The Capital One class action lawsuit remains a critical topic for many customers. This legal action targets the bank’s practices, primarily concerning fees, data security, and account management. A class action lawsuit allows a large group of people with a common claim to sue a defendant collectively.

This approach makes legal action feasible, especially when individual claims might be too small to pursue alone. Consequently, the bank faces scrutiny over various operational areas, which affects thousands of account holders.

Key Issues And Primary Keywords In The Litigation

The core of most of the recent litigation involving the bank would involve certain financial products and security issues. The most common issues typically would be alleged overdraft or insufficient fund fee practices and data breaches.

Data Breach And The Massive Capital One Class Action Lawsuit

It was in 2019 that a huge data breach revealed the personal information of more than 100 million customers, most of whom are from the U.S. and Canada. This immediately led to a major Capital One class action lawsuit.

This action was concluded with a $190 million class-action settlement by the bank in question. This action was supposed to compensate the affected individuals after hacktivism, where numerous claims arose after the breach of customer information.

A data breach is one of the severest kinds of consumer harm that is followed by widespread litigation. This Capital One class action represented a significant milestone in the need for strong cybersecurity in the financial industry.

Fee-Related Claims And The Capital One Lawsuit

Other legal complaints concern service charges. In particular, some plaintiffs filed a lawsuit against Capital One regarding their overdraft fees or NSF (Non-Sufficient Funds) fees.

These suits affirm that the bank charged multiple fees for a single transaction or had misleading practices in transaction processing, according to a Case Study of the Capital One Data Breach by the Sloan School of Management, Massachusetts Institute of Technology.

The plaintiffs claim that these practices produce unfair revenues. The Capital One Lawsuit disputes the bank’s contractual agreements with its customers. As a result, most customers clamor for clarity as well as fairer policies. This has been a common phenomenon within the banking sector.

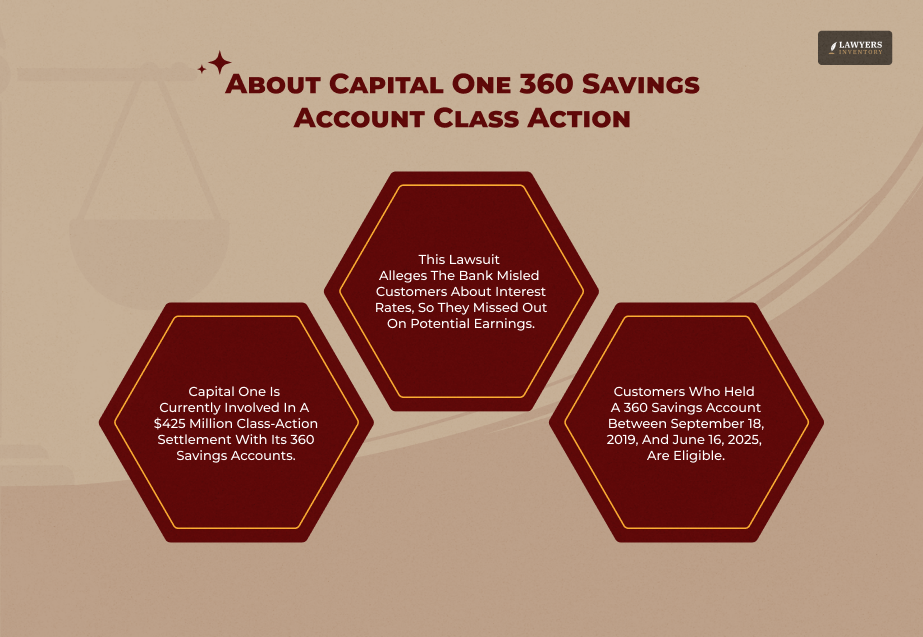

Specific Account Focus: Capital One 360 Savings Account Class Action

Customers holding specific deposit products have also filed a Capital One Savings Account Lawsuit. These lawsuits sometimes concern how the bank calculates or applies interest and fees on savings accounts. The focus of attention is usually on the terms and conditions related to high-yield savings products.

The Capital One 360 Savings Account Lawsuit is a related area of interest. This specific legal matter focuses on the popular online-only product. Claims might involve allegations of changes to interest rate structures or unclear disclosure of account terms.

For example, some customers have contested how the bank handled conversions or transitions between different product generations. The details in any Capital One class action lawsuit concerning savings accounts usually depend upon the strict wording of the bank’s deposit agreements.

Understanding Your Rights And Settlements

If you were a customer during the time period covered by a Capital One class action lawsuit, you probably have rights as a class member. You will typically be sent a formal notice in the mail or via email that describes the case and your options.

Opting Out/In

As a member of the class, you usually have the option to opt out of the settlement. You can opt out and pursue an individual legal claim. You do nothing, meaning that you remain in the class and are bound by the terms of the settlement, which generally means that you will receive a payment but give up your right to sue separately.

Receiving Compensation

After the deduction of attorney fees and administrative costs, the settlement amount is distributed among eligible class members. The amount you receive from a Capital One class action lawsuit often depends on things like the type of account held and the extent of the alleged damages.

In this regard, due process requirements must be taken into consideration to ensure that the notice is valid.

Read Also: AT&T Data Breach: What Affected Customers of This $13 Million Class Action Should Know

Legal Angles And Reform Debates

The ongoing litigation feeds directly into larger reform debates about banking fairness. These suits signal issues of algorithmic risk bias in how financial institutions manage risk and charge fees.

Algorithmic tools sometimes disproportionately impact certain demographics of customers. Major lawsuits on the rise, including the facets that make up the class action lawsuit against Capital One, raise demands for increased transparency in banking operations.

International Comparison And Statutory Citations

Although the emphasis is on U.S. law, comparable consumer protection actions occur internationally. For instance, in the United States, banking operations are subject to such statutes as the Dodd-Frank Act and regulations promulgated by the Consumer Financial Protection Bureau (CFPB).

Moreover, the international operations of the bank may also open it to various suits based on different jurisdictions, such as the GDPR by the EU, in cases of data privacy breach. This, therefore, calls for a cross-jurisdiction comparison.

Case Law And Landmark Decisions

Specific court decisions establish precedents. A case like Choi v. Capital One Bank (USA) N.A. involved NSF fee practice challenges.

These cases help to solidify case law from which banks derive what they can and cannot do regarding consumer accounts. Every Capital One class action helps shape future consumer protection policies, which in turn influence every financial institution.

Read Also: The USAA Data Breach Settlement- Your Guide To Claims And Compensation

Frequently Asked Questions (FAQs):

These various forms of the Capital One class action lawsuit show the might of collective legal action. With such processes, customers can hold big financial institutions accountable. At times, any Capital One class action lawsuit will involve keeping a close eye on the news so that all rights are well-protected and treated fairly in the process.

Generally, you’re eligible if you had the specific account type and were a customer during the dates defined in the Capital One class action lawsuit legal notice. A court-approved notice is the best confirmation.

No. Generally, being a class member in any of the current or past Capital One Lawsuits does not affect the status or service of your current account as long as you continue to meet the requirements for the account.

You should carefully read the notice. It will explain your options: you can file a claim form for payment, or you can opt out to preserve your right to file an individual suit against the bank.

![Understanding The Pay Transparency Law Of Massachusetts [2026 Guide]](https://lawyersinventory.com/wp-content/uploads/2026/02/massachusetts-pay-transparency-law-100x100.png)

0 Reply

No comments yet.