Today’s topic: WithU Loans!

It is an online lender that provides high-interest installment loans to borrowers who were otherwise struggling to secure conventional credit.

The company, which operates under the business name W6LS, Inc., guarantees swift service in emergency financial situations.

However, the financial consequences of their loan product are extremely high. The company has faced significant legal pressure in recent years over its “tribal lending” practice.

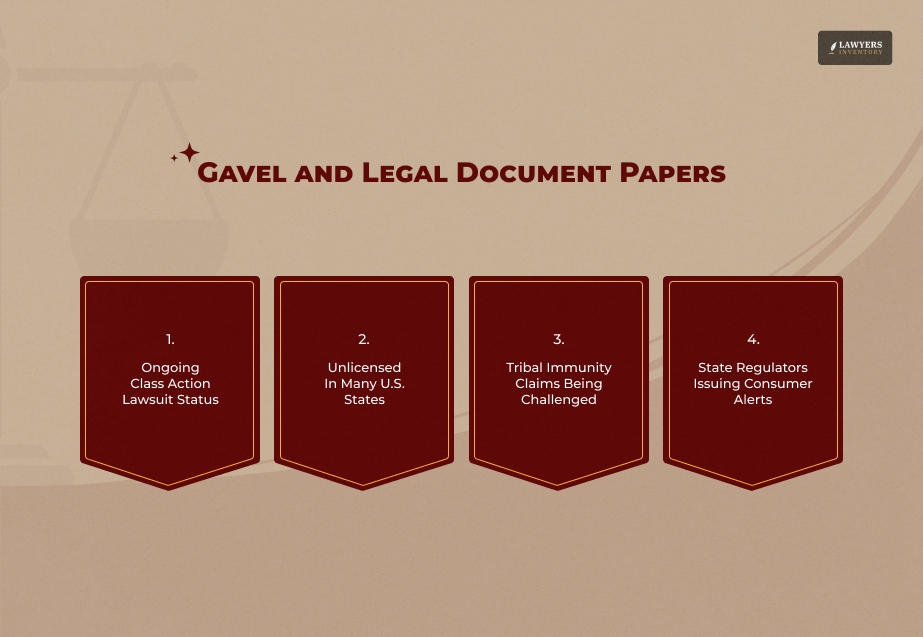

Currently, there is an existing case involving WithU Loans in the Northern District of Illinois, whereby the plaintiff has accused it of evading state usury laws by leveraging tribal sovereignty.

It is argued that it lends at more than 400% interest, which is strictly prohibited in Illinois. (Source: Harris et al. v. W6LS, Inc.)

In the past, such lawsuits against tribal lenders like American Web Loan have led to huge settlements and the annulment of loans.

Borrowers should keenly observe the progression of the case in the early days of 2026, as it may affect repayment of loans.

In the following article, we will elaborate on the following:

- The corporate structure and tribal affiliation of WithU Loans.

- A comprehensive analysis of the astronomical APR and fee structures.

- Critical patterns identified within customer complaints and reports of identity theft.

- Safer alternatives for emergency funding and credit rebuilding.

What Is WithU Loans? Company Overview

With U Loans is an online financial service company that offers small-dollar installment loans between $200 and $2,500.

The company targets subprime borrowers, providing quick approvals for people with thin or adverse credit histories.

Ownership And Tribal Lending Model

The company is an economic arm of the Otoe-Missouria Tribe of Indians, which is federally recognized.

The tribe operates in Oklahoma. This is an essential part of the operational structure of WithU Loans, given that all tribal-based operations can claim immunity against state-imposed interest rate restrictions.

However, it has also been criticized as a “rent-a-tribe” scheme, where other corporations are in actual control.

Loan Products Offered

The primary product offered is a short-term installment loan. Unlike a short-term loan that is paid in full on the next check, WithU Loans enables one to pay back in installments over time.

Although this appears beneficial to the borrower, one pays five times more than they initially borrowed due to the duration. (Source: CFPB)

How WithU Loans Works

The process of obtaining money from WithU Loans is as smooth as possible. The lender uses quick decisions with automated underwriting, which takes just seconds. This attracts people in dire need of money.

Application And Approval Process

To apply, interested parties submit a form on the company’s website, or on its mobile application. A steady income and a valid checking account are usually necessary.

Due to not engaging in a “hard” credit check via the big three credit agencies, the With U Loans processing time is very quick, taking under ten minutes.

Funding And Repayment Schedules

Once they approve that, the loan is sent through an ACH. The way that loans are paid back is based on your paydays. This is often every two weeks.

Many WithU Loans reviews point out that these can be taken early or even on holidays, which causes overdraft charges from your bank. (Source: BBB).

Interest Rates And Costs Explained

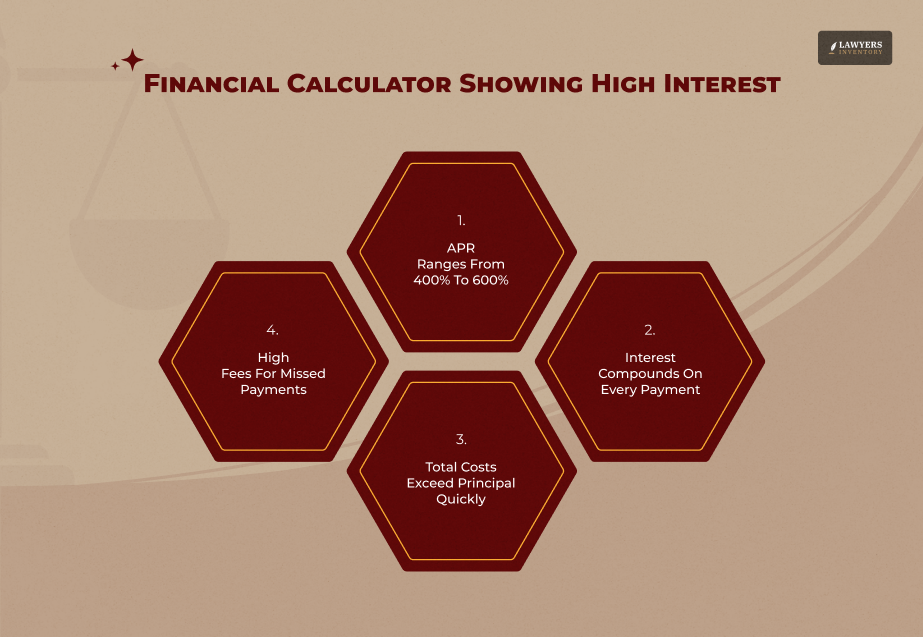

However, perhaps the most controversial aspect of WithU Loans revolves around the cost of these loans.

Although these loans offer individuals access to capital, the APR charges are exceedingly higher compared to any other legal credit means within the United States.

APR Range For WithU Loans

Interest rates have even been known to climb as high as 500%. Using this company as an example, if you borrow a sum of $600, you could potentially pay as much as over $3,000 throughout one year.

This is why many experts have stated that with this type of loan, a “debt trap” is all but guaranteed, meaning you could never pay off this loan.

Fees And Payment Timing Risks

In addition to this interest, there are also penalties for being late on a payment, as well as a non-sufficient funds fee.

Although they state they do not have a “pre-payment penalty,” with the interest that compounds every day, by not paying this balance completely within a few days, one will already owe an astronomical figure in interest charges alone on that loan.

Consumer Experiences – Reviews, Complaints, And Red Flags

Feedback regarding WithU Loans from the public suggests that their overall ratings are negative across websites like the Better Business Bureau (BBB) and Trustpilot. This mainly concerns their deceptive repayment amounts.

Positive Feedback From Borrowers

A tiny fraction of WithU Loans reviews are positive. They are from users who needed to borrow $500 to cover a sudden repair and managed to repay that amount within two weeks. The benefits outweighed the expense for these users.

Identity Theft And Fraud Concerns

There is a disturbing trend in which people are asking whether WithU loans legit, especially after they find loans that were taken in their name but were not applied for.

On Reddit, there are reports across myriad accounts in which people claim that their social security numbers were used to create unauthorized accounts with WithU loans.

This implies that there could have been a problem with WithU’s verification practices. (Source: Reddit, r/personalfinance).

Legal, Licensing, And Regulation Issues

The legal status of WithU Loans is a complex battleground between tribal sovereignty and state laws regarding consumer protection. Several states have issued cease-and-desist orders against W6LS, Inc.

Tribal Lending And Sovereign Immunity

By stating it is a tribal entity, WithU Loans claims that it is not subject to existing state legislation, such as the Illinois Predatory Loan Prevention Act.

However, according to ClassAction.org, the US courts have ruled that if the de facto lender is some third-party non-tribal entity, then the state laws need to be followed.

Bbb Complaints And Lawsuits

Currently, the BBB rating for the company is very low. The reason for this rating is that there are so many unanswered or unresolved complaints.

Additionally, the ongoing lawsuit against WithU Loans in Illinois has the potential to grant the opportunity to have all high-interest debt made void.

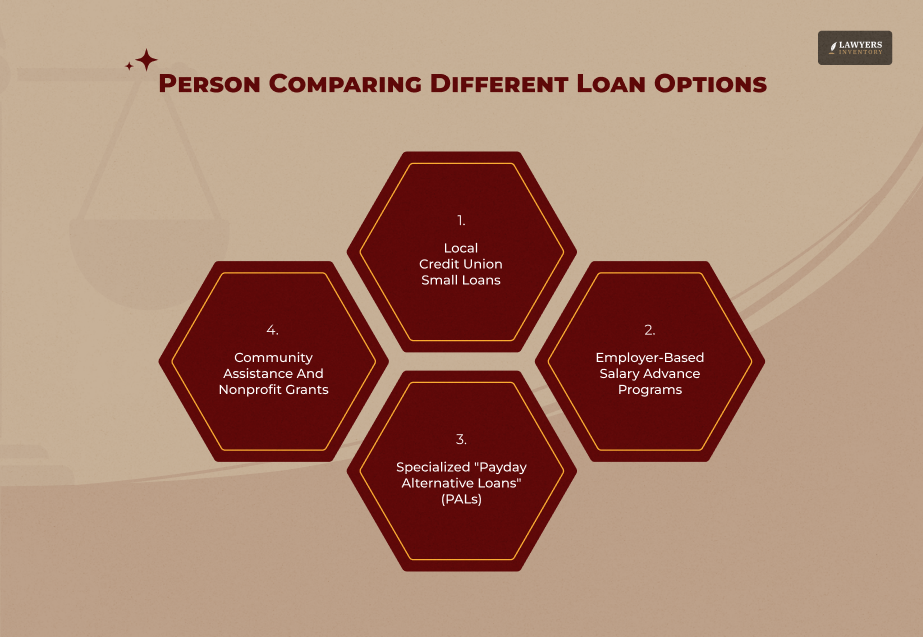

Alternatives For WithU Loans

Before committing to a loan with a 500% APR, it is incredibly important to consider all other possible avenues that may be out there.

There are many non-profit-based organizations that provide small loans for a fraction of the cost.

Credit Unions And Community Banks

As an alternative, there are credit unions that have “Payday Alternative Loans” which have a 28% APR limit.

Even if you have bad credit, these credit unions are more likely to help you since, unlike WithU Loans, they operate out of the local community.

Personal Loan Marketplaces

With apps like EarnIn or Dave, you can get a portion of your next paycheck in exchange for a small fee or “tip.”

Although not perfect, they are far safer than going through WithU Loans, which charges compounding interest that can get out of control.

Best Practices And Financial Safety Tips

In case you are already associated with WithU Loans, as an applicant, you need to take appropriate measures to ensure your financial identity remains secured, considering that high-interest lending environments are usually associated with additional scams and data breaches.

Verify Your Debt

If you get a call regarding a loan you know nothing about, do not give your social security number. Insist they give you a “validation notice” in writing. If they are unable to validate that you borrowed the money, it is probably a scam.

Reporting Of The Predatory Behavior

If you think that you have fallen victim to such a ‘rent a tribe’ operation or to an identity theft scheme with this company, you should make a complaint to the Federal Trade Commission (FTC). This will help them build a case against such predatory lenders.

Read Also: A Transaction You Didn’t Sign Up For: How Does A Cashless Society Affect Your Privacy?

Frequently Asked Questions (FAQs):

Understanding the specifics of tribal lending can be confusing. We have addressed the most common questions regarding WithU Loans below to help you make an informed decision.

Technically, WithU Loans is a legitimate business entity because it is owned by a Native American tribe.

However, many consumer advocates brand their practices as “predatory” because of the huge 400% to 600% interest rates.

While they do fund loans, the extreme cost leads many people to feel like they have been scammed.

In some states, loans above 36% are considered “void,” and the lender has absolutely no legal right to collect.

Nonetheless, you should consult with a legal professional or your State Attorney General before making such a stoppage of payments. Simply halting the payments will lead to aggressive collections and damage to your credit score.

According to a typical WithU Loans review, the company does not consistently report on-time payments to Experian, Equifax, or TransUnion.

This means taking out a loan with them probably won’t help you build credit, but a default could still be sold to a collection agency that does report negative information.

If you are having difficulty repaying a high-interest loan, there could be opportunities for debt relief under current state regulations.

![Why Are People Searching For A Roblox Lawsuit Lawyer At Dolman Law? [Complete Guide]](https://lawyersinventory.com/wp-content/uploads/2026/02/roblox-lawyer-dolmanlaw.com-roblox-lawsuit-100x100.png)

0 Reply

No comments yet.