If you want to know how to get a debt lawsuit dismissed, you are not the only one!

Debt dismissal is a crucial topic for many Americans grappling with financial challenges. Recent statistics reveal that a significant number of individuals are seeking ways to alleviate their debt burdens.

In fact, in 2022 alone, over 1.2 million debt accounts were settled, amounting to approximately $5.6 billion in principal value. This indicates a growing awareness and effort among consumers to address their debts proactively.

With household debt in the U.S. reaching a staggering $17.7 trillion, many are exploring options to get their debts dismissed or reduced. Understanding the process of debt dismissal can empower you to take control of your financial situation.

In this article, I will talk about the effective strategies for dismissing a debt, including legal options and negotiation tactics. So, if that is what you want to know, keep reading this blog till the end

Understanding a Debt Lawsuit

When a creditor sues a debtor for not repaying a loan or debt, we call it a debt lawsuit.

Usually, this procedure starts after the creditor has tried several times to collect the debt via letters, phone calls, or other channels.

Additionally, the creditor may bring a lawsuit in court if these attempts are unsuccessful.

People commonly get sued for debt due to several reasons. Some of them are as follows:

- Unpaid Credit Card Balances: Since creditors want to recoup their losses when payments are missed, lawsuits are the most common way to pursue significant outstanding credit card bills.

- Medical Bills: When people experience financial shocks like illness or job loss, unpaid medical bills sometimes result in lawsuits.

- Personal Loans and Utility Bills: Legal action is often taken when creditors try to recover unpaid utility bills and personal loan debts.

- Debt Buyer Actions: Businesses that buy debts at a discount frequently bring legal action to collect, resulting in many court cases.

- Default Judgments: Many people fail to reply to court cases, which leads to default judgments against them, making their financial circumstances even more difficult.

- Statute of Limitations Misunderstandings: Creditors may attempt to collect on debts too old to be legally enforced, leading to potential lawsuits based on outdated claims.

Risks of Ignoring a Debt Lawsuit

You should be aware that ignoring debt litigation might have major consequences.

For instance, the creditor may automatically win the case by a default judgment if you don’t reply. This implies that, under any circumstances, they can verify that you are in debt.

In order to collect what you owe, creditors may freeze your bank accounts or garnish your earnings after receiving this judgment. Managing your daily costs may become challenging as a result.

Furthermore, having a judgment against you will lower your credit score, which will make it more difficult for you to obtain credit or loans in the future.

In order to collect the debt, creditors may potentially impose liens on your property or confiscate your assets. Ignoring the case could result in increased interest and costs, which would raise your overall debt.

Finally, by not responding, you lose your right to challenge the debt or negotiate better terms, leaving you with very few options.

What are the Key Steps in a Debt Collection Lawsuit?

There are several steps when it comes to the process of debt collection. Some of them are as follows:

- Filing the Lawsuit: The creditor files a complaint with the court detailing the amount owed and the reasons for the claim. This document is served to the debtor, notifying them of the lawsuit.

- Response from Debtor: The debtor has a specific time frame to respond to the complaint. They can either admit to the debt, dispute it, or request more information.

- Court Hearing: A court hearing is scheduled if the debtor contests the lawsuit. Both parties present their evidence and arguments. The creditor must prove that the debt is valid and owed.

- Judgment: The judge will issue a judgment after reviewing the case. If in favor of the creditor, this may lead to wage garnishment or bank account levies to recover the owed amount.

- Appeal Process: The debtor may have the option to appeal the judgment if they believe it was unjust.

What are the USA Debt Collection Laws?

For anyone facing a debt case, it is essential to comprehend US debt collection rules. These regulations guarantee that creditors adhere to certain rules when collecting debts and shield customers from unscrupulous activities.

The Fair Debt Collection Practices Act (FDCPA), passed in 1978, is among the most important legislation. This federal statute prohibits debt collectors from using unfair, dishonest, or abusive methods.

The FDCPA requires debt collectors to give you accurate information about the debt they are trying to collect. They cannot harass, threaten, or call you at odd hours.

For example, they cannot call you before 8 AM or after 9 PM unless you consent. Furthermore, if you ask a collector to stop contacting you, they must abide by your request as long as it is in writing.

Additionally, the Fair Credit Billing Act, which shields consumers from deceptive billing practices, and the Truth in Lending Act, which mandates that lenders reveal all terms and expenses related to a loan, are additional significant laws.

You can register a complaint with the Consumer Financial Protection Bureau (CFPB) or even take legal action against a collector who violates these rules.

Can You Negotiate a Settlement Before Going to Court?

Yes, you can negotiate a settlement with a debt collector before going to court, and it’s often a smart move.

First, make sure the debt is valid and yours. You can request written validation from the collector if you’re unsure.

Once you confirm the debt, assess your finances carefully. Figure out how much you can realistically pay, whether as a lump sum or in installments, without putting too much strain on your budget.

Next, reach out to the debt collector to start negotiations. Be honest about your financial situation and propose a lower amount than what you owe to settle the debt.

Many collectors are willing to accept less to close the account. If you agree, always get it in writing before making any payments. This ensures the terms are clear and protects you legally.

Lastly, if you’re unsure about negotiating, consider seeking advice from a lawyer or credit counselor.

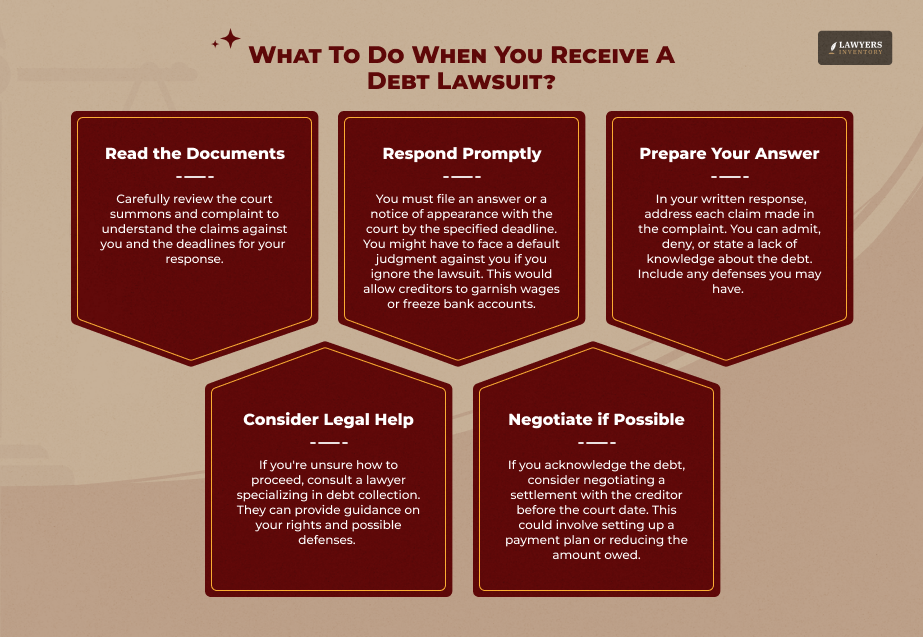

Steps to Take When You Receive a Debt Lawsuit

How to Get a Debt Lawsuit Dismissed?

If you’ve received a debt lawsuit, don’t panic! There are several strategies you can use to dismiss a debt lawsuit quickly. Some of them are as follows:

- Respond Promptly: First and foremost, do not ignore the lawsuit. Depending on your state, you typically have a limited response time—often 20 to 30 days. Failing to respond can lead to a default judgment against you.

- File a Motion to Dismiss: If there are valid reasons for dismissal—such as lack of jurisdiction or failure to state a claim—you can file a motion to dismiss. This legal document asks the court to dismiss the case based on specific grounds.

- Challenge the Validity of the Debt: One effective strategy is to challenge whether the debt is valid. Request verification of the debt from the collector. If they cannot prove that you owe it, you may have grounds for dismissal.

- Check for Violations: Review your case for any violations of debt collection laws. Additionally, if the collector violated the FDCPA or other regulations during their attempts to collect from you, this could strengthen your case for dismissal.

- Negotiate a Settlement: Sometimes, negotiating directly with the creditor can lead to an agreement that drops the lawsuit altogether. Furthermore, if they see that you’re willing to settle for less than what is owed, they might prefer this route over continuing litigation.

- Seek Legal Assistance: If you’re unsure how to proceed, consulting with an attorney specializing in debt collection can be invaluable. They can help identify weaknesses in the creditor’s case and guide you through legal procedures.

Best Strategies To Negotiate A Settlement With A Debt Collector

- Verify the Debt: Confirm that the debt is valid and belongs to you. Request a written validation notice detailing the amount owed and creditor information.

- Assess Your Finances: Determine what you can realistically pay. Create a budget to establish your financial limits before negotiations.

- Start Low: When proposing a settlement, begin with a lower offer (e.g., 25% of the total debt) to create room for negotiation. Aim for a middle ground that works for both parties.

- Communicate Clearly: Maintain open and respectful communication. Explain your financial situation succinctly and avoid oversharing unnecessary details.

- Get Everything in Writing: Ensure to document any agreement in writing, including payment terms and any promises regarding credit reporting. This protects both parties and clarifies expectations.

- Stay Calm and Patient: Keep your composure throughout the negotiation process, even if the collector is aggressive. A calm demeanor can lead to better outcomes.

- Be Persistent: If initial negotiations do not yield results, follow up regularly or try speaking with different representatives who may be more accommodating.

- Consider a Payment Plan: If a lump-sum settlement isn’t feasible, negotiate a manageable payment plan that fits your budget while covering essential expenses.

What is Debt Collection Arbitration?

Debt collection arbitration is a method for resolving conflicts between debtors and creditors outside the conventional judicial system.

Both parties agree that an arbitrator, a third party who is impartial, will rule their dispute instead of a courtroom.

Many people find this procedure an appealing alternative to a court trial because it is frequently speedier and less formal.

In arbitration, the arbitrator hears the arguments and supporting documentation from the debtor and creditor before rendering a legally enforceable ruling.

This implies that the arbitrator’s decision, which may be upheld in court if required, must be followed by both parties.

Compared to drawn-out court proceedings, arbitration can save time and lower legal expenses, which is one of its main advantages.

Debt collection arbitration is typically used for unsecured debts, like credit card bills or medical expenses.

Many contracts include arbitration clauses, meaning that if a dispute arises, both parties must resolve it through arbitration rather than litigation. This process helps settle debts more efficiently and maintains privacy since arbitration proceedings are generally confidential.

Read More: Legal Lending Limit: What You MUST Know While Getting a Loan

Who Can Help You Fight a Debt Lawsuit?

Although defending yourself against a debt lawsuit can seem overwhelming, you don’t have to do it alone! To help you, a variety of materials are available.

To begin with, groups such as the National Consumer Law Center provide helpful assistance to those who are facing debt disputes. They offer instructions on how to deal with legal issues and your rights.

Legal aid societies in many localities provide low-cost or free legal assistance to persons with certain income-based eligibility requirements. These groups can inform you of your rights and, if necessary, act as your legal representatives.

Additionally, hiring a debt lawyer can significantly increase your chances of success. With their extensive legal knowledge and focus on debt collection, these attorneys can provide you with situation-specific counsel.

Furthermore, you can manage your debts and possibly negotiate a settlement before going to court with the help of non-profit credit counseling agencies. These resources can help you get the help you need to deal with your debt litigation.

Read Also:

- Skip Tracing in Debt Collection Can SAVE Your Life! Here’s How

- All You Need to Know About the Federal Arbitration Act

- If My Name is on the Deed, Do I Own the Property?

0 Reply

No comments yet.