The financial world sees its share of legal battles. Lately, the Credit One Bank class action lawsuit has dominated the news. This major legal action focuses on the bank’s practices. Notably, this case concerns itself with unsolicited communications and alleged unfair fees.

People want to know the details about this significant legal development. The aggrieved parties want to find out how they can receive payment.

Thus, in this piece, we break down the Credit One Bank class action lawsuit. Moreover, we will outline the two main settlement issues and guide you through the claim process.

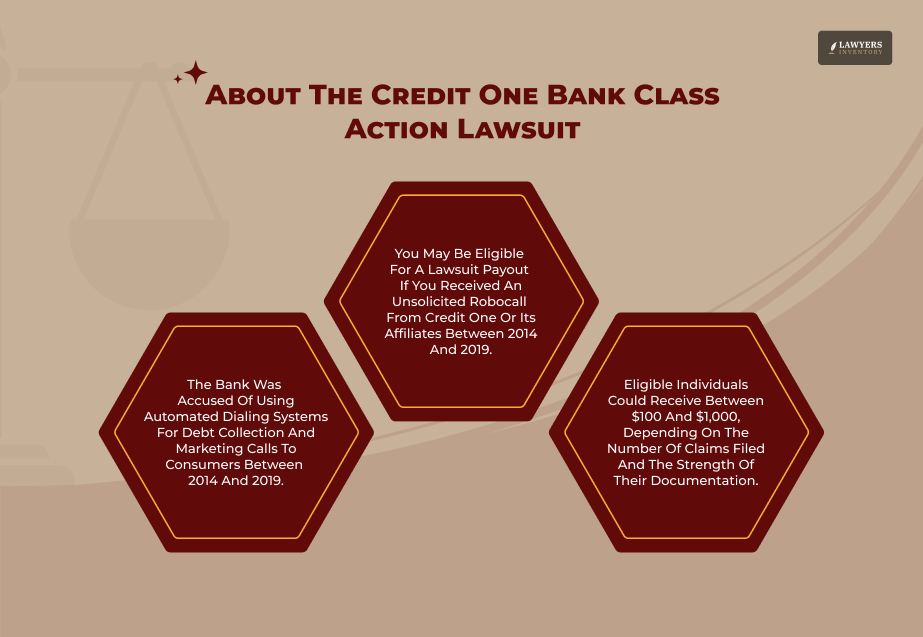

What Is The Credit One Bank Class Action Lawsuit About?

Credit One Bank class action suit actually refers to a number of different legal actions. The most prominent one in recent times involves a massive violation of consumer rights regarding robocalls.

What Happened?

Well, Credit One Bank paid $14 million in 2025 to resolve allegations that it violated the Telephone Consumer Protection Act (TCPA), according to Hindustan Times.

This move was actually meant to protect consumers from unwanted telemarketing.

This TCPA settlement is really a chance for victims to receive their due payment. The calls through automated tools were playing prerecorded voices to consumers. Moreover, they were intrusive in nature.

Thus, the punitive damages move sent a forceful message that all companies were to respect the rights of consumers. Moreover, it also established that all businesses had to abide by the telemarketing regulations.

The Credit One Bank class action lawsuit against the bank shows that no institution is above the law.

Another Spotlight

Additionally, another major legal issue has also been in the spotlight. This separate Credit One Bank class action lawsuit claimed the following.

- deceptive activity,

- exaggerated fees, and

- misstated reporting.

These impacted numerous clients, according to the Economic Times.

Many say that this points towards a larger issue: what is wrong with Credit One Bank?

Well, the ongoing spotlight is evidence of the need for greater transparency and accountability in the banking sector. Now, we will focus mostly on the robocall settlement facts.

Eligibility: Who Can Join The Credit One Bank Class Action Lawsuit?

Eligibility in the Credit One Bank class action lawsuit on robocalls is straightforward. You may be qualified to sue in the credit one class action case if you received a specific type of call within a given timeframe.

Eligibility Requirements

- The calls were made by Credit One Bank or its affiliates with an automated or prerecorded message.

- This call was to a phone number that is registered in your name.

- These calls happened between 2014 and 2019.

- Notably, these calls did not happen with your prior express consent to receive them.

Moreover, you do not need to be a current or former Credit One Bank customer to be a part of this class action claim. People with no connection to the bank were also hit by the dialing for dollars. Thus, the Credit One Bank class action suit actually embraces a wide population.

Documentation Needed

To establish one’s qualification in the Credit One Bank class action suit is most important. Through proper documented proof, you can help the settlement managers verify your claim.

It’s not necessary to provide phone records. Remember that any pertinent proof will assist in your claim.

Additionally, settlement managers will check call logs to ensure your number was dialed. So, if you have any evidence, like:

- Saved voicemails.

- Detailed call logs.

- Provide it when asked for.

Otherwise, you can provide an affidavit or sworn statement. Thus, this court procedure ensures that only the truly affected persons receive a share of the Credit One Bank settlement.

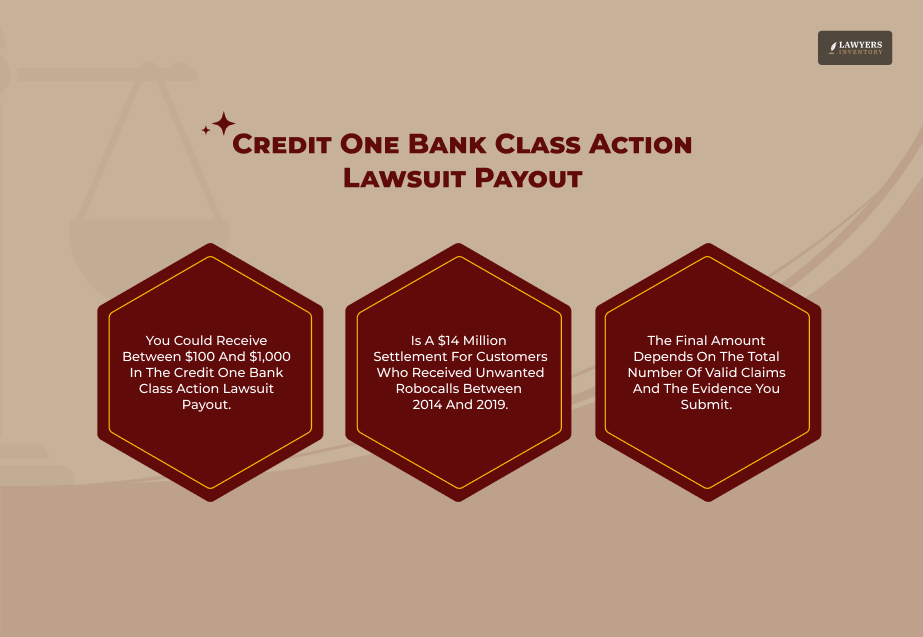

Expected Payout: How Much Can You Receive In The Credit One Bank Class Action Lawsuit?

The settlement fund for the entire Credit One Bank settlement of the TCPA robocall case is $14 million. However, the amount that you will receive for the robocall payment will solely rely on the number of valid claims you make.

Estimated Payout

1. Individual payments are estimated to range between $100 and $1,000 per person (according to Hindustan Times).

2. The final payment an aggrieved party gets is an equitable portion of the settlement fund from the remainder amount.

3. Notably, the remainder is what remains after payment of all legal costs and administrative fees.

Notably, some $8 million to $9 million of the total fund is what will remain for distribution to the consumers.

Factors Affecting Payout

The larger the number of individuals who submit a valid claim, the lower the payment will be for each person.

In addition, the ability to make quality documentation of being harmed can sometimes affect the final payment. The objective remains straightforward: to settle the robocall compensation fairly among everyone in the Credit One Bank class action lawsuit.

How To File A Claim In The Credit One Bank Class Action Lawsuit?

Filing your part of the Credit One Bank class action lawsuit sign up process requires attention to detail and timing.

1. The Claim Process- Wait For The Official Website

Once the court grants final approval, an official settlement website will launch. This site provides all necessary instructions.

2. Receive Notification

If your contact information is in the bank’s records, the settlement administrator will send a notice via email or mail.

3. Complete The Form

Go to the website and complete the claim form online. Provide your personal information and the phone number the robot calls were made to.

4. Send Documentation

Include any proof you have or a sworn affidavit.

5. Choose Payment Option

Designate how you want to be paid by check, PayPal, or direct deposit to your bank account.

6. File Prior To The Deadline

You should file the credit one class action lawsuit claim prior to the deadline. It is typically 60 to 90 days when claims become available.

Use only legitimate sources. Never pay someone to help you file a credit one bank lawsuit claim.

Key Dates

During this process of claiming, there are a few significant dates. This part of the Credit One Bank class action claim is noteworthy.

Final Approval Hearing

According to the Capital One 360 Savings Account Interest Rate Litigation page, the court fixed the final approval hearing for the Capital One 360 Savings Account Interest Rate Litigation (another case) on November 6, 2025.

The final approval of the TCPA settlement is not yet known, but it will likely occur around the same date or shortly thereafter.

Always check the official settlement website for the actual date of the Credit One Bank class action lawsuit.

Deadline To File Claim

We have not heard of it yet. You will need to visit the official settlement website when available. It is a missed deadline and a lost opportunity for robocall pay.

Disbursement Of Payment

Payments typically begin between six and nine months after court approval is finalized.

Read Also: Is Baymark Partners Facing A Lawsuit?

Why Does The Credit One Bank Class Action Lawsuit Matter?

This TCPA settlement is extremely significant to consumer rights. It initially puts Credit One Bank on notice for making illegal robocalls.

Second, it provides relief to thousands of Americans financially. This action sends a strong signal. It informs other companies that violating the telemarketing laws has serious consequences. The highlight on illegal robocalls reiterates a consumer’s right to privacy.

Moreover, the media coverage of the Credit One Bank class action lawsuit also draws attention to other abnormal practices like exaggerated fees and misrepresentation in credit reporting –

The final result reaffirms the whole corpus of law that protects consumers.

Pro Expert Tips: How Can You Maximize Your Claim On The Credit One Bank Class Action Lawsuit?

You must do the following in order to get your fair share of the Credit One Bank settlement.

Keep Records

Save all the records relating to the calls. Keep those voicemails!

Sign Up Early

Do not wait until the last minute for the Credit One Bank class action lawsuit sign up. Sign your claim as soon as the official site opens. This avoids any technical issues or missing out on the deadline.

Get Help

If you are stumped with the credit one class action lawsuit process, get assistance from a legal aid society or consumer advocacy organization.

Remember that providing accurate, correct information increases the chances of a simpler claim review. The more direct your evidence of the credit one bank lawsuit, the better.

Read Also: What Is The Capitol Plaque Civil Lawsuit About?

Frequently Asked Questions (FAQs):

Now, let’s look into the most frequently asked questions and find the proper answers to them. Shall we?

Yes. The Credit One Bank class action lawsuit for the TCPA robocall settlement covers customers and those with no relationship with the bank, but who received automated calls from 2014 to 2019.

No. There isn’t an active sign up claim form for a Credit One Bank class action suit that is open now. The official site will be opened once the court has given final approval.

Moreover, individuals may receive an email or mail notice with instructions, including the official settlement website address.

This week’s featured case is a TCPA settlement solely on illegal robocalls. Credit One Bank has had other cases filed against it, like a huge case involving claims of false credit reporting, outrageously high interest rates, and spooky fees.

The eligibility for those settlements is different.

You don’t need phone records to claim a credit one class action lawsuit. The number that you’ve given will be cross-checked with the bank’s call records by the settlement managers.

However, providing a sworn statement regarding the calls you received will validate your class action claim.

The $14 million figure is the total Credit One Bank settlement fund for the entire class of people impacted. The up to $1,000 figure is the projected high estimate of individual robocall payments an eligible claimant may be able to recover, depending on the number of valid claims received.

Apart from robocalls, the something is wrong with Credit One Bank issue typically includes complaints of misleading credit schemes, excessive fees (such as express payment fees), unclear card designs, and inappropriate communication with customers, often directed at low-score clients.

Generally, U.S. class action lawsuits like this Credit One Bank class action lawsuit only name U.S. residents who were called while physically present in the United States.

So, always check geographical limitations on the official notice of claim.

This TCPA settlement keeps consumer rights in a tight spotlight. It makes major banks and other large financial institutions do better when it comes to automated calls and more tightly follow telemarketing regulations.

Thus, it makes companies blink before using mass-calling technology without authorization.

Official notification will come from the court-appointed settlement administrator, not from the bank. Don’t reply to a suspicious email by following links or providing personal details. And remember that you never have to pay a fee to make your credit one bank lawsuit claim.

If you had credit with Credit One Bank and gave the number when you applied for credit, the bank can really say you gave “prior express consent” to be contacted about the debt, so the Credit One Bank class action lawsuit claim is difficult.

But if calls continued after asking them to stop, you might still have a claim.

We hope our article helped you learn the truth about the new Credit One Bank settlement!

![Understanding The Pay Transparency Law Of Massachusetts [2026 Guide]](https://lawyersinventory.com/wp-content/uploads/2026/02/massachusetts-pay-transparency-law-100x100.png)

0 Reply

No comments yet.