If you ever purchased the stocks and securities of e.l.f. Cosmetics Inc., then there’s good news for you! You are eligible to participate in the elf lawsuit!

But what is it about? Is it about the quality? Or is it about the investors? The answer to this question is BOTH.

The popular cosmetic brand has been around for some time. Even for me, the brand has been my go-to choice for cosmetic products. And I am sure, a lot of us who use the product feel the same way.

However, there’s something you need to understand. You and I, who are consumers of the product, are not going to think twice before buying and using it. However, there are investors who view the company as a potential source of financial rewards.

So, what is the elf lawsuit about? And what are some of the things that you should keep in mind if you are planning to buy some e.l.f. stocks?

Hi. In today’s blog, these are some of the things that I will be talking about. So, if you want to know more, keep on reading this article till the end and thank me later…

Is There an elf Lawsuit Going On?

E.l.f. Beauty has apparently faked its financials, and shareholders are going furious over this one! And I mean, there is a reason for them to go all crazy.

As per the latest details, the cosmetic manufacturers lied about their inventory levels. And when the investors dumped their shares, the stock prices took a massive hit. And that is exactly why some of these investors are taking legal action.

Why does that matter? Because inventory affects how a business looks on paper.

If a company claims it has more products in stock than it actually does, it may seem more successful and financially stable than it really is.

Once the truth started to surface, investors began to sell off their shares, which caused the stock price to drop significantly.

Many of these shareholders felt they had been misled into investing their money based on false information. That’s why they’re now filing a class action lawsuit—to hold the company accountable and try to recover some of their financial losses.

This situation has shaken investor confidence, and as more details come out, more people may join the lawsuit. It’s still developing, but the accusations alone have already done serious damage.

elf Lawsuit: What You Need to Know About the Class Action?

The elf lawsuit is gaining attention, and if you’re an investor or even a casual follower of the stock market, it’s something you’ll want to know about.

The heart of the issue? The company may have provided false information about its inventory levels, which affected its financial reports and, ultimately, its stock price.

This has left many shareholders feeling misled—and for good reason.

What are the Allegations in the elf Lawsuit?

The main accusation in the elf lawsuit is that e.l.f. Beauty misled its investors by not being truthful about its inventory numbers. This type of information is critical because investors use it to decide whether to buy, hold, or sell a company’s stock.

According to the complaint, e.l.f. allegedly overstated its inventory, making it seem like the company was in better financial shape than it really was.

Morningstar states that e.l.f. Cosmetics Inc. “inflated revenue and other financial measures over multiple quarters” to maintain the confidence of the investors.

That made the stock look more attractive to potential investors. However, when the actual numbers were released, they painted a completely different picture.

The company’s stock value took a hit, and those who had invested based on the earlier reports suffered financial losses.

According to the lawsuit, the defendants failed to disclose that:

(i) contrary to its representations to investors, e.l.f. Beauty was experiencing rising inventory levels as a consequence of flagging sales.

(ii) e.l.f. Beauty falsely attributed the rising inventory levels to, among other things, changes in its sourcing practices.

(iii) to maintain investor confidence, e.l.f. Beauty reported inflated revenue, profits, and inventory over several quarters.

(iv) accordingly, e.l.f. Beauty’s business and/or financial prospects were overstated.

| Class Period: In a securities class action, the term “class period” is the timeframe during which the company did something wrong that caused financial harm to the investors. |

This type of misleading behavior is a violation of federal securities laws, which is why it has led to a class action lawsuit.

The court will now have to decide whether e.l.f. knowingly gave out false information, and, if so, what kind of compensation the affected investors should receive.

What is the Deadline to be a Part of the elf Lawsuit?

If you’re an investor in e.l.f. Beauty and you believe you’ve been affected by the misinformation, it’s important to act quickly. There is usually a strict deadline to join a class action lawsuit like this one.

| Lead Plaintiff: Also known as a class representative, a “lead plaintiff” is someone, a group, or an organization that initiates a class action lawsuit. They are the ones who represent a large group of people with the same suffering. |

For the elf lawsuit, the deadline to file for being the lead plaintiff is currently set for 5th May 2025.

Missing this date could mean losing your right to be part of the lawsuit and claim any potential compensation.

To make sure you meet the deadline, you can contact a law firm handling the case or check the official notices online. They’ll guide you through the process and help you understand what documents you need to provide.

How Has the e.l.f. Lawsuit Affected Investors?

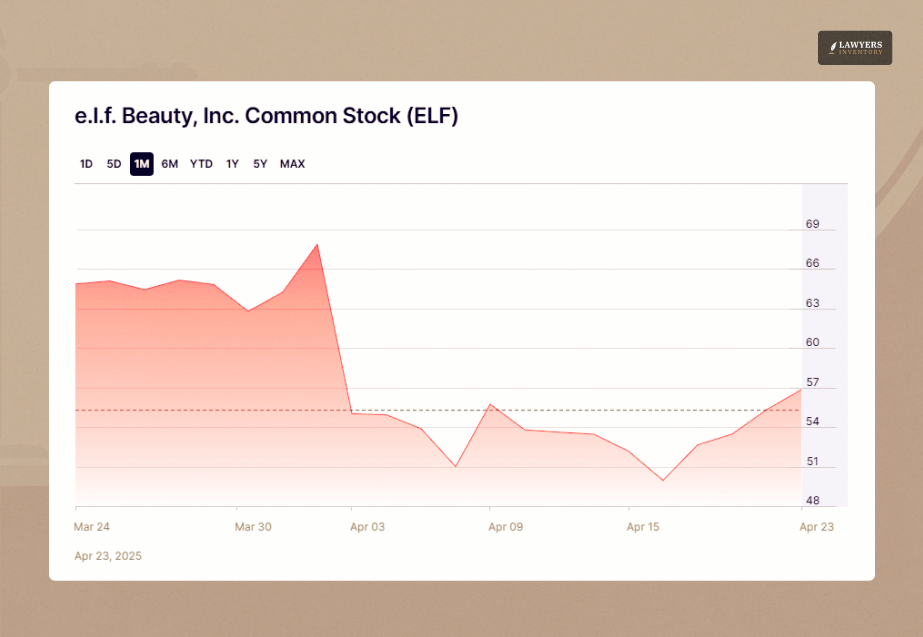

The victims have suffered greatly from the ongoing e.l.f. lawsuit. The company’s share price went down like a stone when the news emerged that there were probably dishonest financial figures.

Had it not been for the decision of valuing the shares based on correct information, many investors would have had to bear the pain of their stock portfolio losing value.

The blow in such cases is not only financial but, in one’s view, even psychological. Thus, for some, it may imply the loss of money earmarked for important life goals like retirement, a house, or the education of their children.

To the company, it presents a problem with trust. Financial reports that are excessively misrepresented to the public make it so that later on, it is nearly impossible for investors to trust.

In case e.l.f. is declared guilty of going against the law, the court might order the company to compensate the injured party.

No, it won’t bring back the stress and frustration that have hit the investors. However, it can be a financial aid through the payout.

What Should Investors Do About the elf Lawsuit?

As I have already told you before, if you are an investor and own certain shares in the e.l.f. Beauty, during this class period, you can join the class action lawsuit.

Now, there are a few things that you need to do. Some of them are as follows:

- Check Your Investment Records: Find out when you purchased your shares and how much you paid.

- Contact a Securities Lawyer: They can tell you if you qualify to join the class action and what your legal rights are.

- Submit a Claim: If you qualify, the lawyer will help you file the necessary documents to be included in the lawsuit.

- Stay Updated: Keep track of news related to the case. You can sign up for email alerts or follow the law firms involved in the lawsuit.

It’s also wise to learn from this experience. When investing in any company, always do your research, and remember that flashy numbers don’t always tell the whole story.

Read Also:

- Real Estate Commission Lawsuit: How to Take Part in the $730 Million Settlement?

- Depo Provera Lawsuit: Updates About the Brain Tumor Lawsuit Against Pfizer

- Generational Equity Lawsuit: The Class Action Settlement That Cost $275k!

0 Reply

No comments yet.