In the recent TransUnion FCRA Class Action settlement, the major US credit bureau has agreed to a $23 million class action settlement to address its failure to remove disputed hard inquiries from consumers’ reports for almost a decade.

The court in the federal district of Pennsylvania, Eastern District, gave its preliminary green light to the case in February 2025. The settlement is estimated to affect more than 485,000 consumers, reports CNBC.

As per a class action complaint, TransUnion did not remove consumer data from its files even after Portfolio Recovery Associates, a debt collection agency, requested the deletion. The plaintiff in the case argues that such a practice amounts to violations of the FCRA.

In this article, we will be talking about the following:

- What is the TransUnion FCRA Class Action settlement?

- What is the background of the lawsuit?

- Major allegations in the lawsuit.

- What are the key settlement terms?

- How to know if you are eligible?

- How to claim the settlement?

Therefore, if these are some of the things that you want to know, keep on reading this blog till the end…

What Is The TransUnion FCRA Class Action Settlement?

In 2025, a major class-action settlement was reached against TransUnion, LLC, one of the three primary U.S. credit-reporting agencies.

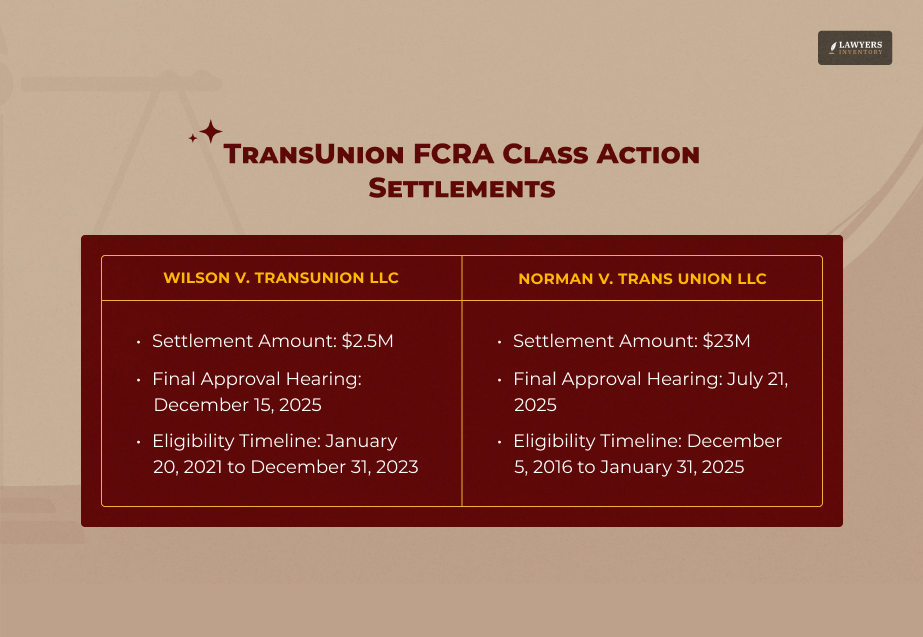

In the first settlement, known as Norman v. TransUnion, LLC, TransUnion agreed to pay US $23 million to resolve claims that it mishandled consumer disputes about “hard” credit report inquiries, according to ClassAction.org.

In a separate but related case, Wilson v. TransUnion, LLC, TransUnion agreed to a US $2.5 million settlement. That lawsuit alleged that TransUnion improperly furnished consumer credit-report data to third parties (notably a debt collector) through its “Triggers For Collection (TFC)” service — even after a request to delete the data.

In both cases, the plaintiffs asserted violations of the Fair Credit Reporting Act (FCRA). The “class” in Norman covers consumers who received a “502 Letter” from TransUnion in response to a written dispute of an unauthorized or disputed hard inquiry between December 5, 2016, and January 31, 2025.

The Wilson class covers individuals whose consumer data was sent to a third party via the TFC service after a deletion request between January 20, 2021, and December 31, 2023.

According to the TransUnion Dispute Class Action page, though TransUnion denies wrongdoing, the company agreed to settle both suits — likely to avoid the time, cost, and risk of protracted litigation.

The settlements represent an important vindication for consumers under FCRA and an opportunity for potentially affected individuals to recover monetary compensation.

Why Did The TransUnion FCRA Class Action Lawsuit Happen?

The FCRA regulates how consumer reporting agencies (CRAs) like TransUnion handle credit information about individuals. According to the Consumer Financial Protection Bureau, among other protections, the law gives consumers the right to:

- Obtain their credit reports.

- Dispute inaccurate or unauthorized information.

- Have the CRA conduct an investigation promptly.

Furthermore, the Legal Information Institute also states that, specifically, under 15 U.S.C. § 1681i, when a consumer disputes information they believe is inaccurate (including “inquiries” recorded on their file), the CRA must:

- Notify the furnisher (the entity that provided the information) about the dispute within five business days.

- Conduct a reasonable reinvestigation within 30 days.

- If the disputed information is inaccurate, incomplete, or unverifiable, delete or modify that information. If not, the CRA must still verify its accuracy before continuing to report it.

- Ensure that previously deleted information is not “reinserted” without proper certification and notice to the consumer.

Additionally, as per Investopedia, the FCRA limits access to credit reports: they may be furnished only for a “permissible purpose” (e.g., loan application, employment screening with consent, etc.).

What Are The Allegations Against TransUnion?

In Norman v. TransUnion, the complaint contended that TransUnion failed to meet these statutory obligations when consumers challenged “hard” inquiries — i.e., notation on their file showing that a third party accessed their credit report (typically in connection with credit, loan, or service applications).

Specifically, the suit alleged that when a consumer disputed a hard inquiry as unauthorized, TransUnion did not contact the entity that made the inquiry, and did not delete or otherwise verify the inquiry.

Instead, it automatically responded with a standardized “502 Letter,” irrespective of whether the inquiry was valid or not.

The effect was that disputed inquiries remained on the consumer’s credit file — without any real investigation — thwarting the FCRA’s reinvestigation and correction requirements under § 1681i.

In Wilson v. TransUnion, the complaint alleged a different violation: that TransUnion continued to furnish consumer credit-reporting data to third parties through its TFC (“Triggers For Collection”) service even after a deletion request had been submitted by a debt collector (Portfolio Recovery Associates). According to the complaint, such furnishing lacked a “permissible purpose.”

Under FCRA, furnishing consumer report data without a permissible purpose, or failing to cease furnishing after a deletion request, violates the law.

Thus, both lawsuits challenged systemic failures by TransUnion to comply with FCRA’s core duties:

- Reasonable reinvestigation.

- Correction or deletion of disputed information.

- Limiting dissemination unless authorized.

What Are The Key TransUnion FCRA Class Action Settlement Terms?

Here is a breakdown of the two settlements — their sizes, class definitions, and payment structure:

| Settlement / Case | Fund Size | Payment Amount per Person |

| Norman v. TransUnion, LLC | $23,000,000 | • Automatic payment: estimated $20–$30 without any claim form. • Higher payment (up to ≈ $160) for those who experienced certain harms and submit a valid claim by the deadline. |

| Wilson v. TransUnion, LLC (TFC data disclosure after deletion request) | $2,500,000 | Expected payout at least $40 per class member (net share after fees, admin costs). |

Other Important Settlement Terms (Norman)

The $23 M fund covers not just payments to class members but also settlement administration costs, up to about $7,966,667 in attorneys’ fees, litigation costs up to $300,000, and a $50,000 service award to the named plaintiff.

TransUnion also agreed to implement changes to how it handles disputes of hard inquiries — including monitoring for patterns of disputes, and possibly re-credentialing or terminating subscribers who generate excessive challenge volume.

According to Claim Depot, those class members who want a higher payment must attest — under penalty of perjury — that they experienced at least one of the following harms:

- Decrease in credit score.

- Credit report with the disputed inquiry being sent to a third party.

- Being denied credit at least in part because of the disputed inquiry.

Deadlines & Administrative Details

- For the Norman lawsuit (hard-inquiry), the claim form / exclusion deadline was June 24, 2025.

- Final approval hearing was held July 21, 2025 (or July 22, 2025 per other sources).

- Settlement checks are to be mailed to the address on file — recipients with updated addresses must update their information on the settlement website’s “Update Address” page.

- For Wilson (TFC), no claim form was required — payments are automatic, unless class members opt out.

Am I Eligible For The TransUnion FCRA Class Action Settlement?

If you think you might be eligible, here’s a simple checklist to walk yourself through:

Did You Receive A “502 Letter” From TransUnion?

For the hard-inquiry settlement (Norman), only consumers who received that standardized 502 Letter in response to a written dispute are part of the class.

Did You Submit A Written Dispute About A “Hard Inquiry” Between December 5, 2016, And January 31, 2025?

If yes — good. If outside that date range, you are not eligible under this class.

Are You A U.S. Resident (Or Resident Of A U.S. Territory)?

Yes — that is part of the class definition. Additionally, for the Wilson (TFC) settlement, ask yourself:

- Did you receive a postcard notice indicating you were among those whose data was sent to the debt collector, after a deletion request?

- Was that data disclosed between Jan 20, 2021, and Dec 31, 2023?

Do You Want To Exclude Yourself?

If you do nothing, you will be part of the settlement and either receive an automatic check or be eligible to submit a higher payment claim (for Norman). If you prefer to keep rights to sue individually for other claims, you may exclude yourself by the deadlines.

Have You Updated Your Current Mailing Address With TransUnion / The Settlement Administrator?

If your address has changed since the dispute, you should log in to the settlement site and confirm or update your address (using your Notice ID / PIN). Otherwise, the check may be mailed to an old address.

If you check “yes” on items 1–3 (or 4, for Wilson) — and did not opt out — you are likely eligible. If still unsure, you can look for your unique Notice ID / PIN on any mailed notice or postcard, then log in to the settlement website to verify eligibility.

How To Claim The TransUnion FCRA Class Action Settlement?

If you are planning to claim your money or part of the TransUnion FCRA Class Action Settlement, here are a few things that you will have to do for each class action:

For The $23 M Norman Settlement

If you did nothing, you should receive a pro rata check for approximately $20-30. TransUnion/the administrator will mail it to your last known address.

To get a higher payment (up to ~$160), here are a few things that you need to do:

- Go to the settlement website (the official site for the class action).

- Enter your unique Notice ID and PIN (these would be on the personalized letter or postcard you received).

- Fill out the claim form and attest under penalty of perjury that you experienced one of the qualifying harms (credit-score drop, denial of credit due to the disputed inquiry, or that TransUnion furnished a credit report with the disputed inquiry to a third party).

- If you prefer, you can request a paper form (mailed with the original notice) and mail it to the Settlement Administrator at: Norman v. TransUnion, LLC, c/o Settlement Administrator, PO Box 23489, Jacksonville, FL 32241

- The deadline for submitting a claim or opting out was June 24, 2025.

For The $2.5 M Wilson Settlement

If you were part of the class and received a postcard notice, you don’t need to do anything. They will mail the checks automatically — unless you timely exclude yourself, according to Wilson FCRA Class action.

If you want to opt out, you must mail a signed exclusion request (include your name, last 4 digits of SSN, and signature) to the Settlement Administrator so it is received by Nov. 4, 2025.

Timeline & What To Expect: What Happens After You Submit?

The general timeline for a settlement like this typically proceeds as follows — and this case appears to be following that path:

- Preliminary approval — for Norman’s $23M settlement, granted early 2025 (preliminary approval on February 24, 2025).

- Claim period / exclusion window — claims and exclusions had deadline June 24, 2025 (Norman).

- Final fairness hearing — for Norman, this took place July 21–22, 2025.

- Payment distribution — according to the settlement website, checks will be mailed “approximately 51 days” after the judge grants final approval (for the $23 M case).

- For Wilson (TFC), after a final fairness hearing scheduled December 15, 2025, the settlement administrator will distribute checks about 45 days after final approval (assuming no appeals) to class members who did not opt out.

What If You Move Or Change Address?

If you update your address on the settlement website (using your Notice ID / PIN), the settlement administrator should mail the check to the new address. Failing to do so could result in a check sent to an old address — possibly lost or delayed.

What If You Opted Out?

If you opted out, you lose the right to receive a settlement check — but you keep the right to file your own lawsuit (subject to statute of limitations)

What If Funds Remain After Distributions?

Some settlements (especially smaller-per-member ones) may leave residual money from uncashed checks or unclaimed shares. For example, according to Claim Depot, Wilson’s leftover funds are earmarked for distribution to nonprofit consumer-protection organizations (per the settlement’s terms).

Read Also: Credit One Bank Class Action Lawsuit- Eligibility And Claiming Your Share

Impact Of TransUnion FCRA Class Action Settlement: What It Means For Your Credit?

The settlement helps reinforce that you have real, enforceable rights — and that CRAs are not above the law. Here are a few things that you should keep in mind:

Cash Compensation

For eligible consumers, this settlement offers modest but real cash payments. While these amounts won’t transform finances, they represent a formal recognition of consumer rights and — for some individuals — reimbursement for tangible harms (credit-score damage, credit denials, or improper data sharing).

Structural Changes At TransUnion

The settlement isn’t just about money: TransUnion agreed to change how it handles hard-inquiry disputes going forward. Among other reforms, it must monitor and investigate patterns of hard-inquiry disputes linked to particular “subscribers” (the entities pulling credit), and may re-credential or even terminate abusive or suspicious subscribers.

These changes should improve consumer protections — helping ensure that future unauthorized or fraudulent hard inquiries are more likely to be caught, reviewed, and properly handled.

Reinforcing FCRA Enforcement And Consumer Rights

The settlement underscores the value and enforceability of rights under the FCRA. It sends a message that credit-reporting agencies may be held accountable when they ignore disputes or continue furnishing data without a lawful purpose.

For consumers, it underscores the importance of:

- Regularly reviewing credit reports,

- Disputing unauthorized or suspicious hard inquiries,

- Keeping records (mail, “502 Letters,” dispute notices), and

- Monitoring for data sharing or unauthorized disclosures.

What You Can (And Should) Do Going Forward

If you ever see a “hard inquiry” on your credit report that you did not authorize — or if you receive suspicious notices or data-sharing communications — you should:

- Dispute immediately with the CRA (in writing),

- Keep a copy of your dispute letter and any response (especially a “502 Letter”),

- Check who pulled your credit report and whether they had a permissible purpose,

- If necessary, consider a formal legal claim or class-action participation.

Expert Tips & Best Practices

Here are actionable recommendations — especially helpful for lawyers researching consumer-credit law, or for consumers seeking to protect themselves:

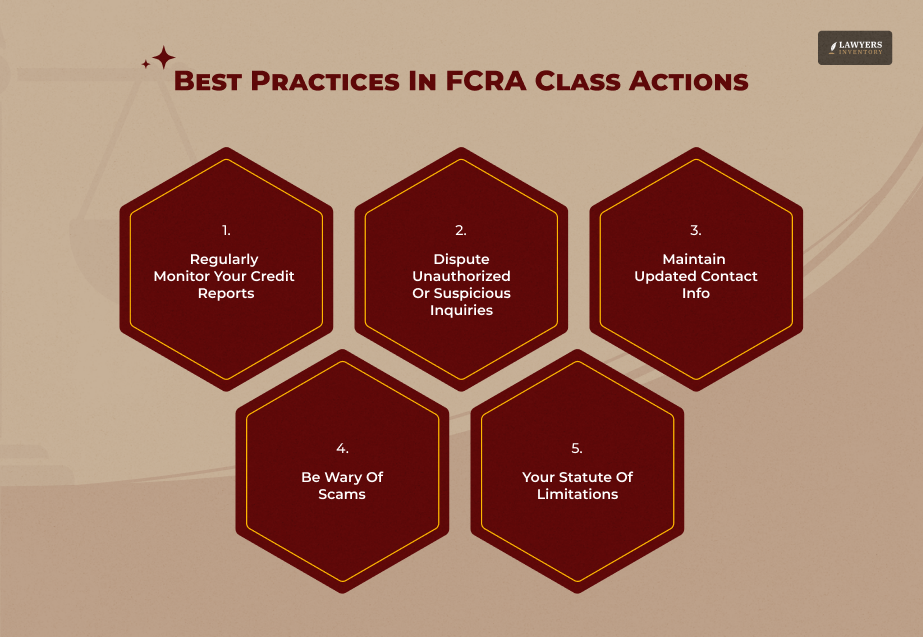

1. Regularly Monitor Your Credit Reports

Under the FCRA, you are entitled to at least one free report per year from each nationwide CRA (like TransUnion). Use these to track inquiries, accounts, and potential identity theft.

2. Dispute Unauthorized Or Suspicious Inquiries

If you see a hard inquiry that you didn’t authorize (or don’t recognize), send a written dispute immediately and request deletion or verification. Under FCRA, the CRA needs to investigate within 30 days, according to the Legal Information Institute.

3. Maintain Updated Contact Info

If you’re part of a settlement, keep your Notice ID / PIN and maintain updated contact info — many class-action payments are mailed automatically, but failed delivery often comes from outdated addresses.

4. Be Wary Of Scams

Legitimate class-action settlements do not require payment or “processing fees” from claimants. Always use official settlement-administrator websites, and verify deadlines directly from court-authorized notices.

5. Your Statute Of Limitations

If you exclude yourself from a settlement, track your statute of limitations — you preserve the right to sue individually, but you may lose that right if you wait too long. Under the FCRA, the statute typically runs no more than five years from the violation or two years from discovery. However, it depends on circumstances.

6. Advise Clients Or Readers Of Available Remedies

For attorneys or consumer-rights writers: this settlement reinforces that hard inquiries and data-sharing practices remain potential grounds for FCRA litigation.

0 Reply

No comments yet.