“How much does probate cost in California?”

If this is the answer that you are searching for, then you have reached the right place! Knowing the point at which an estate needs judicial action is essential to navigating California’s complex probate law.

The minimum amount that initiates probate becomes a crucial factor as families struggle with the intricacies of inheritance.

California takes a more nuanced approach in contrast to certain jurisdictions that have set financial caps. For instance, it takes into account the type and makeup of the estate’s assets.

Providing information that can help people in their estate-planning pursuits, this blog will examine the state’s probate rules. Additionally, I will also talk about the elements that determine whether an estate needs to go through the court-supervised process.

For heirs, executors, and everyone else attempting to negotiate the Golden State’s probate system, knowing these subtleties is essential, regardless of real estate holdings or financial assets.

Understanding Probate in California

A necessary but sometimes difficult stage is probate. Under the supervision of the court, this is a procedure for confirming a will and resolving a deceased person’s financial affairs.

People frequently want to lessen its influence on their estates because they are aware of the possible time and financial consequences.

The gross worth of the estate determines the probate threshold in California. For instance, this includes assets like real estate, bank accounts, investments, and personal property.

Notably, not every asset is covered by probate. Probate procedures are typically avoided for assets held in joint tenancy, community property with the right of survivorship, and those with selected beneficiaries.

Effective estate planning in California requires an understanding of this probate threshold, which enables people to negotiate the legal complexities and make well-informed choices to simplify the transfer of their assets.

How Much Does Probate Cost in California?

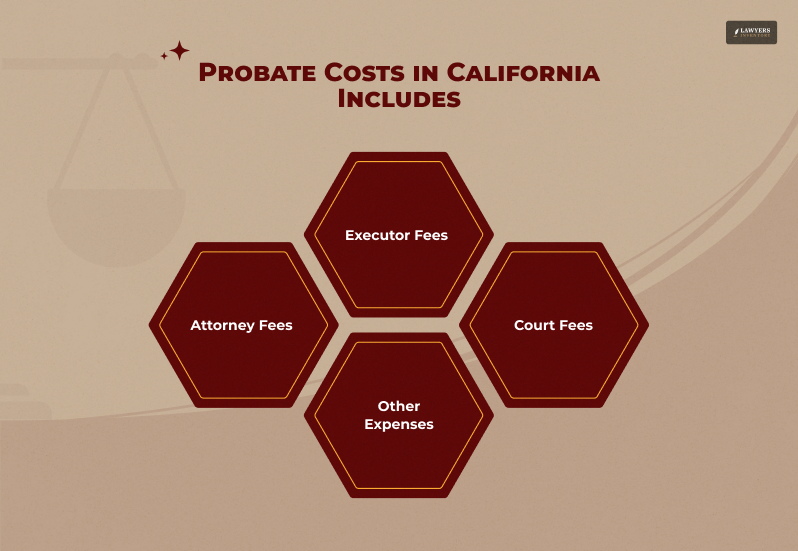

Probate costs in California can vary widely, but understanding the main expenses can help you plan.

In California, probate fees are based on a percentage of the estate’s total value, which includes assets like property, bank accounts, and other valuables.

Here’s a breakdown of the typical costs.

1. Attorney Fees

Firstly, in California, probate attorney fees are set by law and are based on a percentage of the estate’s value.

For example, the attorney may charge 4% of the first $100,000, 3% of the next $100,000, 2% of the next $800,000, and so on. This means if the estate is worth $500,000, attorney fees could be around $13,000. Additionally, larger estates mean higher fees.

2. Executor Fees

Secondly, the executor, or the person handling the estate, is also entitled to fees, which are calculated the same way as attorney fees.

If the executor is a family member, they might waive this fee. However, if a professional executor is used, this cost should be included in your planning.

3. Court Fees

Thirdly, court filing fees in California can add up. Filing a probate petition may cost several hundred dollars, and there could be additional charges for appraisals, document certifications, and other paperwork.

4. Additional Costs

Finally, there are other potential costs that may include appraiser fees for valuing assets, fees for publishing a notice to creditors, and other administrative costs. These extra expenses can add up, especially for larger estates.

In total, probate in California can range from a few thousand dollars to tens of thousands, depending on the estate’s size and complexity.

Therefore, considering these costs, many people explore ways to avoid probate, such as setting up a living trust to make things easier and less expensive for their loved ones.

Minimum Estate Value for Probate in California

Whether probate is needed depends on the types and value of assets in an estate. Some assets can skip probate entirely, while others need court supervision, regardless of their worth.

For instance, in California, probate is typically required if the deceased owned real estate valued over $166,250 (not counting mortgages and liens). This amount aligns with California’s small estate affidavit limit, which allows for a simplified process if the estate is below this threshold.

However, if the estate is above this limit or includes assets that can’t be transferred using a small estate affidavit, a full probate process is usually necessary.

Additionally, this process involves filing a request with the probate court, notifying any creditors and heirs, and managing the distribution of assets.

If there is a will, assets will be distributed according to its instructions. If no will exists, California’s intestate succession laws determine who inherits the assets.

Strategies To Avoid Probate

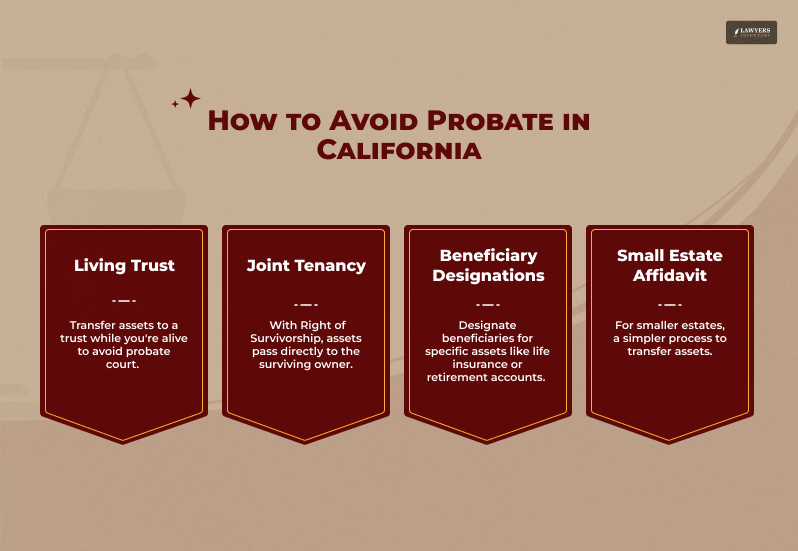

Probate can be time-consuming and costly, so many people look for ways to avoid it when planning their estate. In California, there are a few common strategies to help reduce or even skip the probate process altogether.

Living Trusts

Firstly, a living trust is a popular choice for avoiding probate. By creating a living trust, you can move your assets into a trust while you’re still alive.

When you pass away, the assets in the trust go directly to your beneficiaries without going through probate. This approach not only speeds up the process but also keeps your estate private, as probate proceedings are public.

Additionally, a living trust gives you more control over how and when you want to distribute your assets. Furthermore, it can also reduce the costs often associated with probate. It’s a helpful option for those who want to protect their legacy and make things easier for their loved ones.

Joint Tenancy

Secondly, joint tenancy is another way to avoid probate for certain assets, such as real estate or bank accounts.

When two people co-own an asset in joint tenancy, it automatically passes to the surviving co-owner when one person dies. This transfer happens outside of probate due to something called “the right of survivorship.”

Overall, joint tenancy is a simple way to ensure that assets go directly to a co-owner without probate delays or costs. It’s an effective strategy for people who want to make the inheritance process smoother for their heirs.

Beneficiary Designations

For accounts like life insurance, retirement funds, and bank accounts, you can name specific beneficiaries.

When you do this, these assets automatically pass to your designated beneficiaries without the need for probate.

This is a quick and straightforward way to transfer certain types of assets directly to your loved ones.

Small Estate Affidavit

If the estate’s total value is below California’s small estate limit, you can use a small estate affidavit to transfer assets without a full probate process.

This is a great option for smaller estates. Why? Well, because it helps heirs receive their inheritance more quickly and with less hassle.

Wrapping It Up!

The type of assets involved determines the minimum estate worth in California that requires probate and is not a defined amount. People who want to properly prepare their estates must comprehend the complexities of the state’s probate law.

Although there are some circumstances in which you cannot avoid probate, people can take proactive measures to lessen its effects. For instance, they can try establishing living trusts, using joint tenancy, and carefully choosing beneficiaries.

To handle the unique circumstances surrounding a particular estate and guarantee a seamless transfer of assets to heirs, it is advised to speak with a legal expert.

Read Also:

- Polsinelli Set to Become the BIGGEST Law Firm? Here’s What Experts Say

- Having an Employment Law Attorney is a Blessing During THESE Times!

- A Corporate Lawyer Can Help You Become a Millionaire! Here’s How

0 Reply

No comments yet.