Which of the Following is a Best Practice to Protect Your Identity?

- Throw your credit card and statement from the bank into the dustbin.

- Ask how your information will be used while you are giving it out..

- Always carry your passport no matter where you are.

- Turn on data aggregation on the sites when possible.

If your answer to this question is (2), then you’re absolutely correct! Whenever you are sharing your information, let’s say to a credit card company, it is best that you ask certain questions.

Among these, asking them how they are going to use your information and personal data is the most important!

But why? What will happen if you do not do this? Are you going to face issues later on that will have a lasting impact?

In this article, I will talk about the following things:

- The importance of protecting your identity.

- What are the signs of identity theft?

- Legal steps that you can take to protect your identity.

- Which lawyers can help you?

So, if these are some of the things that you want to know, keep on reading this blog till the end…

Answering “Which of the Following is a Best Practice to Protect Your Identity?”

Sometimes, you need to share some of your personal details, that is, all the details of your credit card. These generally include:

- Social Security number.

- Credit Card Information.

- Email Address.

In such cases, it is very necessary that you seek to know both the usage and the safety of it.

You might be required to provide your personal data or information to a credit card company, an online store, or even an interviewer for a job.

Irrespective of the situation, in every case, you must be made aware of the actions that will be taken with your personal data.

But why is this so important? Can someone who gets the information from you misuse it, and then you end up with a problem?

Unfortunately, yes! Identity theft is a criminal activity that has continued to grow, and as a result, you may have both financial and legal issues and feel emotionally affected.

Having said that, I am going to use this chance to help you understand the legal ways of protecting your personal identity, list the warning signs of identity theft, and tell you how you can prevent it.

Protecting Your Identity is a MUST— Here’s Why!

In today’s connected world, everything from banking to shopping is done online. And while this is super convenient, it also means your personal information is being shared more than ever. This increases the risk of identity theft.

According to the Federal Trade Commission (FTC), identity theft cases in the U.S. have increased sharply in recent years.

In 2023 alone, over 1.1 million reports of identity theft were filed with the FTC. The most common types were government document fraud, credit card fraud, and loan or lease fraud.

What’s even more alarming is that victims of identity theft spend months—or even years—trying to fix the damage. This includes freezing their credit, recovering lost money, and clearing up legal issues that the thief may have caused in their name.

That’s why protecting your identity is not just a good idea—it’s a legal and financial necessity.

What are the Signs of Identity Theft?

Sometimes, people don’t even realize they’ve been a victim of identity theft until it’s too late. Here are some common signs to look out for:

- You receive bills for services or products you never used.

- Your credit report shows loans or credit cards you didn’t apply for.

- You get calls from debt collectors about debts you don’t owe.

- You stop receiving bills or financial statements in the mail.

- There are unfamiliar withdrawals or charges in your bank account.

- You get denied for a loan or credit card even though your credit should be good.

If any of these happen, it’s a red flag that someone might be using your personal information without your permission.

How Can Identity Theft Damage Business?

While identity theft is often seen as a personal issue, it can also seriously harm small and large businesses:

- Loss of Customer Trust: If a business fails to protect customer information, people may stop buying from them.

- Legal Trouble: Companies can face lawsuits and heavy fines if they don’t comply with data protection laws.

- Financial Loss: Fixing the damage caused by a data breach can cost thousands (sometimes millions) of dollars.

- Reputation Damage: A business’s good name can be ruined if it’s associated with poor data protection.

So whether you’re an individual or running a company, protecting identity and data is crucial.

What Are The Laws Against Identity Theft?

The Identity Theft and Assumption Deterrence Act defines the crime of identity theft as one where a person “knowingly transfers or uses, without lawful authority, a means of identification of another person with the intent to commit, or to aid or abet, any unlawful activity that constitutes a violation of Federal law, or that constitutes a felony under any applicable State or local law.”

In 2004, the Theft Penalty Enhancement Act supplemented this legislation by adding the concept of “aggravated” identity theft and defining the penalty for such cases.

The latter is the impersonation of another to commit various felony cases, such as immigration violations, the theft of the victim’s Social Security benefits, and the occurrence of domestic terrorism.

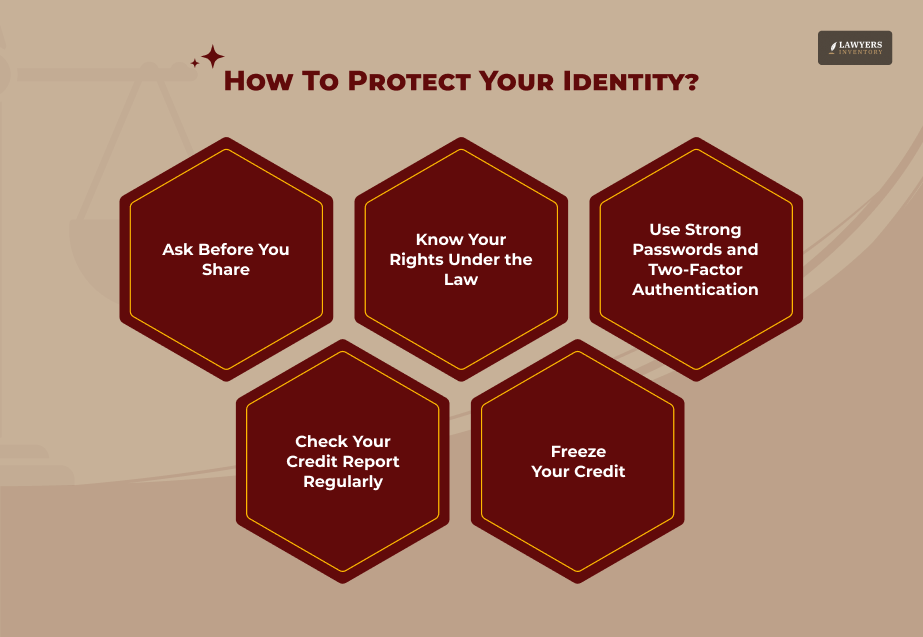

Legal Steps You Can Take to Protect Your Identity Online

While it may seem scary, the good news is that there are legal protections and best practices you can follow to keep your identity safe.

1. Ask Before You Share

The moment they make a move to extract personal information from you, like your Social Security number or credit card, stop and ask questions.

- Why are they doing so?

- How is it going to be safe?

- Are they legally entitled to that information?

Companies usually have to produce proof of how they handle and store your information and explain it to you.

2. Know Your Rights Under the Law

There are a number of laws that are in place to defend individuals from identity theft:

- Through the Identity Theft and Assumption Deterrence Act, the Unites States makes it a federal crime to steal someone else’s identity.

- The Fair Credit Reporting Act (FCRA) is the U. S. federal law that was enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies

- The Gramm-Leach-Bliley Act compels organizations to tell the customers through a notice about their policies of sharing the information and also to protect the consumer’s non-public, personal information.

- Depending on the state, laws on data protection may add more layers of security if the people there are the lucky ones.

These laws stand for your rights as a person whose data is ill-treated. They give you a chance to have your say.

3. Use Strong Passwords and Two-Factor Authentication

One of the most convenient methods of shielding oneself from identity theft online is by creating very strong passwords.

These should include a minimum of 12 characters containing letters (a mixture of upper and lower case), numbers, and special characters.

Additionally, opting for two-factor authentication (2FA) for your important accounts will provide a tighter security layer.

4. Check Your Credit Report Regularly

An individual is entitled to such a service by law, which should be requested from one of the three major credit bureaus, namely Equifax, Experian, TransUnion, and you better take on it every time.

5. Freeze Your Credit

If you suspect that a data breach has taken place, you have the option to freeze your credit file, which requires permission from the lender or a creditor to create a new account in your name until the freeze is removed. It is a free and fairly simple fraud prevention method.

Who Can Help You With Identity Theft Protection?

Identity theft is a serious problem, but you’re not alone—and you do have help.

If you believe your identity has been stolen or if you want to take extra steps to prevent it, here’s who you can turn to:

- Federal Trade Commission (FTC): They provide resources and a recovery plan at IdentityTheft.gov.

- Credit Bureaus: Contact Experian, Equifax, or TransUnion to freeze your credit or place a fraud alert.

- Cybersecurity Professionals: They can help you review your online accounts and improve security.

- Identity Theft Protection Services: Companies like LifeLock, Identity Guard, and Aura offer tools to monitor your data and alert you of threats.

- Attorneys Specializing in Identity Theft: If your case involves serious financial or legal damage, a lawyer can help you take legal action and protect your rights.

So the next time someone asks you for personal information, don’t just hand it over. Stop, ask, and protect your identity—legally and smartly.

Read Also:

- Theft Crime Allegations: Know What They Are & How to Avoid Them

- Child Identity Theft is Increasing! What Parents MUST Do [Experts Advice!]

- Sierra Mist Lawsuit: Did PepsiCo Really Clash with Influencer Over Identity Theft?

![Understanding The Pay Transparency Law Of Massachusetts [2026 Guide]](https://lawyersinventory.com/wp-content/uploads/2026/02/massachusetts-pay-transparency-law-100x100.png)

0 Reply

No comments yet.