If you have searched the Internet for the Kennedy Funding Ripoff Report, you are not the only one. After all, Ripoff Reports has been one of the most popular platforms for consumers to know what is right and wrong. THIS is the place where you get to realize whether you should trust an organization or not.

If you have read my article on the ongoing Kennedy Funding lawsuit, you must have already understood that this funding company that mainly focuses on high-risk loans has recently been the talk of the town.

But what are the allegations? How many of the consumer complaints are true? And does the Ripoff Report also have the same thing to say?

If these are your questions, you have reached the right place for the answer. Therefore, keep reading this blog until the end to learn about this legal issue, and thank me later…

All About Kennedy Funding

Before talking about this lawsuit and why people are looking it up on Ripoff Reports, let me first tell you about the company. Kennedy Funding is a direct private lender specializing in fast, flexible real estate loans.

Unlike traditional banks that often have lengthy approval processes and strict requirements, Kennedy Funding offers quick solutions for borrowers who need access to funds without the usual hassles.

With a focus on bridging the gap for investors and developers, the company is known for its expertise in hard money loans.

Before its reputation was ruined because of the many lawsuits and legal battles it faces now, it was popular as a reliable source for investors. One of the standout features of Kennedy Funding is (or was) its ability to approve and fund loans in a matter of days.

This was a game-changer for borrowers working on tight timelines, such as land acquisition, construction, or refinancing.

Furthermore, they offer loans ranging from $1 million to $50 million, covering everything from commercial properties and residential developments to land deals.

So, what is that one thing that has made Kennedy Funding unique to consumers and clients? Well, I would say that it’s their willingness to work with challenging cases.

Irrespective of whether you’re dealing with credit issues, incomplete projects, or just unconventional properties, they are more likely to say “yes” where others may decline.

This extreme flexibility did not just come in a single day! Rather, it resulted from their decades of experience and understanding of the complexities of real estate investments.

And THAT’S something that has made it possible for Kennedy Funding to operate not just in the U.S. but also internationally. Yes, they, with their determination to do their best provide solutions for borrowers in the following places:

- Canada.

- The Caribbean.

- South America.

Moreover, their tailored approach ensures that every borrower receives a loan structure that meets their needs.

What is the Ripoff Report?

While this one is popular among the people who generally look for reviews, let me explain what Ripoff Report is all about.

Ripoff Report is like a megaphone for consumers who’ve had bad experiences with businesses, products, or services.

Imagine a hypothetical situation: you feel scammed, ignored, or mistreated, and you want to warn others about it. That’s where the Ripoff Report comes in. It’s an online platform where people can share their stories and hold companies accountable.

Started in 1998 by Ed Magedson, Ripoff Report has become a go-to site for exposing unfair practices. It’s free, and anyone can post a complaint. But here’s the thing: once your report is up, it’s there permanently.

For many, this is great because it keeps companies honest. But for businesses, it can be a sore spot—especially if the complaints feel exaggerated or untrue.

What makes Ripoff Report different is that they don’t delete posts, even if the issue gets resolved.

Instead, they let businesses respond publicly, which can help clear misunderstandings. They also offer the Corporate Advocacy Program, where companies can work on repairing their reputation.

For everyday people like you and me, the Ripoff Report is useful for checking out a company before spending money.

But it’s important to read between the lines—not every complaint might be 100% accurate. This is why looking for patterns and common issues is important to get a clearer picture.

At the end of the day, the Ripoff Report is about giving a voice to consumers. Whether you’re warning others or researching a business, it’s a platform that puts power back into your hands.

How Does Ripoff Report Work?

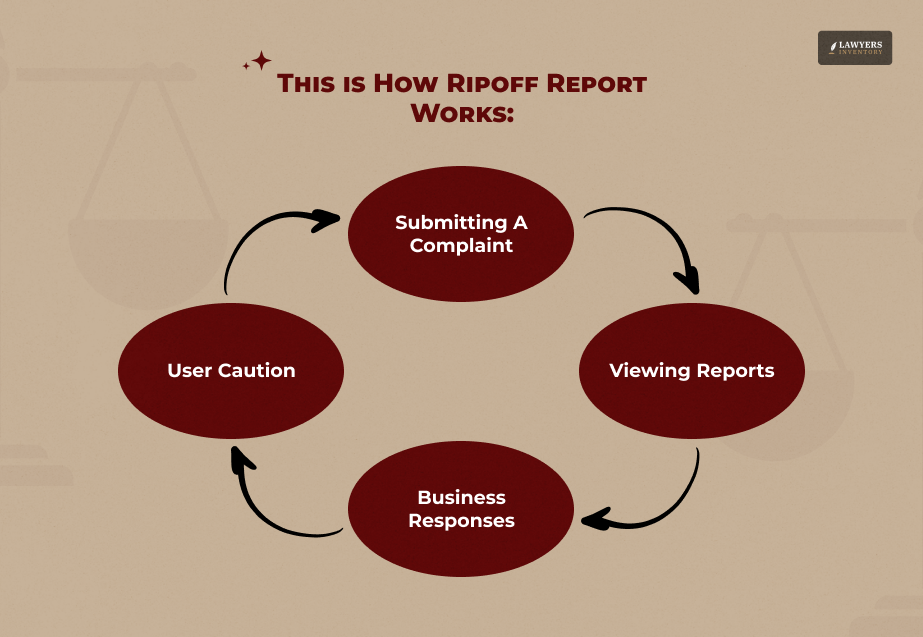

Ripoff Report is designed to be simple and straightforward for users to share their experiences and for businesses to respond.

By providing a platform for both consumers and businesses to share their perspectives, Ripoff Report aims to empower people with the information they need to make informed decisions.

Here’s how it works:

1. Submitting a Complaint: Anyone can create a free account and submit a report about their experience with a business, product, or service. Users are encouraged to provide specific details, like dates, interactions, and the nature of their complaint, to make their report more credible and helpful for others. Once the complaint is published, it stays online permanently, making it a lasting reference for other consumers.

2. Viewing Reports: Visitors can search for businesses or keywords to find related reports. This helps consumers do their research before making a purchase or working with a company. Reports are visible to the public, promoting transparency and accountability for businesses.

3. Business Responses: Businesses can respond directly to complaints to clarify, explain, or resolve issues. Companies can participate in the Corporate Advocacy Program, which helps them address complaints and rebuild consumer trust.

4. User Caution: Not all complaints may be accurate or fair, so users should look for patterns or multiple reports before forming an opinion.

Why are People Searching for the Kennedy Funding Ripoff Report?

When it comes to financing, especially in the private lending sector, trust is everything. Many people search for the Kennedy Funding Ripoff Report because they want to know if the company is reliable before engaging with them.

We all were aware of the fact that Kennedy Funding is a well-known private lender that specializes in unconventional loans. For instance, it was particularly great for borrowers who might not meet traditional bank requirements.

While this makes/made them appealing to many, it also raises questions about their practices. People often turn to the Ripoff Report to uncover potential complaints or issues, such as hidden fees, unmet promises, or miscommunication during the loan process. Essentially, they want reassurance that their financial investment will be safe.

Complaints in the Kennedy Funding Ripoff Report

Complaints about Kennedy Funding on Ripoff Report are varied.

Some borrowers have alleged high interest rates and unexpected fees. Others mention delays in funding, which can be a significant problem for businesses needing quick capital.

Furthermore, there are concerns about customer service, with some customers feeling their issues were not addressed promptly.

While these complaints may seem alarming, it’s important to consider the context and the details provided in each case. Not all reports are verified; some may stem from misunderstandings or unrealistic borrower expectations.

However, considering the recent lawsuits against the funding company, most people have started to trust these complaints on the platform as these are authentic reviews by clients.

Is the Kennedy Funding Ripoff Report Reliable?

So, here’s the deal—Ripoff Report is one of those sites where anyone can post their experience with a business, no filter.

That’s great in theory because it gives regular folks a voice. But there’s a flip side: not everything you read there is 100% accurate or fair.

Some posts? They might be overblown. Others leave out key details. And yeah, sometimes people vent out of spite. That’s why you’ve got to take it all with a grain of salt.

If you really want the full picture, don’t just rely on one site. Do a little digging. Look at different review platforms. See if the same issues keep popping up.

And most importantly, check how Kennedy Funding responds. One person griping online isn’t a smoking gun—but a whole bunch of people saying the same thing? That’s worth paying attention to.

Kennedy Funding’s Response to the Complaints

After the company got tangled up in a lawsuit over hidden fees and complaints about poor customer service, they’ve been pretty active on platforms like Ripoff Report.

They usually respond by explaining their loan terms and stressing that borrowers should understand everything before putting pen to paper. Over time, they’ve tried to be more upfront about fees and how their loans work.

From the looks of it, Kennedy Funding’s been making an effort to patch things up. No lender is perfect, sure, but their responses show they’re at least trying to learn from the criticism and be more transparent going forward.

Here are some of the key points from their public responses on Ripoff Report:

- They’ve denied acting unethically while dealing with borrowers.

- They’ve explained their side of the story on multiple platforms.

- Said everything’s agreed upon upfront—no hidden fine print, supposedly.

- They tend to focus on the strength of the investment more than the borrower’s credit score.

- And they’ve promised to be more open about loan terms so fewer misunderstandings happen down the line.

Dealing With Lenders Like Kennedy Funding? Here’s What to Keep in Mind!

Thinking about borrowing from a private lender like Kennedy Funding? Makes sense—especially if banks are giving you the cold shoulder.

But here’s the thing. Private lenders play by a different set of rules. If you’re not careful, you might find yourself in a financial mess. So, before you sign anything, here are a few things worth remembering.

1. Know What You’re Signing Up For

Private loans can be a lifeline, especially if you need money fast. But—and it’s a big but—they usually come with higher interest rates and fees. Every single line in that contract matters.

If something’s confusing, don’t stay quiet. Ask. Ask again. A lot of people get blindsided by surprise charges, so make sure that’s not you.

2. Research the Lender’s Track Record

Before you commit, take some time to check out the lender. Read up on Ripoff Report, the BBB, maybe even Reddit. Are there repeated complaints about hidden fees or slow funding? Patterns like that are your red flags.

3. Keep Communication Clear

Keep all convos and paperwork organized—emails, texts, contracts, everything. Misunderstandings happen, but having proof can help you sort things out (or protect yourself) if anything goes sideways.

4. Don’t Stretch Yourself Too Thin

Getting approved for a loan might feel like a win, but don’t bite off more than you can chew. If you fall behind, it could hurt your credit or land you in legal trouble. Stick to what you know you can manage.

5. Get Expert Advice

If the terms make your head spin, get someone who speaks the language—a lawyer or financial advisor. That one phone call could save you from a major headache later, especially with big loans or weird clauses.

Legalities in High-Risk Loans and Funds

Now that we are almost done with this blog, let’s talk a little about high-risk loans for a sec, shall we? They’re kind of the go-to option when banks say no—maybe your credit’s bad or you just need the money, like, yesterday.

But—and this is important—there’s a lot of legal stuff baked into these kinds of loans that most people overlook. And that’s where trouble starts.

First off, transparency isn’t optional. Lenders are supposed to spell everything out under laws like the Truth in Lending Act (TILA). That includes interest rates, fees, repayment schedules—all of it.

So, if a lender’s being shady or vague about those details? Huge red flag. Seriously, read the fine print. Yeah, it’s boring, but skipping it could cost you.

Also, not every high-risk lender plays by the rules. Some states have strict caps on interest rates or require lenders to get licensed. If someone’s ignoring those rules? That’s a legal mess waiting to happen—and you don’t wanna be anywhere near it.

Here’s the silver lining though: you’ve got rights. If you get hit with surprise charges or sketchy terms, you’re not stuck. Consumer protection laws have your back. And if things go really bad, agencies like the FTC can step in.

Bottom line? High-risk loans can be a real lifesaver, but they’re not something to jump into blindly. Do your homework, read every word of that agreement, and if something feels off, don’t be afraid to walk away or talk to a lawyer.

When it comes to your money, it’s always better to be a little paranoid than a lot broke.

Read Also:

- Why $100 Million Settlement Fund from Verizon Wireless Class Action Lawsuit is All Over the News!

- Smoothstack Lawsuit: Beware of Unlawful Wage Scheme and Employment Contracts

- 72 Sold Lawsuit Exposed the Deceptive Marketing Strategies of Real Estate Agents!

0 Reply

No comments yet.