If you’re wondering how much do lawyers charge to set up a trust, you’re not alone. Many people want to protect their money and property for their family’s future.

But they’re unsure how to do it—or how much it will cost. Setting up a trust can be a smart way to make sure your loved ones are taken care of after you’re gone.

Hi. In today’s blog, I will be talking exactly about this. Through this article, I plan to make you understand what a trust is and how you can set one up.

And yes, most importantly, I will tell you how much a lawyer may charge to help you with it. If THAT is something you want to do.

Irrespective of whether you want to do it yourself or hire a lawyer, this article will (hopefully) give you the information you need to make the best decision for your situation.

So, keep on reading this blog till the end and thank me later…

What is a Trust?

A trust is a special way to manage and protect your money, house, or things (called “assets”) for someone else. It’s like a treasure chest you create, and you choose who gets what and when.

For example, you can put your home into a trust and say that your children will get it after you pass away.

There are three people in a trust:

- Person who makes the trust: this is you (also called the “grantor” or “trustor”).

- Person who takes care of the trust: called the “trustee.”

- People who will get the money or property: called the “beneficiaries.”

Trusts are used to avoid long court processes (called “probate”) and to make sure your wishes are followed. You can even set rules, like “my son can get this money when he turns 25.” It gives you more control than a regular will.

Can You Set Up a Trust on Your Own?

Yes, you can set up a trust by yourself. Many websites and books can guide you step by step. These are called DIY (do-it-yourself) options. They often have templates or tools where you just fill in your name, your property, and who gets what.

But be careful—trusts have legal rules. If you don’t do it correctly, it might not work the way you want.

For example, if you forget to sign it properly or include all your assets, your family might still have to go to court. It’s a bit like building a bookshelf without instructions—it might look okay, but it will fall apart when you use it.

If you have a simple situation, like giving your savings to one person, a DIY trust might work.

However, if things are more complicated, such as having a business or children from a previous marriage, it’s safer to consult a lawyer.

How Much Does It Cost to Set Up a Trust Yourself?

If you choose to do it yourself, it’s usually cheaper. You might spend anywhere from $50 to $300 on an online trust service or trust kit.

This price might include the forms, some instructions, and maybe a little help from customer service.

But remember: this cost doesn’t include a lawyer looking over your trust. If something goes wrong later, it can cost your family a lot more in legal fees or delays.

Think of it like fixing your own car. You might save money at first, but if it breaks down later, it might cost more to repair.

How Much Do Lawyers Charge To Set Up A Trust?

When you engage the services of a lawyer, you are buying their knowledge about the law and their experience in the legal field.

A lawyer will ensure that everything is in order and that your trust complies with the laws of your state. In most cases, lawyers charge fees using the following two ways:

- Flat fee: This is a fixed amount for the entire project. It is common for the setting up of a trust. Depending on your locale and the intricacy of the trust, the flat fee could be between $1,000 and $3,000.

- Hourly fee: Some attorneys bill by the hour. These can range from $150 to $500 per hour. If your trust is straightforward, it may not take more than a few hours. However, if your situation is complicated, it may take longer and be more expensive.

Person-to-person service performs all the activities without a lawyer. In the case where one seeks a lawyer’s advice and help, the charges will be higher due to hiring the lawyer.

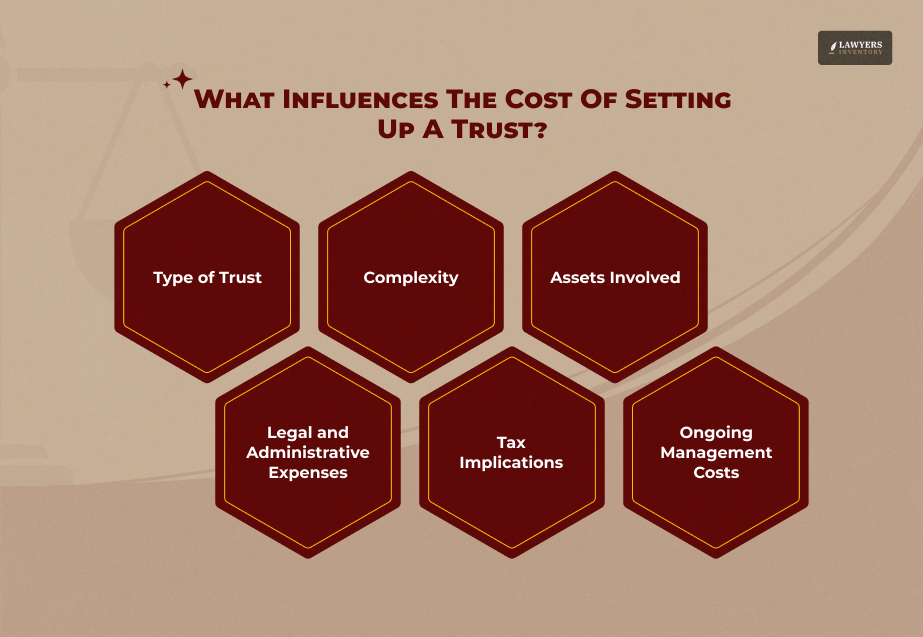

What Factors Influence the Cost of Setting Up a Trust?

Various aspects can influence the amount you will be charged by a lawyer to make your trust:

- Where you live: Attorneys in large cities usually command higher fees than those in small cities.

- Complexity of assets: If you possess a business, more than one home, or have investments, your trust will take a longer to prepare.

- Your family situation: If you’re not married, have children from different partners, or wish to give money to a person with special needs, your trust will need more legal work.

- Type of trust: There are different types of trust, such as revocable (you can change it) or irrevocable (you can’t). Some are more time-consuming and have more legalities than others.

- Extra services: In addition, the attorney may assist in transferring your assets to the trust (this process is called “funding” the trust), but it will be more expensive.

What Services Do a Trust Lawyer Provide?

When you hire a trust lawyer, you’re not just paying for a piece of paper. You’re paying for their help and expertise. Here’s what they usually do:

- Talk with you about your wishes: They ask questions to understand your goals and help you make smart choices.

- Create the trust documents: They write everything down clearly so it’s legal and easy to understand.

- Help you fund the trust: This means making sure your house, bank accounts, and other assets are properly moved into the trust.

- Update your trust later: Life changes, and your lawyer can help you make updates if needed.

- Avoid future problems: A good lawyer makes sure your trust works exactly how you want, and they help avoid court fights or confusion later.

Should You Hire a Trust Lawyer?

You might wonder: Is it really worth the money to hire a trust lawyer?

Let’s look at some facts. A 2023 survey showed that only 34% of Americans have any estate plan, like a will or trust.

Of those who used online tools, 1 in 5 made mistakes that caused problems later. On the other hand, people who used lawyers were 90% more likely to say their wishes were fully carried out without issues.

Using the services of an attorney now may seem to be a costly idea, but it might prevent your family from spending money in a much larger amount in a while later.

A probate case can take lots of months or even years, while the legal procedure can cost many tens of thousands of dollars.

Thus, if you correctly say that there is more to your wealth than your bank account – your house, kids, specific thoughts about money usage, then it is prudent to find an attorney.

Not only will the attorney save how far you have reached, but they will also guarantee that your beneficiaries are meeting your wishes.

Read Also:

- What Does the Legal Phrase ‘Objection Hearsay’ Really Mean?

- Trust Attorney: Why You MUST Hire Them While Estate Planning!

- Detrimental Reliance: What Does It Mean in Law & How Can You Avoid It?

0 Reply

No comments yet.