Being inundated with non-stop robocalls is really infuriating. Many consumers whose phone was targeted with these robocalls from one specific big card issuer were relieved by a court action. The Credit One Bank TCPA Robocall settlement resolves claims that Credit One Bank, N.A., violated federal law by generating calls to consumer mobile phones without valid consent.

This class action suit impacts as many as millions of Americans. If you were contacted between 2014-2019, it’s important to understand the Credit One Bank TCPA Robocall settlement. This is the full guide explaining the legal underpinning, qualification, and exact steps you need to take in order to receive your claim.

The Legal Core- Understanding The TCPA

The foundation for the whole suit is the Telephone Consumer Protection Act (TCPA). The TCPA, which is a robust federal law, was enacted in 1991. It aims to protect consumers from unwanted phone solicitations, including faxes, text messages, and most notoriously, robocalls.

The TCPA itself confines the use of an automated dialing system lawsuit to dial cell phones without prior express consent of the recipient.

Credit One Bank was brought to court for making use of such systems to contact people, most often for collections or servicing of accounts. The violations are severely fined, and that is why the Credit One Bank TCPA Robocall settlement turned out to be a considerable amount.

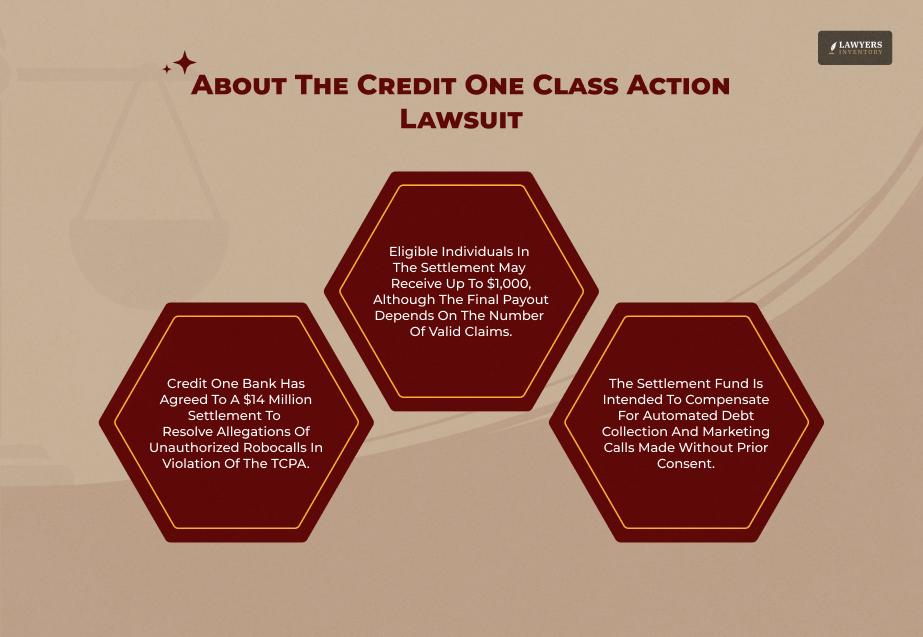

Case Summary- The Credit One Class Action Lawsuit

The suit, often referred to as the credit one bank class action lawsuit, began when customers complained of getting continuous, unwanted calls by or on behalf of Credit One Bank. The plaintiffs alleged that the bank used ATDS and/or prerecorded messages without first acquiring the necessary prior express consent under the TCPA.

The court authorized a national class of individuals. At last, the parties agreed upon a settlement fund to resolve the case, which resulted in the Credit One Bank TCPA Robocall settlement.

This action allowed millions of consumers to receive compensation without pursuing litigation individually. The Credit One Bank TCPA Robocall settlement impacts calls made primarily between May 2014 and April 2019.

Who Is Eligible For The Settlement Fund?

Qualification for Credit One Bank TCPA Robocall settlement is based on two main areas: call timing and equipment.

Defining An Eligible Claimant

You will probably be eligible if you possess the following criteria:

1. Timeframe

You were called by one or more non-emergency phone calls placed by Credit One Bank, or by a third party on its behalf, from May 22, 2014, through April 30, 2019.

2. Technology

The telephone calls were placed on your cellular phone by an automated dialing device or an artificial or a recorded voice.

3. Consent

More importantly, you did not have your prior express consent for receiving those specific automated calls from the bank.

The credit one bank settlement is distinctive because non-purchasers who received collection calls intended for another person might also qualify. The expansive definition promotes broad consumer relief.

The Role Of The Claim Administrator

After initial approval by the court was received, a class action claims administrator was tasked with managing the fund and validating claims. A third party independent of the bank and court that has control over the notice process.

Additionally, they verify claimants’ eligibility and finally distribute the Credit One Bank TCPA Robocall settlement fund. You will have to work directly with the claims administrator and not with the court or the bank.

How To Submit Your Claim For The Robocall Settlement?

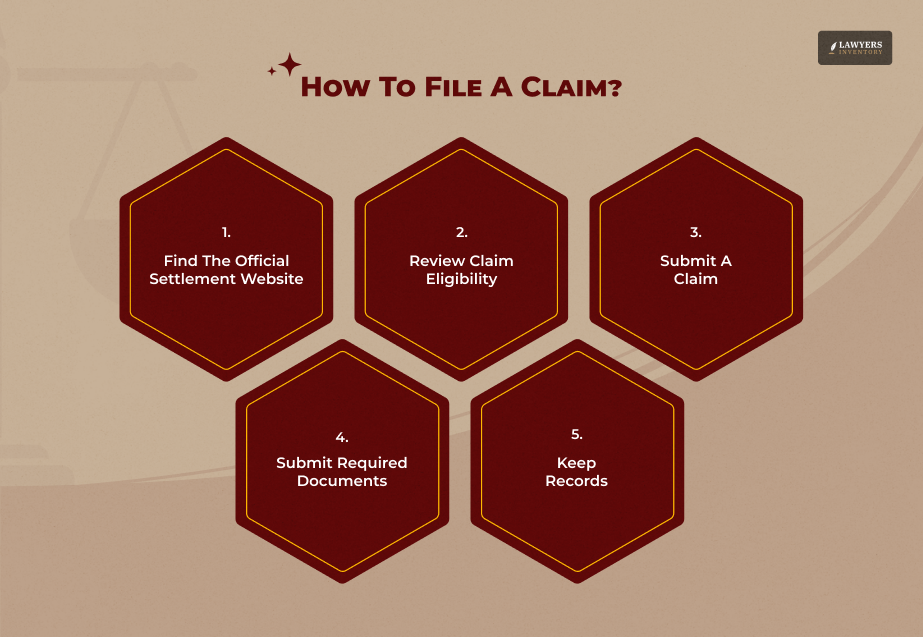

Submitting a claim for the robocall settlement is simple, but it must be done with accuracy and attention to deadlines. The process ensures that all those eligible for a payment from the Credit One Bank TCPA Robocall settlement are identified correctly.

Step 1- Receiving Notice

If your Credit One records indicated that you were a member of the class, you would have gotten a formal notice by mail or email containing a Unique Claim ID. This would have sped up your submission. If notice was not received, but you believe you are a member of the class, you may nonetheless file your claim online on the official settlement website.

Step 2- The Claim Submission Process

You fill out a claim form either online or by mailing a paper copy. The form typically asks for the following.

- Your contact information.

- The number dialed.

- Proof that you were subjected to the calls and did not consent to them.

The deadline for filing the Credit One Bank TCPA Robocall settlement claim matters. Missing this date results in the loss of your right to payment.

Step 3- Required Documentation

Although TCPA settlement qualification is typically based on Credit One’s internal call records, you can strengthen your case by providing supporting documentation. This could be:

- Phone records of the calls.

- Call log screenshots.

- Data on the nature of calls.

This documentation helps the class action claims administrator in verifying your submission without delay.

Read Also: How To Claim Money In The GM Class Action Settlement?

Why Is Credit One Bank Calling Me? Legal Implications Post-Settlement

Many consumers are still left wondering, Why is Credit One Bank calling me? The Credit One Bank TCPA Robocall settlement resolves previously filed claims but does not prohibit all future calls.

Consent Is Key

TCPA allows businesses to call consumers if they have prior express consent. For customers who provided their cell phone number on a credit application, this typically satisfies legal consent requirements.

But under the settlement, the warning is that such consent may be revoked at any time. If you continue to receive unwanted automated calls, you need to explicitly tell the caller to stop calling.

Industry Watchdog Effect

The Credit One Bank TCPA Robocall settlement serves as a stern message to the debt and financial sectors. It is an indication that courts will aggressively enforce the TCPA.

Other companies engaging in non-compliant, aggressive telemarketing risk being targeted by the same TCPA robocall class actions. The precedent ensures better compliance across the industry.

Best Practices And Avoiding Scams

Settlements attract scammers. Be cautious. Stay on the official settlement website or in the contact information contained in the formal court-approved notice.

Never pay a claim-filing fee, and never give out sensitive information like your Social Security number to unknown entities.

Frequently Asked Questions (FAQs):

The Credit One Bank TCPA Robocall settlement gives consumers that were annoyed by unwanted calls a chance to get reimbursement. If you qualify, complete your claim timely and accurately so that you can get your portion of the Credit One Bank TCPA Robocall settlement money.

Ans. The size of the final payment per claimant depends on the total number of approved claims filed. The total fund is divided pro rata among all eligible claimants after deducting their legal fees and administrative costs.

Payments are typically made several months following a final approval of the Credit One Bank TCPA Robocall settlement to be granted by the court.

Ans. No. Regardless of whether you are a customer, the key issue of the credit one bank settlement is whether you explicitly agreed to the automated dialing system to use your cell phone. This is where the offense is going to have been, even if you are a customer.

Ans. If the deadline has passed, you can regretfully no longer claim a payment from the Credit One Bank TCPA Robocall settlement fund.

If you “opted out” of the settlement, you still retain your right to file a personal lawsuit against Credit One Bank for the calls. However, you receive no money from the class action award.

0 Reply

No comments yet.