Today’s topic: Lady Bird Deed

If you think about how to best secure your property and plan ahead, a Lady Bird Deed may be the right choice for residents in North Carolina.

Practical Law by Reuters states that it “allows a property owner, acting as the life tenant, to designate one or more remaindermen to receive the property automatically upon the life tenant’s death, effectively avoiding the probate process.”

There is no doubt that Lady Bird Deeds are gaining popularity and rightly so — they give you the power to hold yourself in the property while at the same time making a smooth transition to your family.

Therefore, if these are a few things that you want to know, keep on reading this blog till the end…

What Is A Lady Bird Deed?

A Lady Bird Deed, which might also be called an Enhanced Life Estate Deed, is basically a legal instrument that allows you to hand over ownership of your property to a third party (called the “remainderman”) upon your death, but you still retain full ownership rights during life.

Here’s a breakdown:

- The person who currently owns the property, or “grantor,” retains the right to use the property, and can even choose to sell, lease, or mortgage it without having to ask the remainderman.

- After the death of the grantor, the ownership of the property is automatically transferred to the remainderman, thereby skipping probate.

There is no statute in North Carolina specifically dealing with Lady Bird Deeds, but they are a well-known and reliable component of estate planning.

In a sense, this method of handing down your property is a sort of compromise: you get to keep the control and freedom of your property while still ensuring a clean transition for your heirs.

The Lady Bird Deed is another name for an “Enhanced Life Estate Deed,” and it only exists in five states: Florida, Texas, Michigan, Vermont, and West Virginia. At the moment, the demand for such deeds in Florida is very high for various reasons.

On the one hand, these deeds offer a great deal of flexibility, and on the other, they are extremely inexpensive.

History Of The Lady Bird Deed

Lady Bird Deed is a really popular topic in Florida. However, not many people know exactly what a “Lady Bird Deed” is or even the history behind the strange name, do they?

Lyndon B. Johnson, the president, was married to a woman named Claudia Alta “Lady Bird” Johnson. Well, back in the 1980’s, Florida attorney Jerome Ira Solkoff took the ideas of the Lady Bird Deed and illustrated it in his educational materials.

He made Claudia Alta “Lady Bird” Johnson, the President’s wife, a fictional character in his fact pattern to demonstrate how the deed worked. And the name has been used ever since (especially as the deed increased in popularity).

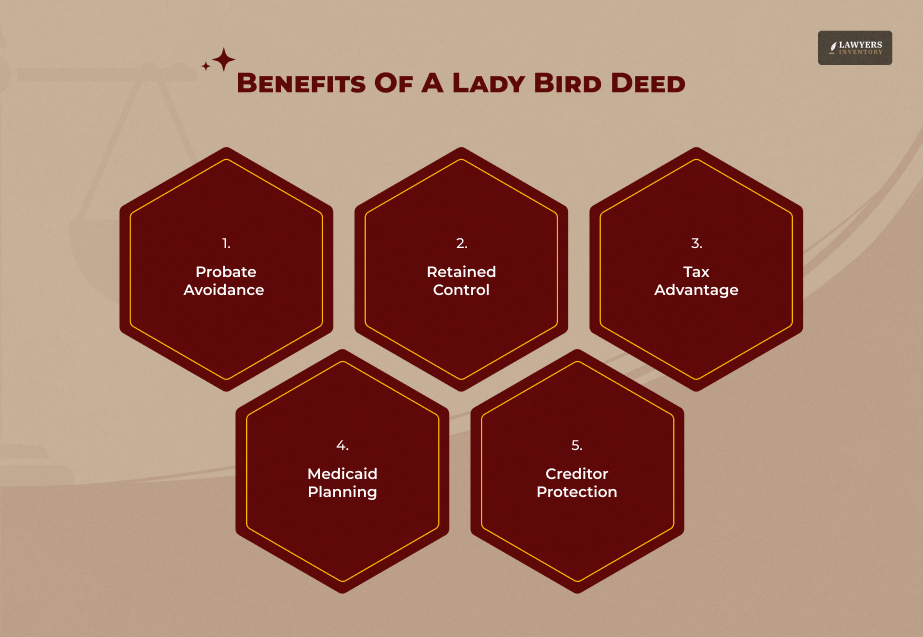

What Are The Benefits Of Using A Lady Bird Deed?

Lady Bird Deeds has many wonderful aspects. Here is a list of the main advantages that make them a favorite option:

Skip Probate

One of the primary benefits of a Lady Bird Deed is that it facilitates the transfer of your property upon your death directly to the beneficiary without going through probate. This can spare your family from a lengthy, costly, and stressful probate procedure.

Freedom

Whereas traditional life estate deeds limit the rights of the life tenant, with a Lady Bird Deed, you have full authority over the property for as long as you live.

Not only can you do whatever you want with the property, but you also don’t have to get the remainderman’s approval for such matters.

Tax Benefits

In certain cases, a Lady Bird Deed can yield some tax perks. For example, the donor may preserve the stepped-up cost basis of the property for capital gains tax purposes. This, in turn, works to minimize the tax liability of the inheritors.

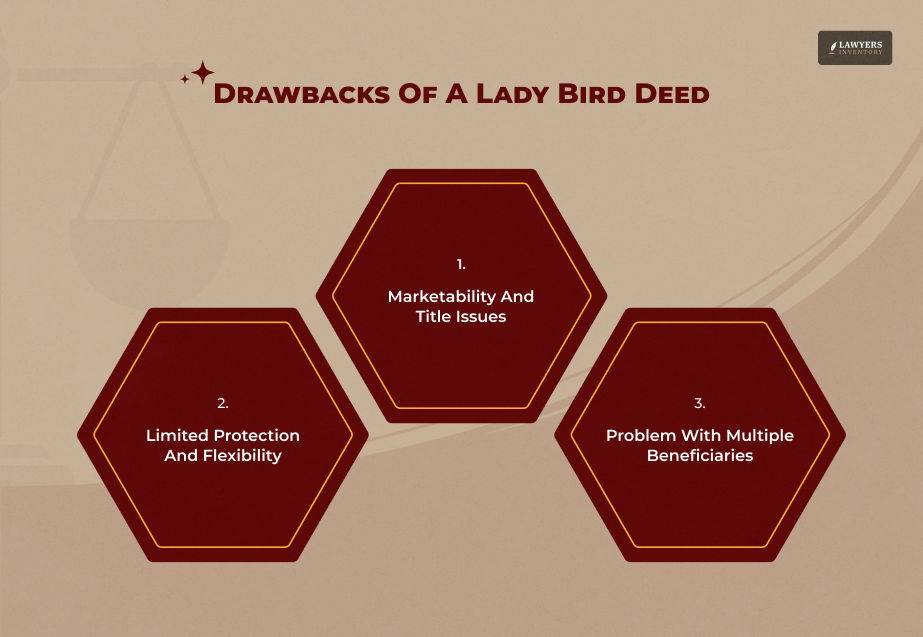

Potential Drawbacks Of A Lady Bird Deed

Lady Bird Deeds offer great advantages to be sure, but they still have certain limitations. Here are some things to think about::

Capital Gains Taxes

Upon your death, if the property is sold by your heirs, they might have to pay higher capital gains taxes in case the property value has gone up considerably.

Remainderman Predeceasing Grantor

In the event that the one to whom you have given the property dies before you, it will be necessary to change the deed. Eventually, this may cause more problems.

Title Insurance Challenges

As North Carolina does not officially regulate Lady Bird Deeds, a few title insurance companies might refuse to insure properties with such deeds.

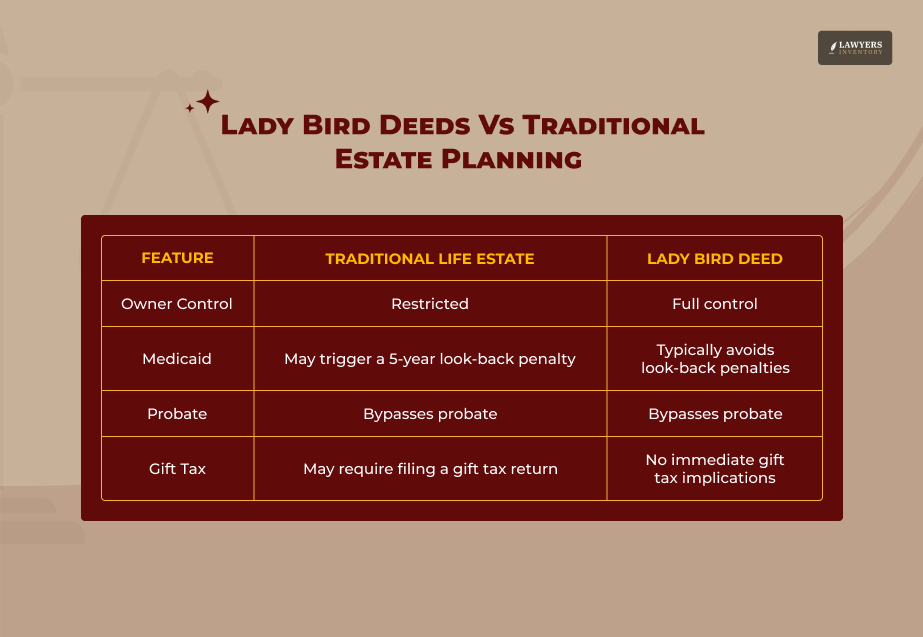

Difference Between Lady Bird Deeds Vs Traditional Estate Planning Deeds

When it comes to managing your estate, it’s always a good idea to weigh your options. Here is a comparison of Lady Bird Deeds to other common tools:

Revocable Living Trusts

Trusts can give you more control and protection over your assets. However, generally, they are more complicated and costly to establish.

On the other hand, Lady Bird Deeds are straightforward and inexpensive ways of property transfer.

Traditional Life Estate Deeds

A Traditional Life Estate Deed actually involves the granting of a portion of control of the property. For instance, without the remainderman’s consent, you cannot sell or mortgage the property.

Will-Based Transfers

A will is undoubtedly a tool for estate planning. However, depending on a will alone implies that the property will be subject to probate. And this is usually lengthy and expensive. A Lady Bird Deed completely bypasses the probate process.

How To Create A Lady Bird Deed?

If you are considering a Lady Bird Deed here is what is important to understand about the process:

- Get legal advice from a professional.

- Analyze your needs.

- Prepare the deed.

- Check and sign.

- Make a public record.

- Take care of it and monitor.

Read Also: If My Name is on the Deed, Do I Own the Property? Answering the MOST Asked!

Do I Need A Lady Bird Deed To Qualify For Medicaid?

People sometimes ask, “If I own real estate, do I need a lady bird deed to get Medicaid?” The short answer—no, you don’t.

Now, a lady bird deed (or “enhanced life estate deed”) can play a role in Medicaid planning, sure. But let’s be clear: having one doesn’t make you eligible for Medicaid in Florida or anywhere else.

What it can do, though, is help limit how much Medicaid takes back from your estate after you’re gone. So, while it won’t get you qualified, it might protect your heirs down the line.

Medicaid Financial Eligibility Criteria

Medicaid assists people who can’t afford medical care. To get it, you usually have to show that you don’t make much money and don’t have many things of value.

To see if you qualify for Medicaid, they usually don’t count your main home, or they limit how much it’s worth.

For example, the state might not count your house if it’s worth less than $750,000. But if it is worth, say, $800,000, then the $50,000 over the limit will be added to your assets.

When you apply, you have to tell them about anything you’ve given away in the last few years.

This look-back period is to stop people from giving away their stuff to look poor so they can get Medicaid. If you’ve given away valuable things recently (usually in the last five years), you might not get benefits for a while.

But you do not always need to report the Lady Bird deeds. This is because you still have control over the property.

So, if your state lets you keep your home off the asset list when you apply for Medicaid, keeping it won’t stop you from getting help.

Medicaid Recovery Of Assets

There is yet another Medicaid-related reason when it comes to using a Lady Bird Deed. It can really help your family when you’re gone.

If you get Medicaid while you’re alive, after you pass away, the state will try to get back what it paid from what you leave behind. It’s a federal thing – every state has to try and recover Medicaid costs from estates.

Some states only look at stuff that goes through probate, which is the legal process after someone dies.

Other states go after anything you leave, no matter if it goes through probate or not. Like, a state might try to claim money from a bank account that goes straight to your son when you die, without going through probate.

Basically, your family gets to keep your property without paying back Medicaid if:

- You leave your property in a way that skips probate (like with a Lady Bird deed), and

- Your state doesn’t try to get Medicaid money back from things that don’t go through probate.

How The Enhanced Life Estate Deed Life Tenant Should Substitute The Remainderman

For the initial Lady Bird deed that will be in the record, the attorney should write with clarity that the life tenant’s right to divest or change the remainderman is retained.

Then, a hypothetical second deed that changes remainderman, adds remainderman, or removes remainderman from the enhanced life estate deed would be, in fact, clear that it would not cause any problems.

Some title insurers may balk at the issue if the enhanced life estate deed does not explicitly point out this right.

Therefore, the first ladybird deed, which is in the record, should contain the proper wording.

Subsequently, the life estate holder may want to change the remainderman by recording a second Lady Bird deed, conveying the property to themselves with a new remainderman, or to themselves in fee simple, or to a third party.

0 Reply

No comments yet.