A financial crime lawyer, a specialist lawyer who skillfully handles financial misconduct cases, can help in this situation. Financial crimes, including embezzlement, fraud, and money laundering, can harm people and companies.

Apart from this, it can be challenging to navigate the intricate web of financial laws and regulations, particularly when accused of something serious. That is exactly why we need these lawyers.

However, what precisely does a financial crime attorney do? What qualifications and experience do they offer? And what unexpected advantages do they present to people accused of financial crimes?

In this article, I will explore the field of financial crime law and reveal the unforeseen ways a financial crime attorney can have a significant impact. Therefore, prepare to learn more as I take you through this roller coaster ride.

So, keep reading this blog till the end…

What are Financial Crimes?

Before getting into the know-how of financial crime lawyers, let me explain what exactly counts as financial crimes in the first place.

You might have seen all kinds of criminal activities related to money. These include money laundering, fraud, embezzlement, and so on. These are financial crimes.

In other words, any crime or illegal money-related activity is a financial crime. Organizations, companies, or people might commit these, which can cause the victim to suffer immense financial losses.

Additionally, it is not mandatory that the economic loss hence caused will be minor. These crimes can also cause harm to the economy. As a result, they might hurt the public’s confidence in financial institutions.

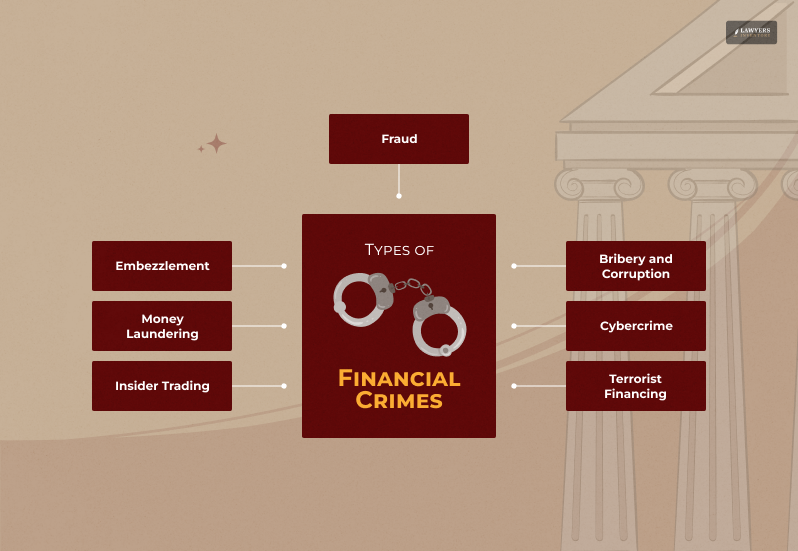

Types of Financial Crimes

There are several types of financial crimes. Some of the most common ones are as follows:

- Fraud: The deception of individuals or groups to obtain funds or property; examples include credit card fraud, identity theft, and investment fraud.

- Embezzlement: Stealing assets or cash from a company or employer is known as embezzlement.

- Money Laundering: It is the practice of disguising the source of funds obtained illegally by transferring them through reputable companies or accounts.

- Insider Trading: Trading stocks or other securities using insider information is known as insider trading.

- Bribery and Corruption: These refer to the exchange of gifts or cash to sway judgments or behaviors.

- Cybercrime: Financial crimes like phishing and hacking carried out through technology.

- Terrorist Financing: Financing terrorist activity with money or other resources is known as terrorist financing.

Rise in Financial Crimes in the USA

Many organizations are rethinking their approach to risk due to economic uncertainty. In fact, 99% of organizations worldwide are re-evaluating their risk appetite because of the economic environment. A significant 57% of them are doing so to a great extent.

Fraud and scams are constantly evolving. In 2023, tax and investment fraud are the top concerns for compliance professionals.

Credit and debit card fraud remains a major worry, with 39% of respondents citing it as a concern. New types of fraud, such as synthetic identity fraud, are also becoming more significant.

Environmental crimes, including wildlife trafficking, are a growing concern globally. In 2022, international concern about these crimes surged, reflecting the threat they pose to food security, political stability, and more.

Crowdfunding is being used to fund political extremism, with 87% of respondents reporting an increase in this trend. A significant 31% of them believe this growth is substantial.

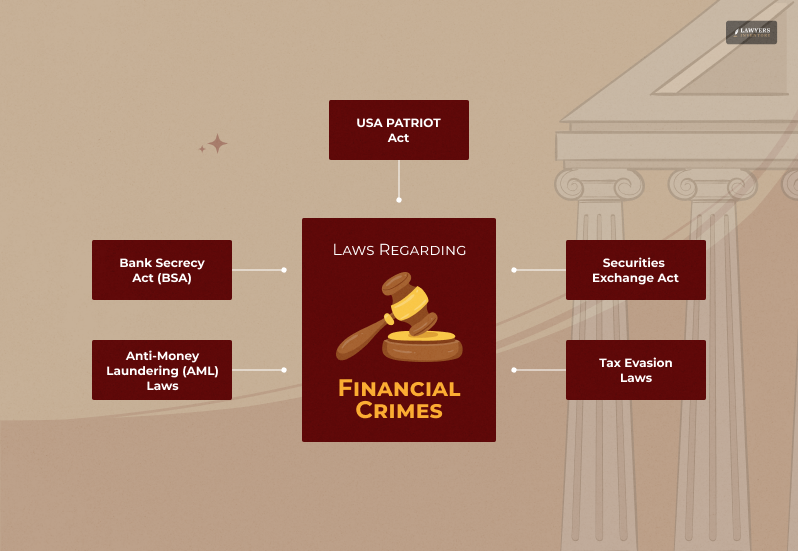

Laws Regarding Financial Crimes in the USA

Unless the court states specific laws, finding the faults and punishing the criminals engaged in such fraudulent money-related activities is impossible.

That is why, repeatedly, the U.S. has made several amendments and made their laws stricter.

Here are some of the most important financial crime laws that you must know about:

1. Anti-Money Laundering (AML) Laws:

First of all, by forcing financial institutions to report suspicious transactions, confirm the identities of their clients, and keep an eye on accounts, Anti-Money Laundering (AML) laws seek to prevent criminals from concealing illicit funds.

This keeps the financial system safe and secure by assisting in the prevention of money laundering, financing of terrorism, and other financial crimes.

2. Bank Secrecy Act (BSA):

Second, financial institutions must report cash transactions exceeding $10,000 and report suspicious activity by the Bank Secrecy Act (BSA). It additionally seeks to maintain transaction records.

Moreover, by doing this, it is possible to ensure that banks and other financial institutions are not utilized for illicit purposes and to detect and prevent financial crimes such as money laundering and financing of terrorism.

3. USA PATRIOT Act:

Thirdly, this act was passed in the wake of 9/11 and contains measures to fight financial crime and international terrorism. Moreover, it reinforces the need for due diligence and improves controls for international transactions and trade laws.

Furthermore, Section 311 of the USA PATRIOT Act grants law enforcement increased authority to investigate financial crimes. It also monitors financial transactions and exchanges data among agencies.

Additionally, it keeps the nation and its financial systems safe and secure and aids in detecting and preventing financial crimes such as money laundering and funding terrorism.

4. Securities Exchange Act:

Fourthly, the next one on this list is the Securities Exchange Act of 1934. This act regulates stock trading. Furthermore, it aims to prevent insider trading and stop market manipulation.

Created to govern the securities transaction in the secondary market, this act significantly protects investors from fraudulent activities.

The U.S. Securities and Exchange Commission states that the Securities Exchange Act “identifies and prohibits certain types of conduct in the markets and provides the Commission with disciplinary powers over regulated entities and persons associated with them.”

5. Tax Evasion Laws:

Finally, the last set of laws I want to discuss is the tax evasion laws, which help you fight financial crimes.

U.S. Code 7201 states that there are legal consequences for anyone who knowingly tries to avoid paying taxes the government has levied against them. Additionally, these people will be held accountable for their crimes and must deal with the charges.

For example, the law would impose a $100,000 fine on them. Fraud charges against corporations may carry a maximum fine of $500,000. In addition, they could be hit with a $100,000 fine and five years in prison.

Types of Financial Crime Lawyers that You Must Know About!

Financial crime lawyers are attorneys who specialize in dealing with financial crimes. These can be fraud, money laundering, and embezzlement.

Some of the most common types of financial crime lawyers are as follows:

- White-collar Crime Lawyers: First and foremost, they deal with cases involving executives and business professionals charged with financial offenses like embezzlement, insider trading, and fraud.

- Securities Fraud: These attorneys focus on cases involving insider trading, stock market manipulation, and other crimes about securities.

- Money Laundering Lawyers: They represent clients in situations where assets and money are hidden.

- Asset Forfeiture Lawyers: They assist clients in getting back assets that the government has taken due to suspected financial crimes.

- Tax Fraud Attorneys: Tax lawyers represent clients in cases involving tax avoidance, tax evasion, and other crimes about taxes.

- Financial Regulatory Lawyers: They counsel clients on adhering to financial regulations and defend them in legal disputes arising from such infractions.

- Corporate Compliance Lawyers: These are lawyers specializing in corporate compliance and assisting businesses in creating compliance initiatives that stop financial crimes.

- Criminal Defense Lawyers: These attorneys defend individuals and organizations accused of financial crimes in criminal court.

- Civil Fraud Lawyers: Lastly, these lawyers handle civil cases involving financial fraud, such as lawsuits for damages or restitution.

Cost of Hiring a Financial Criminal Lawyer

“How much will this cost me?” is one of the first things that comes to mind when considering hiring a financial criminal lawyer.

Hiring a financial criminal lawyer can vary significantly based on their expertise, the intricacy of the case, and the location. At the same time, giving an accurate number without specifics is difficult.

To begin with, the majority of financial criminal attorneys bill on an hourly or fixed fee basis. The lawyer’s reputation and experience will determine the hourly charge, varying from $150 to over $600.

If your case is highly complicated or includes high-stakes financial crimes like fraud or money laundering, expect the higher end of the scale.

Conversely, flat costs are frequently assessed for simple matters or consultations. These can be anything from $2,000 and $10,000, but the details are essential. An experienced attorney with a solid reputation may bill extra.

However, they also contribute years of experience, which can make all the difference in a court case. Remember to account for expenses like filing fees, expert witnesses, or investigation services.

A thorough cost breakdown should always be requested upfront. Take advantage of the free consultations that many attorneys provide to learn more about what you’re paying for and how their services meet your needs.

Remember, while hiring a financial criminal lawyer may seem costly, the price of not having proper legal representation can be far more significant.

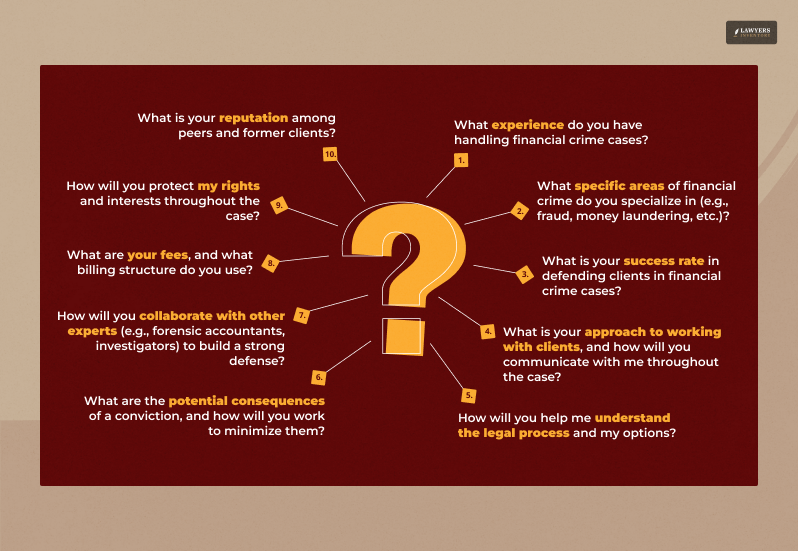

Questions to Ask a Financial Crime Lawyer Before Choosing Them!

While it is true that you need a lawyer for your case related to financial crimes, it is also equally important that you choose the right one. Therefore, before you stick to one, you MUST ask your financial lawyer a few questions, just like you ask questions to any other lawyer!

Best Financial Crime Lawyer in the USA Right Now!

Now that you know all the things related to financial crime law, it is time for you to know about the best legal aid to go to if you need help with such financial crime cases.

Therefore, here are the top financial crime lawyers that you must know about:

1. Norman Spencer Law Group

Firstly, we have Norman Spencer Law Group. It is a renowned law firm in New York City specializing in financial crime cases.

Their team of experienced attorneys has a deep understanding of financial regulations and laws, enabling them to provide expert defense strategies for clients facing financial crime charges.

Their expertise includes:

- Credit card fraud

- Bank fraud

- Securities fraud

- Investment management disputes

- Embezzlement

- Money laundering

Located in the heart of New York City, the firm offers a flexible fee structure to accommodate clients’ needs, including:

- Flat fees

- Hourly rates

- Contingency fees

Additionally, you will get free consultations to discuss your case and determine the best approach.

By choosing Norman Spencer Law Group, you can expect:

- Personalized attention from experienced attorneys

- Expert knowledge of financial regulations and laws

- Aggressive defense strategies to protect your rights and interests

2. Zoukis Consulting Group

Secondly, Zoukis Consulting Group is a network of experienced financial crime attorneys dedicated to providing clients with expert legal guidance and defense strategies.

Moreover, their team of skilled lawyers deeply understands financial regulations, laws, and procedures. Therefore, it enables them to offer comprehensive support and representation.

Their expertise includes:

- Financial crime defense

- White-collar crime defense

- Federal crime defense

- Regulatory compliance

- Asset forfeiture

Located in Washington, D.C., the firm also offers a flexible fee structure to accommodate clients’ needs, including:

- Hourly rates

- Flat fees

- Retainer fees

Apart from this, they also offer free consultations to discuss your case and determine the best approach.

By choosing Zoukis Consulting Group, you can expect:

- Personalized attention from experienced attorneys

- Expert knowledge of financial regulations and laws

- Aggressive defense strategies to protect your rights and interests.

3. The Justis Law Firm

Lastly, the Justis Law Firm is a reputable law firm specializing in financial crime defense and regulatory compliance.

Similar to the above ones, their team of experienced attorneys has a deep understanding of financial laws and regulations. Additionally, they provide expert legal guidance and representation for clients.

Their expertise includes:

- Financial crime defense

- White-collar crime defense

- Securities fraud

- Embezzlement

- Money laundering

- Regulatory compliance

Located in Tampa, Florida, the firm offers flexible fee structures to accommodate clients’ needs, including:

- Hourly rates

- Flat fees

- Contingency fees

Furthermore, you can also get free consultations to discuss your case and determine the best approach.

By choosing The Justis Law Firm, you can expect:

- Personalized attention from experienced attorneys

- Expert knowledge of financial regulations and laws

- Aggressive defense strategies to protect your rights and interests

- Compassionate and understanding approach to your case.

How to Become a Financial Criminal Lawyer?

If you’re considering a career as a financial criminal lawyer, you’re probably wondering what it takes to get there. While it’s a challenging path, it can be highly intellectually and financially rewarding.

Here’s a guide to help you understand what you must do and the skills required for success.

Skills You Need

To become a successful financial criminal lawyer, certain skills are crucial. First, you’ll need a deep understanding of law and financial systems.

Financial crimes often involve complex financial transactions, so knowledge of accounting, finance, and business law is essential. This will help you dissect complicated cases and explain them clearly to clients, judges, and juries.

Another key skill is attention to detail. Financial crimes often involve intricate documents, data, and figures.

A mistake or oversight could significantly impact the outcome of a case. Strong research and analytical skills are just as important as you’ll need to gather evidence and analyze financial records thoroughly.

Effective communication is also vital. Whether you’re presenting your case in court or negotiating settlements, the ability to explain complex legal and financial matters clearly will set you apart.

Lastly, you’ll need excellent problem-solving skills to develop strategic solutions for your clients.

Salary You Can Earn

The salary of a financial criminal lawyer can vary depending on experience, location, and the complexity of the cases they handle. A financial criminal lawyer earns between $70,000 and $150,000 per year.

However, top-tier lawyers at prestigious firms or those who handle high-profile cases can earn even more—sometimes upwards of $200,000 annually or more.

In addition to salary, many financial criminal lawyers receive bonuses, especially when they win cases or work with high-paying clients.

So, while it takes time and dedication to reach the top, the financial rewards can be significant for those who excel in this field.

Save Yourself From Financial Crimes!

Financial crime attorneys are crucial to protect individuals and businesses from the devastating consequences of financial crime allegations.

With their expertise and support, you may successfully negotiate the complex legal system and obtain the best outcome.

Regardless of the allegations you face, such as fraud, embezzlement, or money laundering, an experienced financial crime lawyer can help you build a strong defense and protect your rights.

Do not put things off till the last minute! If you are accused of economic crime, act immediately and get legal counsel from a reputable financial crime lawyer. Keep in mind that you should defend your future.

If you are searching for the best financial crime lawyer, I hope that this article has been of help to you. If you have any other questions related to this, please feel free to let me know.

All you need to do is scroll down until you reach the page’s bottom. Then, leave your suggestions and queries in the box below. And I will be there to answer them all for you!

Read Also:

- What If You Can’t Afford a Family Lawyer? Explore Options

- Who Are Superannuation Lawyers? A Complete Guide

- The Impact Of Racial Profiling On Criminal Justice

0 Reply

No comments yet.