“If my name is on the deed, do I own the property?”

Trust me, this is one of the most asked questions that I have come across. It is a confusion that is pretty common.

In most cases, people often think that if your name appears on a deed of a particular property, you have a property title. This is a collection of rights you enjoy as a homeowner. However, is that really the case?

Although state-by-state variations exist in property rights, title rights generally grant you authority over the use of the property and the ability to sell or bequeath it as part of your estate plan.

Answering “If My Name is on the Deed Do I Own the Property?”

Although having your name on the property deed is important, it is important to realize that ownership is not determined by this alone.

Even though they are not the only element considered when assessing ownership rights, deed names offer important information regarding who is legally the property owner.

Determining the rights and obligations of the parties involved depends critically on the kind of ownership, such as sole or joint ownership.

Tenancy in common and joint tenancy are two different forms of joint ownership, each having unique consequences for survivorship and property ownership.

To determine property ownership rights, it is crucial to understand that deed names are only one puzzle component.

What is a Deed?

When it comes to property ownership, a deed and a title are frequently confused. First, let’s get that straight!

A physical document known as a deed is used to transfer ownership between individuals. Consider it the formal document that certifies that you are now the owner of this property.

The title, on the other hand, signifies your legitimate ownership of that property. To put it simply, the title is what you have as evidence of ownership, and the deed is the instrument that establishes it.

You may now be curious about the recording procedure. Things become important at this point! A deed should be registered with your local government office as soon as it is signed.

Recording helps establish a public record of ownership, which protects your rights and makes it harder for others to claim your property. It’s like putting a flag on your land saying, “This is mine!”

To help visualize this, imagine a deed document. It typically includes key elements such as:

- Grantor: The person selling or transferring the property.

- Grantee: The person receiving the property.

- Property Description: A detailed description of the property being transferred.

Having these elements clearly outlined ensures that everyone knows who owns what, reducing confusion and potential disputes in the future.

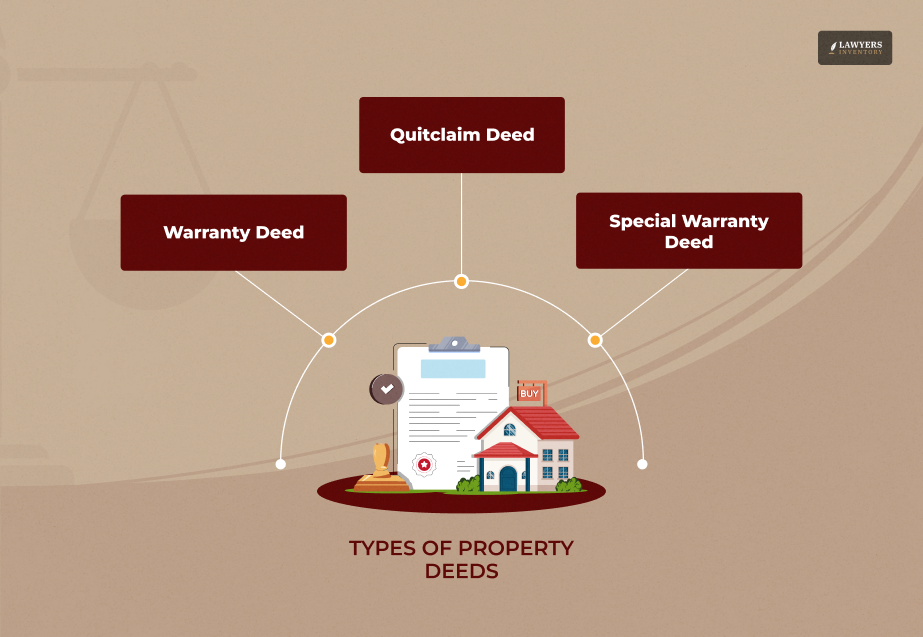

Types of Property Deeds

When it comes to property deeds, understanding the different types can make a big difference in your ownership experience. Let’s talk about three common types: warranty deeds, quitclaim deeds, and special warranty deeds.

Warranty Deed

A warranty deed offers the highest level of protection for the buyer. This type of deed guarantees that the seller has a clear title to the property and can legally transfer it.

The seller is responsible for resolving issues, such as undisclosed liens or claims. For example, if you buy a home with a warranty deed, you can feel confident that you’re getting what you paid for.

Quitclaim Deed

On the other hand, unlike a warranty deed, a quitclaim deed provides no guarantees. It simply transfers whatever interest the seller has in the property. This means that if there are problems with the title, you’re on your own.

Quitclaim deeds are often used in family situations, such as when one spouse transfers their interest to another during a divorce. However, this lack of protection can be risky; you could face unexpected issues later if there are hidden claims against the property.

Special Warranty Deed

Lastly, a special warranty deed falls somewhere in between. It protects the buyer only against issues that arise during the seller’s ownership.

This means they aren’t liable if problems existed before they owned the property. This type is often used in commercial transactions where the seller wants to limit their liability.

Types of Ownership

Understanding the types of property ownership is essential for making informed decisions. This is mainly because the type can limit or expand the rights and power that you have on a property.

Let’s dive into the two main types of ownership: joint ownership and sole ownership.

Sole Ownership

This means one person holds full title to the property. This type of ownership is straightforward and gives the owner complete control over the property.

For instance, if an individual buys a house solely in their name, they can sell, rent, or modify the property without anyone else’s approval.

This is common for single individuals or investors who want full authority over their real estate.

Joint Ownership

Joint ownership involves two or more people sharing ownership rights. Mainly, there are two types of joint ownership. They are tenancy in common and joint tenancy.

In joint tenancy, co-owners have equal shares and the right of survivorship. Therefore, the share automatically transfers to the surviving owner(s) if one owner dies.

For example, a married couple might choose joint tenancy for their home to ensure that if one dies, the other retains full ownership without going through probate.

Conversely, tenancy in common allows owners to have unequal shares and does not include the right of survivorship. If one owner dies, their share goes to their heirs rather than the other co-owners.

Business partners investing in real estate often use this arrangement, allowing for flexibility in ownership percentages.

Additionally, some states offer tenancy by the entirety, a special form of joint ownership for married couples. This type protects against creditors and ensures that both spouses must agree to any sale or transfer of the property.

Trusts or Other Legal Entities

When considering property ownership, many people ask, “If my name is on the deed, do I own the property?” While the answer is generally yes, other ways to hold property can offer significant benefits.

A common choice is to put assets in a trust. Probate, the legal procedure for allocating your assets after death, may be avoided in this way.

By using a trust, you can save time and money by transferring your property to your beneficiaries directly rather than through the legal system.

Furthermore, trusts offer anonymity since, unlike probate proceedings, they do not become public records.

Holding assets in a Limited Liability Company (LLC) is an additional choice. Your assets can be shielded from property-related obligations by an LLC.

Let’s say someone is hurt on your rental property, for instance. In that scenario, they are typically only able to seek the assets that the LLC holds, not your assets. For real estate investors, this makes it a wise decision.

However, navigating these options can be complex. That’s why consulting with an attorney specializing in real estate or estate planning is crucial. They can help you understand the implications and choose the best structure for your needs.

Doing so ensures that your property ownership aligns with your financial goals and provides the protections you desire.

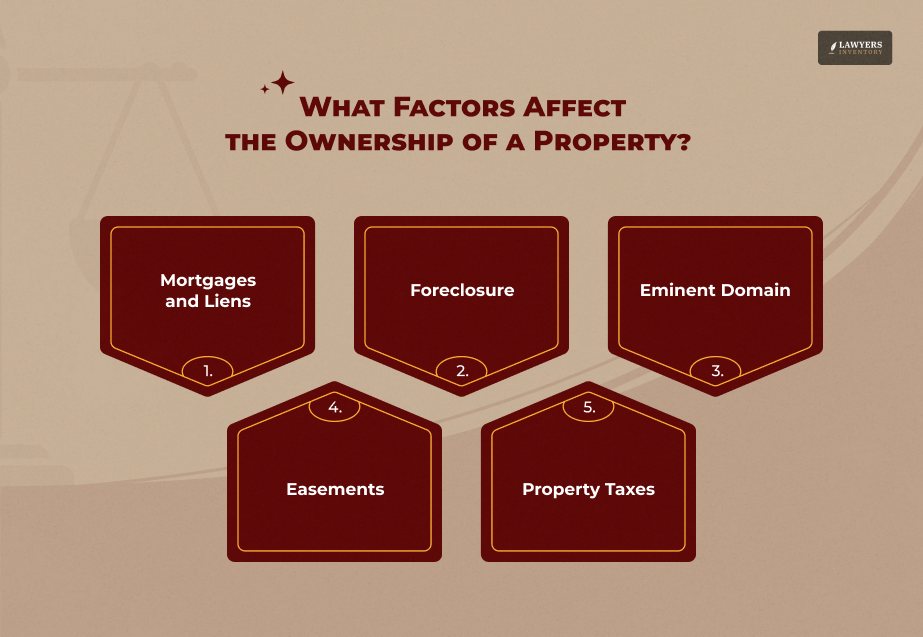

Factors Affecting Ownership

Understanding property ownership goes beyond just having your name on the deed. Several factors can influence your actual rights and control over the property.

Mortgages and Liens

First, let’s talk about mortgages and liens. If you have a mortgage, it means you borrowed money to buy the property. While your name is on the deed, the lender claims the property until you pay off the loan.

Similarly, a lien can be placed on your property due to unpaid debts, affecting your ownership rights. Essentially, just because your name is on the deed doesn’t mean you fully own the property if there are outstanding financial obligations.

Foreclosure

Next, there’s foreclosure. The lender can initiate foreclosure proceedings if you fail to make mortgage payments. This means they can take back the property to recover their losses, resulting in you losing ownership despite being on the deed.

Eminent Domain

Another important factor is eminent domain. This allows the government to take private property for public use, like building roads or schools. While you may receive compensation, it can still disrupt your ownership.

Easements

Easements also play a role in property rights. An easement allows someone like a utility company to use part of your property for specific purposes—such as installing power lines. While you still own the land, these rights can limit how you use it.

Property Taxes

Lastly, don’t forget about property taxes. If you fail to pay your taxes, the government can place a lien on your property or sell it at auction to recover owed taxes. This could lead to losing ownership altogether.

Responsibilities and Rights of Deed Holders

If your name is on the deed, you have both responsibilities and rights regarding the property. Understanding these responsibilities and rights helps ensure that you manage your property effectively while enjoying the benefits of ownership.

Here’s a quick overview:

- Property Taxes: As a deed holder, you are responsible for paying property taxes. Failing to do so can lead to penalties or even loss of ownership.

- Maintenance: You must keep the property in good condition. This includes regular upkeep and repairs to ensure it remains safe and habitable.

- Right to Sell: If you follow legal procedures, you can sell the property whenever you choose.

- Adherence to Local Ordinances: You must follow local laws and regulations, such as zoning laws and building codes. Ignoring these can result in fines or legal issues.

- Right to Lease: If you want, lease the property to tenants. This can provide a source of income while maintaining ownership.

- Right to Make Improvements: You can make improvements or renovations if they comply with local regulations. This allows you to enhance the property’s value and your living experience.

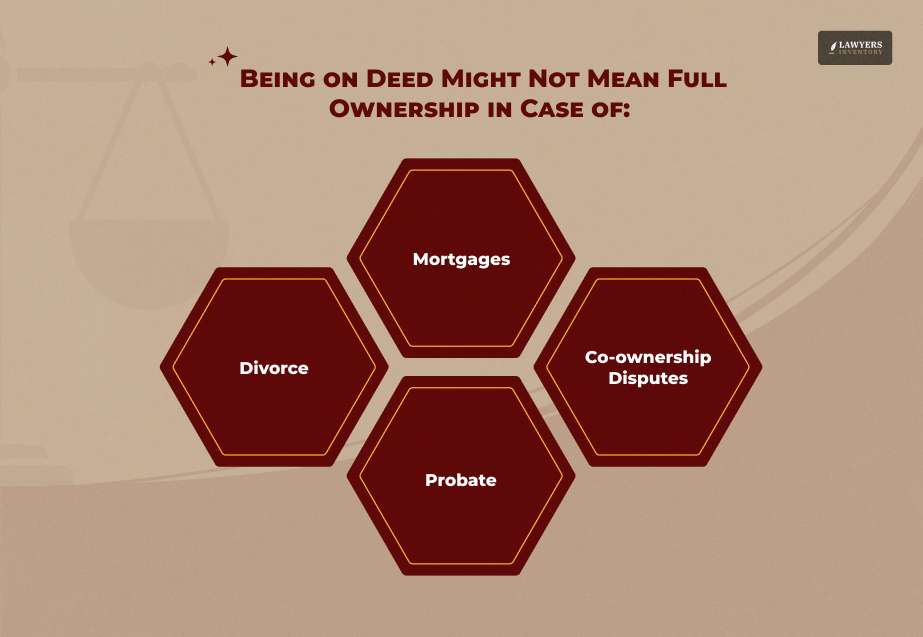

When Does Being on the Deed Not Mean Full Ownership?

Having your name on the deed is an important step in property ownership, but it doesn’t always mean you have full control.

Here are some scenarios where being on the deed may not equate to complete ownership.

Mortgages

First, consider mortgages. If you have a mortgage on the property, the lender has a claim to it until you pay off the loan.

For example, if you own a home with a mortgage and decide to sell, you must first pay off the remaining balance to the lender before you can keep any profits from the sale.

Although your name is on the deed, financial obligations can limit your control.

Co-ownership Disputes

Next, think about co-ownership disputes. Suppose you and a friend buy a rental property together.

If disagreements arise—like whether to sell or make improvements—both parties must agree before taking action.

This can lead to frustrating situations where one owner feels stuck because the other disagrees.

Probate

Another important factor is probate. If a property owner passes away, their share of the property typically goes through probate court.

This process can take time and may not allow immediate access for surviving co-owners or heirs.

For instance, if a parent leaves their home to their children, they might face delays in taking ownership until probate is resolved.

Divorce

Lastly, in a divorce, property division can complicate ownership. Even if both spouses are on the deed, the court may decide how to split assets based on various factors.

For example, one spouse might keep the house while the other receives other assets, impacting who ultimately owns what.

What to Do If You Are on the Deed but Not Sure of Ownership Status

If your name is on the deed, but you’re uncertain about your ownership status, don’t worry! There are steps you can take to clarify your situation.

Steps to Clarify Ownership

1. Review the Deed: Start by examining the deed itself. Look for details about ownership type, such as sole ownership or joint tenancy. This will help you understand your rights.

2. Check for Mortgages or Liens: Investigate whether there are any mortgages or liens against the property. This can affect your ownership rights, as lenders may claim the property until debts are settled.

3. Consult Public Records: Visit your local property records office or website. You can find information about property taxes, past transactions, and legal claims against the property.

4. Talk to Co-owners: If you share ownership with someone else, communicate openly with them. Discuss any concerns or questions you have regarding ownership and responsibilities.

How to Resolve Disputes

If you encounter disputes with co-owners or others regarding the property, there are ways to address these conflicts:

- Mediation: This is a voluntary process where a neutral third party helps facilitate discussions. Mediation can lead to a mutually agreeable solution without going to court.

- Litigation: If mediation fails, litigation may be necessary. This involves taking the dispute to court, where a judge will make a binding decision. Keep in mind that litigation can be time-consuming and costly.

Who Can Help You in Such Cases?

Navigating property ownership can be tricky, especially if you’re unsure about your rights. Fortunately, several professionals can help clarify your situation and guide you through legal complexities.

Real Estate Attorneys

One of the best resources is a real estate attorney. These legal experts specialize in property law and can provide tailored advice based on your circumstances.

They can help you understand the implications of being on the deed, assist with disputes, and ensure that all transactions are legally sound.

Title Companies

Another valuable resource is a title company. They conduct thorough public records searches to verify ownership and check for any liens or claims against the property.

If you’re considering buying or selling, they can ensure the title is clear, which is crucial for a smooth transaction.

Mediators

If you’re facing conflicts with co-owners or other parties, a mediator can help facilitate discussions.

Mediation is often a cost-effective way to resolve disputes without going to court, allowing both parties to agree amicably.

Local Government Offices

Don’t forget about local government offices! They can provide information about property records, taxes, and zoning laws. This knowledge can be essential in understanding your rights and responsibilities.

Read Also:

- What Is An Arbitration Agreement? What Are Its Essentials?

- Asset Purchase Agreement: What are These and When do You Need One?

- Co-Ownership Challenges: How Partition Lawyers Can Resolve Real Estate Disputes

0 Reply

No comments yet.