If you have been trying to figure out why there has been hype about the Social Security Fairness Act, I am here to help you understand!

Imagine putting in years of hard work as a police officer, firefighter, or teacher. And then you get to know that your Social Security payments from those occupations have been cut back or eliminated entirely. Isn’t that frustrating?

Due to two antiquated regulations, the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP), that is precisely what used to occur.

But there’s good news! This issue has now been addressed by the passage of the Social Security Fairness Act in 2025.

Regardless of whether they contributed to Social Security or a public pension, this new law guarantees that public employees receive the benefits they have earned by doing away with WEP and GPO.

Hi. In today’s blog, I will explain what this Act means and why it’s such a big deal for public workers. Additionally, I will also explain how you can make the most of these changes to secure your financial future. So, if you want to learn more, keep scrolling down…

What is the Social Security Fairness Act?

The Social Security Fairness Act was created to improve retirement benefits for public servants, including firefighters, teachers, and police officers.

Now, most people would ask, “What was the need?” Let me explain.

The necessity arose because many of these individuals are under the state or local government pension plans. Essentially, they do not contribute to Social Security while working in those jobs.

It’s possible that they did contribute to Social Security through other jobs they held during their lives.

The GPO and the WEP were two clauses that produced issues under the previous regulations.

Social Security benefits for public employees receiving public pensions were cut under the WEP. The GPO reduced or eliminated Social Security spousal or survivor benefits for people who received a public pension, going one step further.

As a result, many retirees had less money than they were entitled to or anticipated. WEP and GPO are no longer in effect, according to the 2025 Social Security Fairness Act.

Public employees are now eligible to receive their whole Social Security income from previous employment. And guess what? This is in addition to their public pensions.

Many supporters believe it’s a step in the right direction. This makes sure that no one is punished for serving in the public sector.

In short, it increases retirement security by allowing people to keep what they have worked so hard for. But is that really that great?

Who Were Most Affected by the Previous System?

The previous Social Security system disproportionately impacted the public employees who held positions under the state or local government pensions before the passage of the Fairness Act.

Teachers, firefighters, police officers, and other public sector employees fall under this category.

These people frequently did not contribute to Social Security while working in these positions. And this was because a public pension system provided their retirement benefits,.

However, many of these individuals contributed to Social Security through other jobs they held during their lifetimes.

Their Social Security payments from these jobs were diminished under the previous regulations due to the Windfall Elimination Provision (WEP).

Additionally, the GPO created yet another layer of inequity. How? Well, by reducing or eliminating spousal and survivor benefits for public employees receiving pensions.

The result? Retirees who dedicated their lives to public service often had far less financial support than expected. This created significant hardship for many.

What Problems Did the Social Security Fairness Act Aim to Solve?

Biden’s government introduced the Social Security Fairness Act to solve two major problems caused by outdated rules: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

As I have mentioned before, these rules unfairly reduced or eliminated Social Security benefits for public employees. Thereby, it created financial stress for many retirees.

The WEP reduced the Social Security benefits of individuals who earned a public pension irrespective of whether it contributed to Social Security. This left many retirees with much less income than they had thought.

The GPO was even harsher. It reduced or eliminated spousal and survivor benefits for public employees receiving a pension. This left the surviving spouses in financial hardship.

The Act aimed to fix these inequities by removing WEP and GPO, ensuring that public workers and their families received the full Social Security benefits they earned. It was a much-needed step toward fairness.

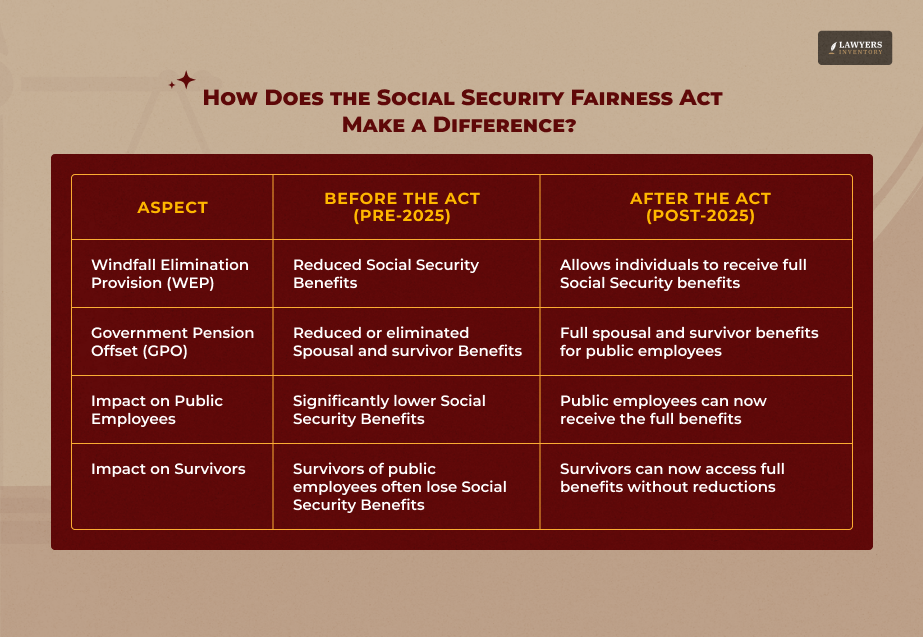

How Does the Act Make a Difference?

The Social Security Fairness Act greatly enhances the system by correcting the unjust reductions in Social Security benefits.

Teachers, police officers, firefighters, and other public servants can now earn their full Social Security benefits from other professions since the government eliminated GPO and WEP.

Because they also received a public pension under the old system, teachers who worked part-time in the private sector might have seen a large decrease in their Social Security income.

In a similar vein, if a firefighter’s spouse loses their eligibility for survivor benefits, the family may experience financial instability. These people are no longer subject to penalties for holding public office thanks to the Act.

In addition to offering them more financial stability in retirement and a sense of justice for their years of service, it guarantees they can receive the benefits they earned.

Social Security Fairness Act: Why Does It Matter?

As you know by now, the WEP would make it more difficult for people who had earned a public pension to rely on the benefits they received while working in the private sector by lowering their Social Security benefits. Additionally, the GPO further harmed government pension recipients by reducing or eliminating spouse and survivor payments.

These clauses were eliminated when the Social Security Fairness Act was signed into law on January 5, 2025. To ensure that they receive what they have earned, public employees can now collect their full Social Security payments without worrying about reductions.

This safeguards the financial stability of surviving wives and families. Additionally, it offers increased financial security to those who have served in the public sector for many years.

I would say that it’s a step toward improving the fairness and justice of the Social Security system for all workers, irrespective of their professional route.

Financial Impact of the Social Security Fairness Act

As an example of how the new law could function, consider this:

One spouse in a married couple receives $4,000 monthly from a pension associated with work in the public sector that did not pay Social Security taxes.

In order to be eligible for a $2,000 monthly government retirement payment, the other spouse had to work in the private sector and make enough Social Security contributions.

Spousal benefits were offered under the now-repealed GPO regulations, but not all the time. They would get the benefits only in cases where half of the benefit amount was greater than two-thirds of the pension amount.

Two-thirds of the $4,000 pension ($1,333) is not met by half of the $2,000 benefit ($1,000). Consequently, this spouse has not received any Social Security benefits.

However, with the Fairness Act, this couple’s retirement budget will be greatly improved. That’s because there will be an additional $2,000, which they can now earn each month thanks to the new statute.

The Social Security Fairness Act has positive and challenging financial implications for individuals and the broader Social Security system.

Here is a quick overview of how this act will impact the lives of the people financially:

For Individuals

- Increase Benefits: In addition to their public pensions, public employees like teachers and firefighters are now eligible to receive full Social Security payments. This gives you a big income boost when you retire.

- Improved Spousal and Survivor Benefits: Public employees’ families, particularly those of surviving spouses, can now obtain full benefits, which lessens the financial burden.

- Increased Retirement Security: Retirees can make plans for a more secure financial future by doing away with the GPO and WEP.

For the Social Security System

- Increased Payouts: The elimination of GPO and WEP results in a larger payout total, further taxing the Social Security trust fund.

- Proposed Long-Term Costs: According to critics, the Act might hasten the depletion of Social Security funds, which are already being strained by an aging population.

- Fairness Over Cost: Proponents emphasize that since the Act addresses decades of injustice, the benefits to public employees outweigh the costs.

While the Act provides much-needed relief to retirees, balancing fairness and the system’s sustainability will remain a key challenge.

Read Also:

- Having an Employment Law Attorney is a Blessing During THESE Times!

- Virginia Employment Law: A Guide So That You DON’T Get Fired!

- Quit Claim Deed Loopholes You MUST Know to Avoid Probate!

0 Reply

No comments yet.