The Kennedy Lending Lawsuit was a landslide moment for the financial industry. It changed the very look of the industry. It managed to become one of the most talked about lawsuits of recent times.

Therefore, understanding the lawsuit can truly help businesses get an idea of the dos and don’ts of the financial industry. Follow along to learn more about the lawsuit that changed the financial landscape forever.

Let’s go!

Kennedy Funding Background

The Kennedy Funding lawsuit simply rocked the whole world when it came to light. As a result, the lawsuit instantly became a hot topic of conversation. This is primarily because of the appeal it had to the landscape.

However, before we can actually get into the meat of things, let us take a moment to understand the key players in this lawsuit to get an idea of the whole ordeal. First, let us start with an overview of Kennedy Funding.

Kennedy Funding is a well-known company in the high-risk loan or bridge finance sector. The organization has been operating in this sector for a long time and has made a name for itself.

Kennedy Funding was often lauded for its more accessible approach. In other words, the company would often finance risky or shoddy ventures that others won’t. This helped the organization to create its sense of niche for itself.

Arkansas Business & Commercial Laws

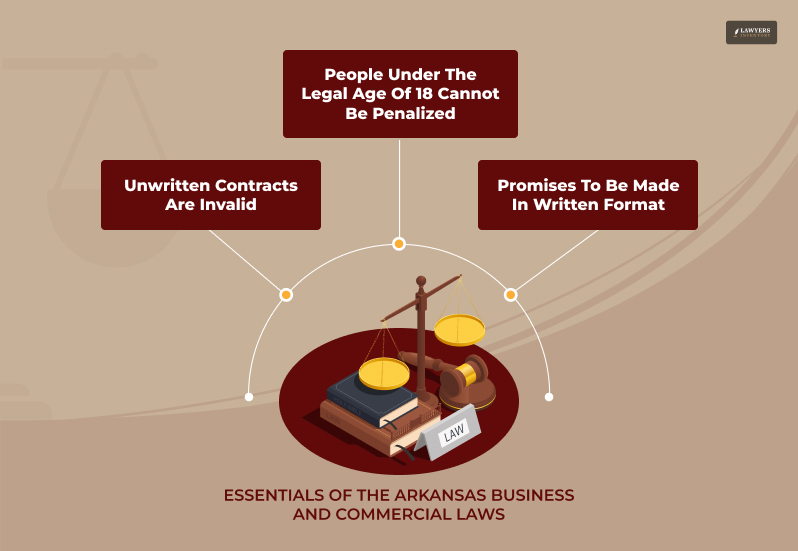

Since we are already on the topic of the Kennedy Funding lawsuit, we should also look at the second piece of the puzzle as well, which is the Arkansas Business and Commercial Laws.

This would help you understand the general area of lacking and the primary reason behind the lawsuit or what pushed the Arkansas legal organizations to slam Kennedy Funding with lawsuits.

Hence, follow along to learn more about the flouts of the Kennedy Funding Lawsuit:

- No contract is valid if it is not in writing. This could be an agreement promise or a legal contract. Therefore, companies cannot pressurize customers with unnecessary force unless there is a legal and written document.

- Promises to pay debts during bankruptcy cannot be entertained unless it is given in a written format.

- Finally, no individual under the legal age can be penalized for loan recovery. Therefore, making it a barrier or a buffer that can safeguard customers from unethical soliciting by companies.

What Is Kennedy Funding Lawsuit?

With the basics out of the way, we can finally concentrate on the more important side of the discussion, the Kennedy Funding Lawsuit overview. The company’s primary focus was bridge loans. These are short-term mortgages that can help people to bridge the financial gap.

Many lenders find this form of loaning to be high-risk in nature. This is primarily because this form of loan is usually used for risky projects that come with a high rate of failure. Therefore, this is where the Kennedy Funding lawsuit comes into play.

Kennedy Funding Lawsuit primarily functions in this sector. However, over the years, the brand has managed to become infamous due to regulation flouting. In other words, the company is often accused of mishandling loan agreements.

In some instances, the company is accused of practicing predatory lending practices. Practices that actually compel individuals to lose money and end up paying extra. Therefore, it is seen as an unethical practice by banks.

This is the primary lawsuit against the company. However, the lawsuit is like an onion. You peel off one layer, and there is a stinkier lawyer underneath.

Primary Lawsuits Against Kennedy Funding

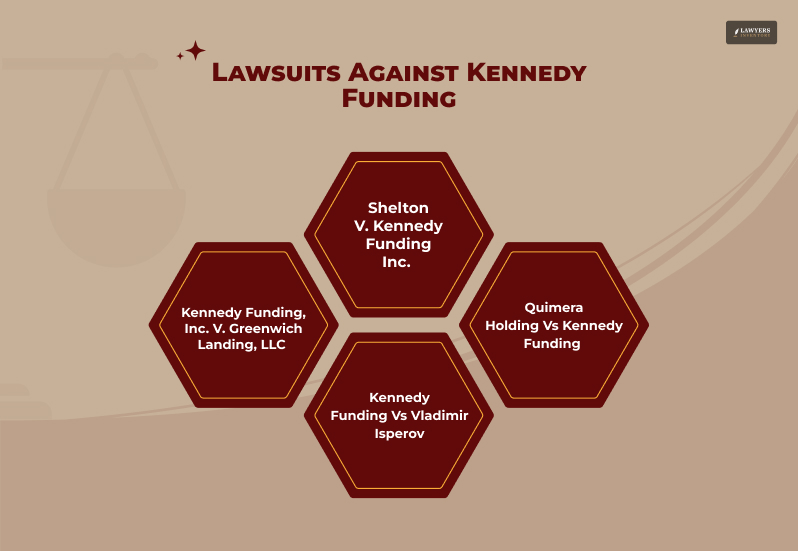

Kennedy Funding has been in the business for a while now and has managed to earn a name for itself for its unconventional loans. However, the infamous lawsuit exposed the company for its predatory practices.

As a result, more and more cases of bank’s predatory loan practices came to light. Kennedy’s Lawsuit is a Class Action Lawsuit, which means that it is an amalgamation of several different lawsuits at the same time.

Therefore, in this section, we will be looking at some of the most prominent lawsuits that Kennedy Funding faced.

Kennedy Funding, Inc. v. Greenwich Landing, LLC (2010)

One of the most infamous Kennedy funding is the Greenwich Landing LLC against Kennedy Funding. This infamous lawsuit took place back in the year 2010. Kennedy Funding issued a mortgage to Greenwich Landing LLC.

The primary case generally revolved around the question of whether the said entity holds a promissory note. This note allows the entity to take up responsibilities as agents and true owners of said property.

The case went on for a while before the court decided on a verdict. The court claimed that the holder of the promissory note (Kennedy Funding) is seen as the right owner of the said property and can foreclose it.

Shelton v. Kennedy Funding Inc. (2010)

Another very notable lawsuit against the Kennedy Funding was Shelton Vs Kennedy Funding. This case involved Shelton and Acklin. Shelton sold his owned cemetery named Rest In Peace to Willie Acklin back in the year 1992. As soon as the transaction went ahead, Acklin signed a specialized promissory note. This note claimed that Acklin agreed to pay Shelton in installments.

However, things turned sour back in the late 1990s, and Acklin ran into financial problems. This resulted in Acklin taking out a financial loan to clear out the obligation. This was a high-risk venture. Hence, Kennedy Funding was the first to pick up the loan.

Kennedy Funding granted the loan and sanctioned around $675,000 for Shelton. However, the company decided to keep the amount. This was a highly inconsistent move on Kennedy’s part.

Eventually, Acklin defaulted on the loan. As a result, Kennedy Funding started the foreclosure procedure. However, the lender did not pay Shelton any money. As a result, Shelton took the matter to court and decided to sue Kennedy Funding for unethical business practices.

Eventually, the case escalated, and judges found that Shelton’s claim was valid. As a result, the court asked Kennedy to pay the $675,000 that he was owed.

Other Notable Cases

The Shelton Vs Kennedy Case was one of the eye-openers for everyone. In other words, the case singlehandedly managed to expose the general rot underneath the company’s business masquerade. This resulted in more cases coming to the forefront.

Quimera Holding vs Kennedy Funding is another notable lawsuit in which Kennedy Funding found itself. However, details of the case have not been released to the general public yet. Therefore, more details of the case were not released.

Another very notable Kenedy Funding case was the Kennedy Funding Vs Vladimir Isperov case. The case was brought to light in the year 2020. The case not only involved Vladimir, but also involved an affiliate lending company named Lending Bee.

Again, the details of the following case are muddled. Therefore, there is not much detail about the case. All in all, these cases added to Kennedy Funding’s infamy.

Legality of The Problem

Most plaintiffs who filed claims came forward with familiar complaints against the organization. In most of the cases, Kennedy funding was accused of mishandling loan agreements.

As a result, terms like ‘deceptive and cruel’ were thrown at the organization. Kennedy Funding miscommunicated the true cost of the loan or the interest rate. This is one of the primary charges against the organization.

Like for example, the plaintiff was supposed to receive a full payment of $675,000 in the shelton case. However, Mr Shelton claimed that he was deceived about the whereabouts of the money and the payment channel.

This exposes a blatant and egregious problem that is latent in the financial sector. In most Kennedy Finding Lawsuits, state or federal laws were broken. As a result, this shows how this is part of a bigger problem that plagues the system.

Impact of Kennedy Funding

Kennedy Funding has managed to stray under the radar by keeping its shady businesses out of public eyes. However, soon enough, the business started to smell. More and more people came forward with their stories about Kenny Funding’s predatory lending policies.

In the Shelton Case, Kenedy Funding managed to use legal loopholes to reduce the overall amount payable by the organization as damage. The company just paid the principal amount and not a penny more.

This shows that the company is well-equipped to handle these lawsuits, and it is concerning. However, this is not an isolated incident. In fact, the company has done this multiple times. This shows how flawed the general system is.

Industry-Wide Implications

The Industry-Wide implication of the case was huge. The case singlehandedly managed to change the industry standard. This case managed to open people’s eyes to predatory lending and its implications.

The case reignited the discussion of lending vs recovery. How and what means a financial organization might use to recover the loan. Therefore, making things easier for the customers.

This industry shift is important as it can make things more transparent for the people taking loans and the lenders. Which in turn can allow for a better business environment. Hence making things better all around.

The Final Thought

In summation, the Kennedy Funding Lawsuit managed to change the very essence of the financial business environment. As a result, changing some things permanently.

This is one of the most important cases of this decade and can really change the very landscape of the business for the better.

Then again, predatory lending is a very problematic situation that has no easy solution. Therefore, it will be years before a permanent solution can be devised.

Read Also:

- 72 Sold Lawsuit Exposed the Deceptive Marketing Strategies of Real Estate Agents!

- From Contraception To Courtroom: A Guide To Paragard Lawsuit

- Ozempic Lawsuit: Can You Get Justice in Healthcare?

0 Reply

No comments yet.