Today’s topic: Denver Restaurant Service Charge lawsuit.

If you notice a service charge at a restaurant, what do you assume the money is being used for? This is primarily the crux of the lawsuit that we will be explaining today.

The employees are suing a Denver restaurant group that allegedly had management automatically take 30% of a 20% service charge. And all of this happened without informing employees that the remaining 70% was for the staff.

Culinary Creative Group is a Denver restaurant group. It is responsible for some of the city’s trendiest restaurants, including Tap and Burger and Forget Me Not. Eventually, employees came together and accused the group of violating Colorado wage and hour laws.

For customers, workers, and the restaurant sector, the lawsuit raises serious questions about transparency, wage law, and fair treatment.

In this article, we will talk about the following things:

- Who is Culinary Creative Group, and what work do they do?

- The terms related to the Denver Restaurant Service Charge.

- Major allegations in the Denver Restaurant Service Charge lawsuit.

- CCG’s response to the lawsuit.

So, if these are some of the things that you need to know about, keep on reading this blog till the end…

Who Is CCG And What Happened?

Culinary Creative Group operates several of Denver’s trendier restaurants. Some of these include Kumoya, Tap & Burger, Fox and the Hen, Mister Oso, and Forget Me Not.

As CBS News Colorado reports, workers at Denver eateries are suing a cluster of restaurants. They are alleging that out of the automatic 20% service charge, 30% went to management without their knowledge.

CCG has for some time charged customers an automatic 20% service fee on all guest checks (bills). This is in addition to giving a separate line for discretionary tips. According to Denverite, the company’s policy is that the service fee is “distributed equitably among staff.” This includes both front-of-house (servers, bar staff) and back-of-house (kitchen) employees.

In early 2024, and in subsequent months, some employees began raising concerns. They allege that the service charge funds were not fully or fairly shared as they had promised.

Specifically, the lawsuit claims that CCG diverted approximately 30% of the service charge proceeds to management (rather than to all “staff”). And that the base wages for certain front-of-house employees were reduced, effectively shifting more of the compensation burden onto the service fee/tips.

Additionally, the coworkers claim a lack of transparency regarding the calculation and distribution of fees. Furthermore, they mentioned that they did not always get the mandatory rest breaks.

What Are The Legal Definitions You Need To Know Under The Colorado Law?

To understand the lawsuit, it’s essential to know how Colorado law treats tips, service charges, and wage requirements. Here are some of the things that you need to know:

- Under Colorado’s wage law (INFO #3C: Tips (Gratuities) and Tipped Employees), a tip is a voluntary payment from a customer above what is mandatory. Additionally, the customer controls the amount entirely.

- By contrast, a mandatory service charge (also called a service fee) is not voluntary. Because it is automatically added, customers do not have the discretion whether or not to pay it. Under Colorado law, service charges are not “tips.” They are part of the cost of service or goods.

- Employers are allowed to use service charges to compensate employees, but those amounts are treated as wages/compensation rather than tips, for purposes of the minimum wage law. A service charge cannot be used as a “tip credit” to reduce an employer’s obligation for minimum wage if the law requires full minimum wage or a certain tipped wage.

Also, Colorado’s law provides that employers cannot keep tips or service amounts promised to employees under some representation if those were misled, or redirect them improperly (e.g., to ineligible employees or management) without proper disclosure.

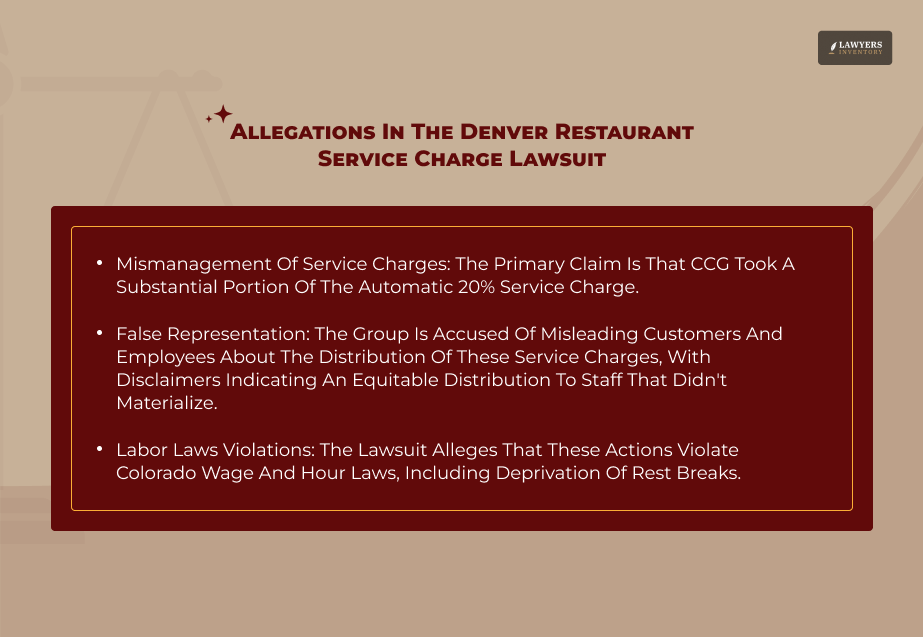

What Are The Major Allegations In The Denver Restaurant Service Charge Lawsuit?

According to CBS News, “the group is facing claims from employees that it violated Colorado wage and hour laws in a recently filed lawsuit.” Here are some of the major allegations of the lawsuit that you need to know about:

Misrepresentation To Customers And Staff

Employees assert that CCG has advertised the service fee as something that they would distribute equitably to “staff.” This gives the impression that those fees are going fully to servers, kitchen staff, etc. In reality, the suit claims, about 30% or so is going to management.

Reduction Of Base Pay / Tipping Wage Issues

In January 2024, front-of-house employees say their base pay (hourly wages) was lowered to the tipped minimum wage. According to Moneywise, the tipping regulations that the Labour Department of Colorado provides, “Direct wages can be less than full minimum wage by up to $3.02, an amount that’s called the employer’s ‘tip credit.”

When service charges are treated more like wages, this becomes significant. That’s because workers argue that the change left them earning less than they had expected under earlier representations. Additionally, the misdistribution of service fee funds made it worse.

Rest Breaks And Unpaid Wages

The lawsuit also claims that employees were not always getting their mandatory breaks as per the law. Furthermore, the CCG did not pay them the wages they were supposed to receive to compensate for this overtime.

Lack Of Transparency

One of the core contentions is that neither customers nor employees had sufficient detail on how the management split the 20% service charge. Exactly how much goes to front vs back of house? And how much (if any) goes to management? No one knew.

Employees say this prevented them from assessing whether they were receiving fair compensation. “It just didn’t seem fair to me that they were, I don’t know, first of all not really being honest with … where the service charges were going, and then cutting the wages on top of that,” Hailey Jamieson, former employee of Fox and the Hen, said to CBS News.

Read Also: Do You Understand the Terms in Your Employment Contract

Denver Restaurant Service Charge Lawsuit Timeline

The former employees filed a lawsuit against the Denver-based Culinary Creative Group (CCG) in February 2025, alleging the misuse of a 20% service charge.

The case is now on hold while the employees’ lawyers are disputing arbitration agreements. Here is the complete timeline of the Denver restaurant service charge lawsuit:

- February 2025: A group of former employees, among them Faith Lindstrom and Hailey Jamieson, filed a lawsuit against the Culinary Creative Group. The plaintiffs claimed that the company deliberately falsified the cause of its service charge and that the staff, especially at the restaurant Kumoya, did not get the full amount of the fee. The complaint also sought compensation for forcibly withheld rest breaks.

- March 2025: Media sources began covering the lawsuit, quoting the employees’ statement in which they accused the management of taking an unjust share of the service charge, thus breaking Colorado law that stipulates that mandatory charges are not tips and their use must be clearly disclosed.

- April 2025: In response to the lawsuit, CCG issued a press release denying all accusations and stating that they “have never misappropriated a single penny of employee tips” and that the money collected from service fees has been properly handed out to the employees, among whom a certain percentage of management, whom they say are in accordance with Colorado law, has also been included.”

- Present Day (December 2025): The lawsuit is on hold due to challenges to the employees’ arbitration agreements. The resolution of these challenges will decide where the case will go next.

How Did CCG Respond To The Allegations?

CCG denies wrongdoing. According to Moneywise, they mentioned that the service fee is clearly labeled as a “service fee” on guest checks, separate from voluntary tips.

Additionally, they state that their menu and checks include disclosures that the 20% service fee will be distributed among staff. Managers are part of “staff” in CCG’s view. Thus, Denverite reports, manager pay from service charges is lawful.

Apart from that, they also assert that they have never misappropriated tips and that any service fee funds are distributed appropriately. CCG disputes the claim that 30% of the service fee goes to management. As per what CBS has reported, the company has said that, in fact, the portion going to management is much lower (around 10%) at certain restaurants.

What Are The Potential Outcomes Of The Denver Restaurant Service Charge Lawsuit?

The trend toward automatic service fees is growing in the restaurant industry nationwide. Some view them as a way to more fairly share revenue with kitchen staff, which historically get fewer tips; others worry about the lack of clarity and possible unfair employer practices.

Here are some of the things that might happen depending on how the case goes towards resolution:

- If employees succeed, there could be an award of unpaid wages (for misallocation of service fees, rest breaks, etc.), possibly also damages, penalties, and attorneys’ fees.

- It could force CCG (and similar restaurant groups) to change how service fees are disclosed, how money is split, and avoid using service fees in ways that reduce base wages improperly.

- The case may set a precedent: Clarify how mandatory service charges must be treated under Colorado law, possibly influencing enforcement or new regulations.

- Even if the lawsuit settles, it might prompt regulators (e.g., Colorado Department of Labor & Employment, CDLE) to revisit interpretive guidance or enforcement around service fees, tip pooling, and wage law.

Read Also: Smoothstack Lawsuit: Beware of Unlawful Wage Scheme and Employment Contracts

What Is The Current Status Of The Denver Restaurant Service Charge Lawsuit?

The CCG Denver service charge lawsuit brings into focus how restaurants label, disclose, and distribute mandatory service fees. And how those practices intersect with wage and tip laws in Colorado.

As of the latest reports, the lawsuit is ongoing. Some portions (e.g., claims for unpaid wages or rest breaks) may be under mediation or negotiation. However, according to Moneywise, formal legal proceedings are in motion.

Enforcement by state agencies might also become involved if CDLE finds systemic violations. According to Littler Mendelson P.C., the new or upcoming changes in Colorado law (including enforcement penalties) could also affect the case’s outcome.

For workers, it raises questions of fair pay, transparency, and legal protection. For diners, it underscores the importance of understanding what restaurants are charging you for. And whether your money is doing what you believe it is.

The outcome of this case may reshape how diners use service fees. It might also change the way the hospitality industry regulates these in Denver and beyond.

0 Reply

No comments yet.