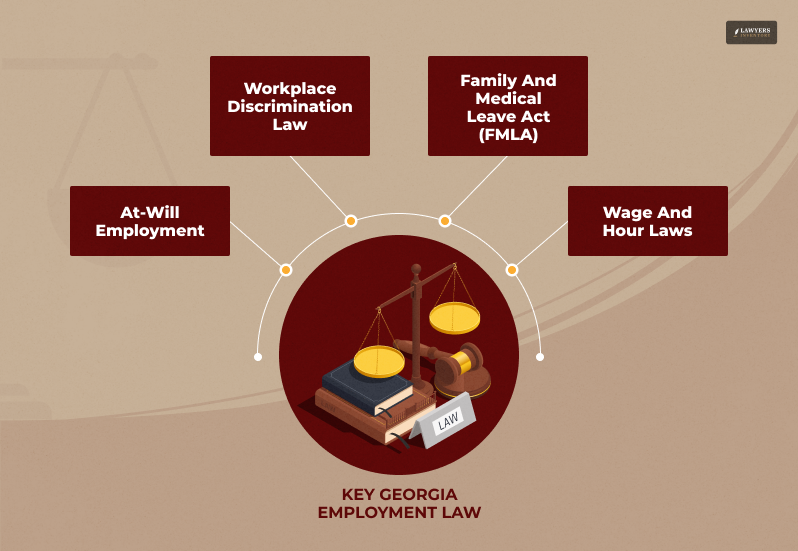

Understanding the state’s employment laws is crucial if you plan to work or live in Georgia.

These laws govern various aspects of the employer-employee relationship, including at-will employment, discrimination, wage and hour regulations, and more.

Knowing your employee rights and responsibilities can help you navigate the workplace effectively and avoid legal issues.

In this blog, I will provide essential information about Georgia employment law. Additionally, I will cover key topics such as at-will employment, discrimination protections, wage and hour requirements, and other relevant laws.

So, if you are planning to know and understand the labor laws here to navigate your rights in the Georgia workspace better, this article you MUST read!

Georgia Employment Law: Understanding the Labor Laws Before You Settle

While Georgia’s labor laws share many similarities with those of other states, there are some key differences to be aware of.

One notable aspect is the state’s “at-will employment” doctrine. This means employers can generally hire and fire employees at will, without providing a reason, unless there’s a specific exception, such as discrimination or a breach of contract.

Another distinctive feature of Georgia’s labor laws is its approach to worker’s compensation. The state has a no-fault system, meaning injured workers can receive benefits regardless of who was at fault in the accident.

However, the amount of compensation is often limited, and workers may still be able to file a separate personal injury lawsuit if they believe their employer was negligent.

Additionally, Georgia’s minimum wage laws may differ slightly from federal regulations. While the state typically follows the federal minimum wage, it may also have its minimum wage requirements, especially for certain industries or occupations.

It’s important to be familiar with federal and state minimum wage laws to ensure you receive appropriate compensation.

At-Will Employment

In Georgia, most employment relationships are considered “at-will.” So, what does it mean?

Simply put, it means that the employer or the employee can terminate the employment relationship at any time, for any reason (that is not illegal), with or without warning.

This is a significant departure from other states where employment contracts may provide more job security.

Exceptions to At-Will Employment

While the at-will doctrine is a general rule, there are some exceptions. An employee may have legal recourse if an employer’s actions violate one of these exceptions. Here are some common exceptions in this regard in Georgia employment law:

- Implied Contracts: An implied contract is an agreement not expressed in words but inferred from the parties’ conduct or circumstances. For example, if an employer promises an employee a certain salary, benefits, or job security in exchange for continued employment, this could create an implied contract that overrides the at-will doctrine.

- Implied Covenant of Good Faith and Fair Dealing: This implied term in contracts requires both parties to act in good faith and deal fairly with each other. Suppose an employer terminates an employee in bad faith or in a way that violates this implied covenant. In that case, the employee may have a legal claim.

Examples of Implied Contracts

- Employee Handbooks: If an employee handbook contains promises of job security, termination procedures, or other terms that suggest a long-term employment relationship, these promises could create an implied contract.

- Oral Promises: Even if not written down, oral promises made by an employer to an employee can sometimes create implied contracts, especially if they are specific and clear.

Examples of Implied Covenant Violations

- Retaliation: If an employer terminates an employee in retaliation for exercising their legal rights (e.g., filing a complaint, taking FMLA leave), this could violate the implied covenant of good faith and fair dealing.

- Bad Faith Termination: If an employer terminates an employee without a legitimate reason or unfairly or unreasonably, this may also violate the implied covenant.

Discrimination in the Georgia Workplace

Georgia employment law prohibits discrimination in workplace based on certain protected characteristics. This protection is provided by the Georgia Fair Employment Practices Act (GFEPA).

The GFEPA protects individuals from workplace discrimination based on the following characteristics:

- Race

- Color

- Religion

- Sex

- Age (over 40)

- National origin

- Disability

Types of Discrimination

Discrimination can take many forms. Some common types include:

- Harassment: It occurs when an employee is subjected to unwelcome conduct based on a protected characteristic. Harassment can include verbal, physical, or visual conduct that creates a hostile work environment.

- Retaliation: An employer cannot retaliate against an employee for complaining about discrimination or participating in a discrimination investigation. Retaliation can take many forms, such as demotion, suspension, or termination.

How to File a Discrimination Complaint

Suppose you believe you have been discriminated against in violation of the GFEPA. In that case, you can file a complaint with the Georgia Department of Human Affairs (GDOA). You must file your complaint within 180 days of the alleged discriminatory act.

The GDOA will investigate your complaint and may attempt to mediate a settlement between your employer and you. If, for some reason, the mediation is unsuccessful, the GDOA may file a lawsuit on your behalf.

It’s important to note that you may also have the right to file a private lawsuit against your employer if you believe you have been discriminated against. However, it’s advisable to consult an attorney before taking this step.

If you experience discrimination in the workplace, it’s essential to document the incident and report it to your employer or a human resources representative. You may also want to seek legal advice to understand your rights and options.

Wage and Hour Laws

Georgia’s wage and hour laws regulate the minimum wage, overtime pay, and meal and break requirements for employees.

Understanding these laws is essential for employers and employees to ensure compliance and avoid legal issues. Additionally, it also ensures that you protect yourself from wage theft.

Minimum Wage in Georgia

The minimum wage in Georgia is typically the same as the federal minimum wage, which is currently $7.25 per hour.

However, it’s important to note that some local jurisdictions may have higher minimum wage requirements. You must check with your local government to determine the minimum wage for your situation.

Overtime Pay Requirements

Under federal law, non-exempt employees who work more than 40 hours in a workweek are entitled to overtime pay at a rate of time and a half.

Georgia law generally follows the federal overtime rules. However, some specific exceptions or nuances may apply in certain circumstances.

Exempt and Non-Exempt Employees

Employees are classified as exempt or non-exempt based on their job duties, salary, and other factors.

Exempt employees are generally not entitled to overtime pay, while non-exempt employees are eligible for overtime.

The criteria for determining whether an employee is exempt or non-exempt can be complex, and it’s often advisable to consult with an attorney or the U.S. Department of Labor for guidance.

Meal and Break Requirements

Georgia law does not explicitly mandate meal or break periods for employees. However, federal law requires employers to provide a 30-minute break for employees who work 5 hours or more shifts.

If the break is less than 30 minutes, the employer must pay the employee for the entire time. Additionally, employers must provide a 10-minute break for employees who work 3 hours or more shifts.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act, which is also known as FMLA, is a federal law which entitles employees who are eligible to take unpaid leave to care for themselves or a family member with a serious health condition.

While Georgia does not have its own FMLA law, it generally follows the federal regulations.

Eligibility Requirements for FMLA Leave

To be eligible for FMLA leave, an employee must:

- Work for an employer with 50 or more employees

- Have worked for the employer for at least 12 months

- Have worked at least 1,250 hours during the previous 12 months

Types of FMLA Leave

You can take an FMLA leave for the following reasons:

- Birth of a child

- Adoption of a child

- Placement of a child in foster care

- To care for a spouse, child, or parent with a serious health condition

- To care for the employee’s serious health condition

- Taking leave to care for a military service member who is a spouse, child, or parent if the service member is injured or wounded in active duty

Employer Obligations Under FMLA

Employers with 50 or more employees must provide FMLA leave to eligible employees.

During the leave period, the employer must maintain the employee’s health insurance coverage under the same terms and conditions as if the employee were still working.

Upon the employee’s return from FMLA leave, the employer must restore the employee to their original position or an equivalent position with the same pay and benefits.

However, suppose the employee’s position is no longer available due to circumstances beyond the employer’s control. In that case, the employer must offer the employee a similar position with equivalent pay and benefits.

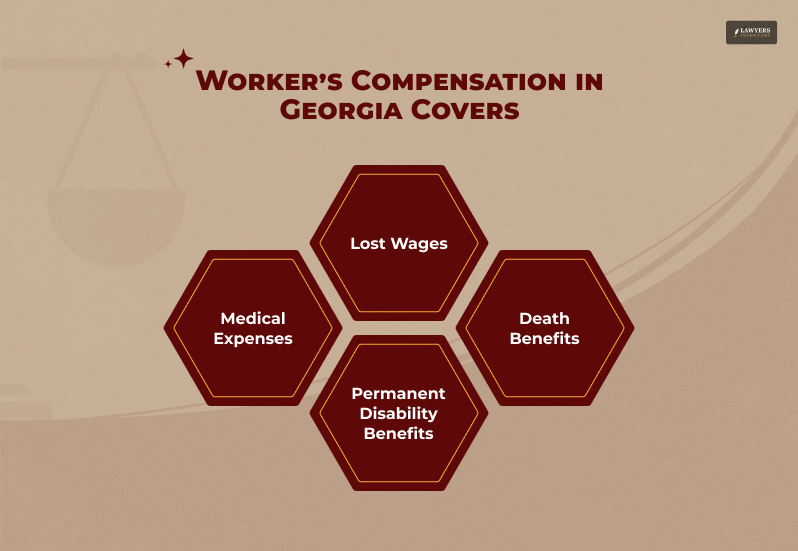

Worker’s Compensation

Worker’s compensation is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. The purpose of worker’s compensation is to provide financial assistance to injured workers, regardless of who was at fault in the accident.

Eligibility for Worker’s Compensation Benefits

To be eligible for worker’s compensation benefits per employment law in Georgia, an employee must:

- Be an employee, not an independent contractor

- Have suffered a work-related injury or illness

- Report the injury or illness to the employer within a specified period

Types of Worker’s Compensation Benefits

Worker’s compensation benefits typically include:

- Medical expenses: This includes the cost of medical treatment, medications, and physical therapy.

- Lost wages: If an employee cannot work due to their injury or illness, they may be entitled to receive temporary disability benefits to replace their lost wages.

- Permanent disability benefits: If an employee’s illness or injury results in a form of permanent disability, they may be entitled to permanent disability benefits.

- Death benefits: In the event of a work-related death, the employee’s dependents may be eligible for death benefits.

Filing a Worker’s Compensation Claim

Suppose you have suffered a work-related injury or illness. In that case, as per Georgia employment law, you should report the incident to your employer immediately. Your employer will likely provide you with information about how to file a worker’s compensation claim.

The specific process for filing a worker’s compensation claim may vary depending on the circumstances of your case. However, it typically involves providing your employer with a written notice of the injury or illness and completing any required forms.

Note: If you believe your employer was negligent in causing your injury, you may also have the right to file a separate personal injury lawsuit. However, it’s advisable to consult with an attorney to determine your options.

Unemployment Benefits and Eligibility

You may be eligible for unemployment benefits if you lose your job in Georgia and are unemployed temporarily (not because of their fault). To qualify, you generally must:

- Be unemployed through no fault of your own

- Be actively seeking work

- Have a minimum amount of earnings from previous employment

- Be able to work and be available for work

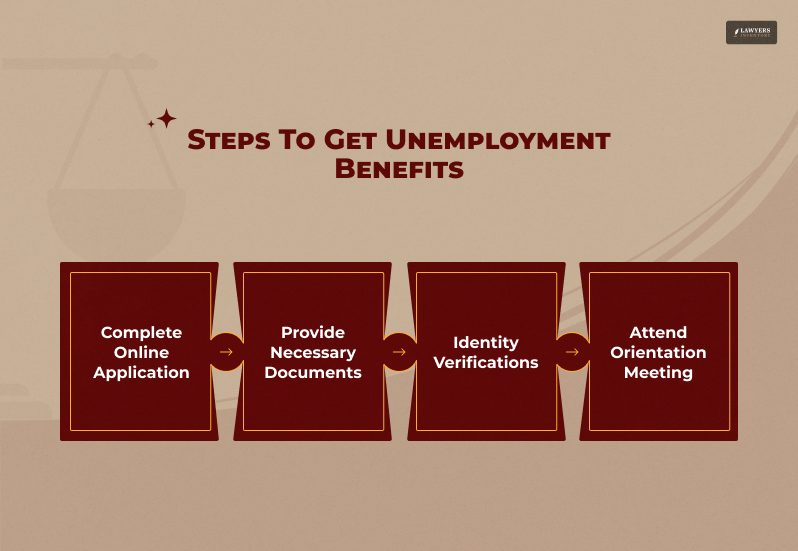

How to File for Unemployment Benefits

You can file for unemployment benefits in Georgia online through the Georgia Department of Labor’s website. You must provide information about your previous employment, earnings, and the reason for your unemployment.

The application process typically involves several steps, including:

- Completing an online application

- Providing documentation, such as your Social Security card and driver’s license

- Verifying your identity through a phone call or in person

- Attending a mandatory orientation meeting

Appealing an Unemployment Benefits Decision

You can appeal the decision if your initial unemployment benefits claim is denied. The appeal process involves filing a request for a hearing with the Georgia Department of Labor. You may need to provide additional evidence or testimony to support your appeal.

If your appeal is denied, you may have the option to file a further appeal with the Georgia Board of Review. The Board of Review is an independent agency that reviews appeals of decisions regarding unemployment benefits.

Make the Move

If you were searching for information about Georgia employment law and other regulations, I hope that this article has provided a comprehensive overview of them. Remember, understanding your rights is crucial for navigating the workplace effectively.

If you have questions or believe you’ve been wronged, I highly recommend consulting with an attorney. They can provide personalized advice and guidance tailored to your specific situation.

By sharing this article with your friends, family, and colleagues, you can help raise awareness about important employment laws and protect the rights of others. Together, we can create a more just and equitable workplace for all.

Read More…

- Employee Rights You Didn’t Know About But You MUST

- Tips To Secure Your Employment Rights With The Best Lawyer?

- Having an Employment Law Attorney is a Blessing During THESE Times!

0 Reply

No comments yet.