deduction in prior years, then that portion of your settlement may be taxable.

4. Wrongful Death Settlements

Amounts awarded in wrongful death cases for loss of companionship or pain and suffering are typically exempt from taxes, similar to personal injury settlements.

5. Certain Structured Settlements

If structured correctly, settlements can provide tax benefits over time, allowing recipients to spread payments across multiple years and potentially remain in a lower tax bracket.

How Much Tax Do You Need to Pay in Lawsuit Settlements?

Determining how much tax you owe on a lawsuit settlement can depend on various factors. For instance, if your settlement includes compensation for lost wages or profits, that amount is generally considered taxable income.

The IRS requires you to report this income just like any other earnings. Here’s a simple breakdown of what might be taxable:

- Lost Wages: This amount is taxable if your settlement compensates for lost income due to your injury.

- Punitive Damages: Any punitive damages awarded are also subject to taxation.

- Interest Earned: If your settlement includes interest (for example, if it’s delayed), that interest is also taxable.

Conversely, amounts awarded for physical injuries or emotional distress typically do not incur taxes. This includes settlements from car accidents or medical malpractice cases where physical harm was evident.

How Does the IRS Determine the Taxable Amount?

The IRS determines the taxable amount of a lawsuit settlement based on several key factors, primarily focusing on the nature of the damages awarded. Here’s how it works:

1. Origin-of-the-Claim Test

The IRS uses this test to assess whether the settlement proceeds are taxable. The payment is generally non-taxable if it stems from a claim for physical injuries or sickness.

Conversely, amounts received for lost wages, punitive damages, or emotional distress unrelated to physical injuries are typically taxable.

2. Tax Benefit Rule

Second, a portion of the settlement may be taxable if you previously claimed medical expenses associated with your accident as a deduction on your tax return and later received payment for those charges.

For instance, $20,000 in medical expenses that you deducted and subsequently received a $20,000 settlement for would be taxable income.

3. Allocation in Settlement Agreements

Settlements can specify how much of the total amount is allocated to different types of damages. The IRS generally respects these allocations unless evidence suggests otherwise.

For instance, if a settlement specifies that a portion is for pain and suffering (non-taxable) and another for lost wages (taxable), each part will be treated according to its classification.

4. Reporting Requirements

Finally, you must report taxable portions of settlements as income on your tax return. This includes punitive damages and any interest earned on the settlement amount.

Factors Affecting Tax Amount on Lawsuit Settlement

When you receive a lawsuit settlement, understanding the tax implications can be quite daunting.

Several factors influence how much tax you may owe, and knowing these can help you navigate the complexities of your financial situation.

1. Origin of the Claim

The IRS primarily bases a settlement’s taxability on the claim’s origin. The settlement is usually not taxable if your lawsuit involves physical injuries or sickness.

For instance, if you were injured in an accident and received compensation for medical bills, pain, and suffering, that amount is generally exempt from taxes.

On the other hand, if your settlement is for lost wages or punitive damages, those amounts are taxable as ordinary income.

2. Type of Damages Awarded

The nature of the damages awarded in your settlement plays a significant role in determining tax liability. Here’s a breakdown:

- Physical Injury or Sickness: Settlements for physical injuries are typically non-taxable as long as there’s observable bodily harm.

- Emotional Distress: If you receive compensation for emotional distress unrelated to a physical injury, that amount is usually taxable.

- Punitive Damages: These are always taxable since they are for punishing the wrongdoer rather than compensating for losses.

- Medical Expenses: Awards covering medical expenses are non-taxable unless you previously deducted them from your taxes; in that case, they become taxable under the IRS’s “tax benefit rule.”

3. Allocation of Settlement Amounts

How a settlement is allocated can significantly affect tax outcomes. During negotiations, specifying which portions of the settlement are designated for different damages is beneficial.

For example, allocating more funds to physical injury compensation can reduce your overall tax burden since those amounts are typically tax-exempt.

4. Legal Fees and Tax Implications

Legal fees can also complicate tax matters. These generally won’t impact your taxable income if your settlement is non-taxable.

However, you may owe taxes on the entire amount for taxable settlements, even if the part goes directly to your attorney as a contingency fee.

Therefore, understanding how legal fees are treated in your settlement is crucial.

5. State Tax Laws

In addition to federal taxes, state laws can affect how much tax you owe on your settlement. Some states have specific rules regarding the taxation of lawsuit settlements that may differ from federal guidelines.

Always check with a local tax professional to understand how state laws apply to your situation.

6. Timing of Payments

The timing of when you receive your settlement can also impact your tax situation. If you spread out payments over several years instead of receiving a lump sum, this strategy might keep you in a lower tax bracket and reduce your overall tax liability.

Can You Avoid Paying Taxes on Lawsuit Settlements?

When you win or settle a lawsuit, the last thing you want is to be hit with a hefty tax bill. But here’s what you should keep in mind!

While it may not be possible to avoid paying taxes completely on lawsuit settlements, understanding the rules and employing effective strategies can significantly reduce your tax liability.

By knowing what types of damages are taxable, wisely allocating settlement amounts, utilizing structured settlements and QSFs, and seeking professional guidance, you can maximize your financial recovery and minimize unexpected tax bills.

Fortunately, there are strategies to minimize or even avoid paying lawsuit settlement taxes. Here are some of them that you should know:

1. Know What’s Taxable

First and foremost, it’s essential to understand what types of settlements are taxable. According to the Internal Revenue Code (IRC), most payments that you receive from a lawsuit are gross income unless a specific exemption applies.

For example, settlements for physical injuries or sickness are generally non-taxable under IRC §104(a)(2).

However, amounts you receive for lost wages or punitive damages are taxable. Knowing the nature of your settlement can guide your tax strategy.

2. Allocate Damages Wisely

During the negotiation phase, consider how the settlement amount is allocated.

If possible, negotiate to classify a significant portion of your settlement as non-taxable damages, such as physical injuries or medical expenses.

Doing so can lower the taxable amount and reduce your overall tax liability.

3. Utilize Structured Settlements

A structured settlement allows you to receive your compensation in smaller payments over time rather than a lump sum.

This approach can help you avoid pushing yourself into a higher tax bracket in any given year.

You may pay taxes on smaller amounts each year by spreading the income, potentially saving thousands.

4. Consider Qualified Settlement Funds (QSFs)

Qualified Settlement Funds provide an excellent way to defer taxes on settlement proceeds. When establishing a QSF, the funds can be held in trust until all claims and liens are resolved.

This means you won’t owe taxes until the funds are distributed, allowing you to manage your tax liability more effectively.

5. Explore the Plaintiff Recovery Trust

The Plaintiff Recovery Trust is another innovative tool designed to help plaintiffs avoid double taxation on attorney fees.

Due to changes in tax laws, many plaintiffs can no longer deduct legal fees from their taxable income.

By setting up this trust before finalizing your settlement, you can exclude attorney fees from your taxable income, significantly reducing your tax burden.

6. Seek Professional Tax Advice

Navigating the complexities of tax laws can be overwhelming, especially regarding lawsuit settlements. Consulting with a tax professional who specializes in this area is crucial.

They can provide personalized advice tailored to your situation and help you identify all available strategies for minimizing taxes on your settlement.

Bonus: Mistakes to Avoid While Dealing with Taxes on Lawsuit

Now that you have your answer to “do you pay taxes on lawsuit settlements,” it is time to learn the tricks!

Many people make common mistakes when managing taxes on lawsuit settlements that can lead to unexpected tax liabilities.

Avoiding these common mistakes can save you from unnecessary stress and financial strain when dealing with lawsuit settlements and their tax implications.

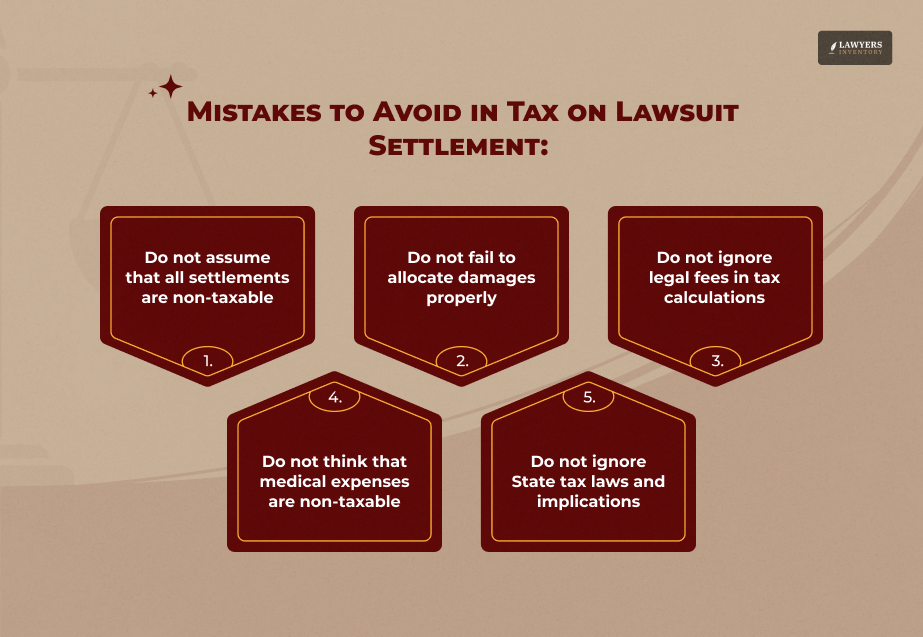

Here are some of the most frequent errors to avoid:

1. Assuming All Settlements Are Non-Taxable

One of the biggest misconceptions is that all lawsuit settlements are tax-free. Many people believe they won’t owe any taxes because they received a settlement for personal injuries.

However, while there are no taxes on settlements for physical injuries, you must pay taxes on the awards for emotional distress, punitive damages, or lost wages. Understanding the nature of your settlement is crucial to avoid surprises come tax time.

2. Not Allocating Damages Properly

Another common mistake is failing to negotiate the allocation of damages in the settlement agreement.

Suppose you do not specify how much the settlement is for non-taxable damages (like physical injuries) versus taxable damages (like emotional distress).

In that case, you may end up paying taxes on a larger portion than necessary. Always aim to allocate more funds to non-taxable categories during negotiations.

3. Ignoring Legal Fees in Tax Calculations

Many plaintiffs mistakenly think they will only be taxed on the net amount they receive after legal fees are deducted.

However, the IRS requires you to report the entire settlement amount as income, including the portion paid to your attorney. This misunderstanding can lead to a significant tax bill if not accounted for properly.

4. Believing Medical Expenses Are Always Non-Taxable

While awards for medical expenses related to physical injuries are typically non-taxable, this changes if you have previously deducted those expenses from your taxes.

Under the IRS’s “tax benefit rule,” you may have to pay taxes on those amounts if you claimed them in previous years.

Therefore, keeping track of any deductions related to medical expenses is essential.

5. Neglecting State Tax Implications

Many individuals focus solely on federal taxes and overlook state tax implications. Each state has its tax laws regarding lawsuit settlements, and some may impose additional taxes or have different rules about what is taxable.

It’s important to consult with a tax professional familiar with state laws to ensure compliance and avoid unexpected liabilities.

6. Failing to Consult a Tax Professional

Lastly, one of the most significant mistakes is not seeking professional advice. Tax laws surrounding lawsuit settlements can be complex and nuanced.

A tax professional can provide personalized guidance tailored to your situation and help you navigate potential pitfalls effectively.

They can also assist in planning strategies that minimize your overall tax burden.

Read Also:

- Class Action Lawsuit Attorney: Do You REALLY Need Them?

- What If I Owe The IRS But Can’t Afford To Pay? Raleigh, NC

- If My Name is on the Deed, Do I Own the Property?

0 Reply

No comments yet.