If you are searching for ways to challenge a quit claim deed regarding a property, you might want to know about certain quit claim deed loopholes. And yes, it is exactly what it sounds like— finding loopholes to exploit the weaknesses in the deed.

But is it easy to do so? What are the elements that you need to look out for? And, most importantly, how can you use it to avoid a probate?

Hi. In today’s blog, these are exactly the questions I will answer. So, fi you are interested to know them, your search ends here!

Keep reading this blog till the end to learn more…

What is a Quit Claim Deed?

A quit claim deed is one of the most popular legal documents that transfers property ownership from one person (the grantor) to another (the grantee). What makes it unique is its simplicity.

A quit claim deed doesn’t guarantee that the property is free from liens or disputes, unlike a warranty deed. It only transfers the grantor’s interest in the property—whatever that may be—without any promises about its legal status.

For instance, if you own a property and want to transfer it to a family member or add a spouse’s name after marriage, you can use a quit claim deed.

The process is typically quick and doesn’t require a title search or an in-depth legal review, making it cost-effective. However, its simplicity comes with risks.

The grantee has no legal protection if there are hidden issues with the title, like unpaid taxes or legal claims.

Understanding how and when to use a quit claim deed is critical, especially if you’re trying to avoid complications like probate.

Quit Claim Deed Loopholes: Your Ultimate Way of Avoiding Probate?

Here’s the big question: Can a quit claim deed help you avoid probate? The answer is yes, but it comes with a few catches.

When a person passes away, their assets—including property—typically go through probate, a court-supervised process of distributing the estate. This process can be lengthy, costly, and stressful for loved ones.

A quit claim deed offers a potential loophole by allowing the property owner to transfer ownership while still alive.

For example, you transfer your house to your child using a quit claim deed. Your child becomes the legal owner once the deed is recorded with the local county recorder’s office.

Since the property is no longer part of your estate, it skips probate entirely. This strategy can save your heirs time, legal fees, and emotional stress.

But here’s the catch!

Experts warn that this loophole isn’t foolproof. While it can be a probate-avoidance tool, it has risks.

First, if the property has any liens or legal claims, the grantee inherits those problems. Second, in some cases, transferring property via a quit claim deed may trigger gift taxes, which could be significant.

Additionally, legal professionals advise against using quit claim deeds as a one-size-fits-all solution.

According to John W. Stevens, a probate attorney with 20 years of experience, “While a quit claim deed can help you avoid probate, it’s essential to understand the long-term implications. Improperly executed deeds can lead to disputes, title issues, or even legal challenges down the road.”

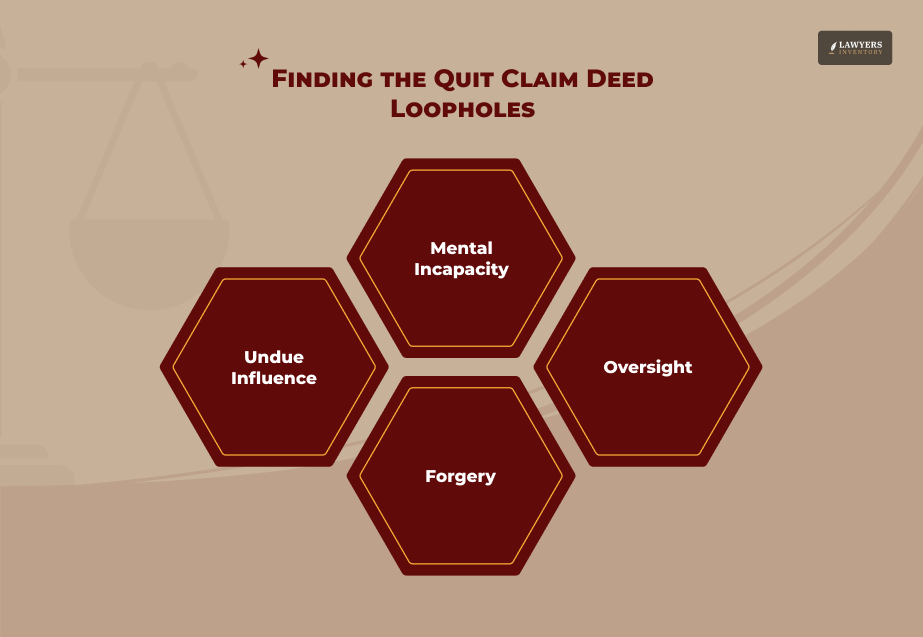

Quit Claim Deed Loopholes: What Are They?

The meaning of “Quit Claim Deed Loopholes” is exactly what it sounds like: the loopholes in the deed that let you get away with or avoid something.

Numerous loopholes may exist in quitclaim deeds. A challenger may argue that the deed was faked and that the grantor never signed it, or they may point to unfulfilled state requirements that render the instrument void.

Other disqualifying circumstances include the following:

Undue Influence:

A quitclaim deed is only lawful if both parties freely made the property transfer and there was no undue influence in the contract. If there is evidence that someone pressured the grantor into submitting the quitclaim against their will, there are grounds to revoke it.

Mental Incapacity:

Just like any other contract, mental incapacity can be a dealbreaker. You can challenge a deed if the signer lacks the mental capacity to make legal decisions. To demonstrate the victim’s fragile mental state, gather testimonies or medical data.

Oversight:

No one can enforce or file the quitclaim deed at your local recorder’s office if it is notarized or lacks the necessary information.

Forgery:

The deed would be void if someone else falsified the document’s signature. However, you’d likely have to prove that the signature and notary are inauthentic.

Quit Claim Deed Loopholes: How to Use It to Avoid Probate?

Using a quit claim deed is one ingenious method to get around the frequently drawn-out and costly probate process. It should be handled cautiously, though, as risks are involved. However, you need to be familiar with the ins and outs of probate to comprehend that.

This leads me to the subject: what is probate, and why is it something you should try to avoid?

The legal procedure known as probate examines and distributes a deceased person’s estate following their will (or state regulations in the absence of a will). Probate is a must. However, it might sometimes take months or years and can be expensive.

To transfer property ownership while the grantor is still living, you use a quit claim deed to remove the property from the estate. This saves your heirs time and money by removing the necessity for probate for that item.

You can swiftly and easily transfer property ownership using a quit claim deed. In contrast to other deeds, it does not include any assurances on the property’s title. Rather, it gives the recipient the grantor’s stake in the property.

A quit claim deed, for instance, can be used by a parent to transfer ownership of a home to their child. The property no longer belongs to the parent’s estate when the deed is recorded, making the child the legal owner and avoiding probate upon the parent’s passing.

Best Tips for Using Quit Claim Deed Loopholes

Quitclaim deeds can be useful to avoid probate, but they must be handled carefully to be effective.

You might wonder, “Can a quitclaim deed be challenged?” The answer is yes. Although these documents are simple to create and use, they must meet specific legal requirements to hold up in court.

Here are some tips to ensure your quitclaim deed is valid and protects your interests:

Verify Your State Laws:

Depending on where you live, different laws may apply to quitclaim deeds. For example, whereas some states do not require a witness to sign the deed, others do.

Legal issues may arise if your deed does not comply with state regulations. To prevent issues, make sure your quitclaim deed conforms with local laws.

Notarize the Deed:

Much like other legal documents, it is important that you notarize a quitclaim deed.

This confirms the deed’s validity and offers further protection if anyone challenges the ownership transfer by having it validated by a notary public.

Notarization is a very simple process that greatly increases the deed’s credibility.

File the Deed with the County Clerk:

You must submit the quitclaim deed to the county clerk to formally transfer ownership. In this phase, you can update public documents to reflect the property’s new owner.

Without this paperwork, the ownership transfer does not get legal recognition, which may cause problems.

Speak with an Attorney for Disputes:

If someone attempts to contest the quitclaim deed, the best defense is to speak with an attorney.

A knowledgeable lawyer can assess the circumstances, outline your options, and assist in resolving ownership disputes in a way that makes sense.

Legal advice is particularly crucial if the property has a complex past or is the subject of several claims.

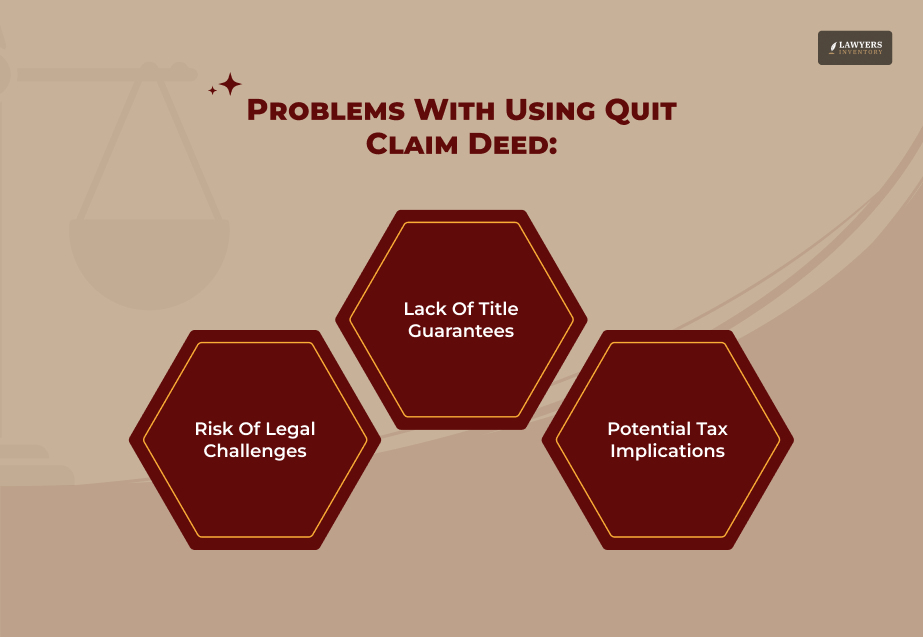

Consequences of Using Quit Claim Deed

Using a quit claim deed can be a quick and simple way to transfer property ownership, but it’s essential to understand the potential consequences before you proceed. While quit claim deeds have advantages, they also have certain risks that may affect your long-term goals.

Lack of Title Guarantees

One of the most significant drawbacks of a quit claim deed is that it doesn’t guarantee a clear title.

The grantor transfers whatever interest they have in the property, but there’s no assurance that the title is free from liens, unpaid taxes, or disputes.

This can lead to legal or financial problems for the new owner down the line.

Risk of Legal Challenges

Since most people often use quit claim deeds in informal or familial transactions, it makes them more prone to disputes.

The grantee could face legal challenges if the grantor did not fully own the property or if the execution of the deed was improper. This is especially important if you rely on the deed to avoid probate.

Potential Tax Implications

Transferring property through a quit claim deed can trigger tax consequences, such as gift taxes, depending on the property’s value and your state’s laws.

Additionally, the grantee might face higher capital gains taxes if they sell the property, as they don’t benefit from a stepped-up basis (the property’s value at the time of the grantor’s death).

Effectiveness in Avoiding Probate

While quit claim deeds can help avoid probate by transferring property ownership during the grantor’s lifetime, the deed must be legally sound.

Any errors in execution or failure to record the deed with the county clerk can undermine its effectiveness.

Warranty Deed vs Quit Claim: Which One Helps You With Probate?

When planning your estate, it’s essential to understand the differences between a warranty deed and a quit claim deed.

Both can transfer property, but they serve different purposes and offer varying levels of protection.

Let’s break it down to see which might be more helpful for avoiding probate.

1. Warranty Deed: More Protection, More Assurance

A warranty deed is a legal document that guarantees the transferred property has a clear title. The grantor assures that there are no liens, debts, or claims against the property.

Most people commonly use this type of deed in real estate sales because it protects the buyer from future disputes over ownership.

While a warranty deed offers security, experts do not typically use it for probate avoidance. That’s because probate usually applies to assets the deceased owned at the time of death, and warranty deeds are often executed during a property sale.

2. Quit Claim Deed: Quick Transfers, Probate Avoidance

A quit claim deed is simpler and faster to execute. It transfers ownership without warranties, making it a popular choice for gifting property to family members or transferring assets to a trust.

Since the transfer of ownership occurs while the grantor is alive, the property doesn’t go through probate after their passing.

3. Which One Is Best for Probate Avoidance?

A quit claim deed may be better if your main goal is to avoid probate. It allows you to transfer ownership during your lifetime, keeping the property out of your estate. However, ensuring the proper execution and keeping the deed record is crucial.

Consider consulting with a real estate attorney or estate planning expert for peace of mind. They can help you determine whether a quit claim deed is the right tool for your situation and ensure the transfer is legally sound.

Quit Claim Deed Loopholes: What to Do If It’s Challenged?

Once a quitclaim deed is recorded with the county clerk’s office, it becomes much harder to challenge because the transfer is officially documented.

However, it’s not impossible to dispute. The person challenging the deed must prove it was falsified or improperly executed. If you’re dealing with a quitclaim deed challenge, here’s a step-by-step guide to navigate the situation.

Consult an Attorney

If someone is challenging your quitclaim deed, your first step should be to speak with an attorney. A lawyer can review the specifics of your case and provide guidance based on your state’s laws.

For example, many states have a two-year statute of limitations for disputing a quitclaim deed, but this timeline can vary depending on where you live. An attorney will help you understand your rights and the best action.

Review the Deed

When a court receives a quitclaim deed challenge, one of the first things they’ll do is examine the deed to confirm if the transfer was legally valid.

You’ll need to show that the grantor (the person transferring the property) had the right to do so and that the deed meets all your state’s requirements.

Remember, even if the deed wasn’t filed with the county clerk, it may still be legally valid if all the necessary steps were followed.

Identify the Basis of the Challenge

You must understand why someone is challenging the deed to make a strong defense. For instance, common claims include forgery, mental incapacity of the grantor, or undue influence during the transfer process.

Once you understand the basis of the challenge, work with your attorney to develop a defense strategy tailored to the specific allegations.

Gather Evidence

Collecting evidence is a critical step in defending your deed. Depending on the nature of the challenge, useful evidence could include:

- Testimonies from witnesses who saw the deed being executed.

- Proof of the grantor’s intent, such as emails or letters.

- A copy of the recorded quitclaim deed from the county.

- Documents proving the grantor had full ownership rights to the property.

This evidence can help you show that the execution and validity of the quitclaim deed were legal.

Defend Your Deed in Court

Once you have evidence, work with your attorney to present your case in court. The burden of proof lies with the person challenging the deed, meaning they must provide solid evidence to support their claims.

If your deed complies with all legal requirements and your evidence is strong, the court will unlikely rule against you.

Consider a Settlement

Sometimes, settling the dispute outside of court is the best option. Settlements are often quicker and allow both parties to agree on a resolution without the stress of a trial.

Talk to your attorney about drafting a fair offer if you think a settlement could work.

Read Also:

- How to Get a Debt Lawsuit Dismissed in the FASTEST Way!

- 72 Sold Lawsuit Exposed the Deceptive Marketing Strategies of Real Estate Agents!

- Why Do I Need Estate Planning? A Comprehensive Guide to Safeguarding Your Family’s Future

0 Reply

No comments yet.