Today’s topic: USAA Data Breach Settlement.

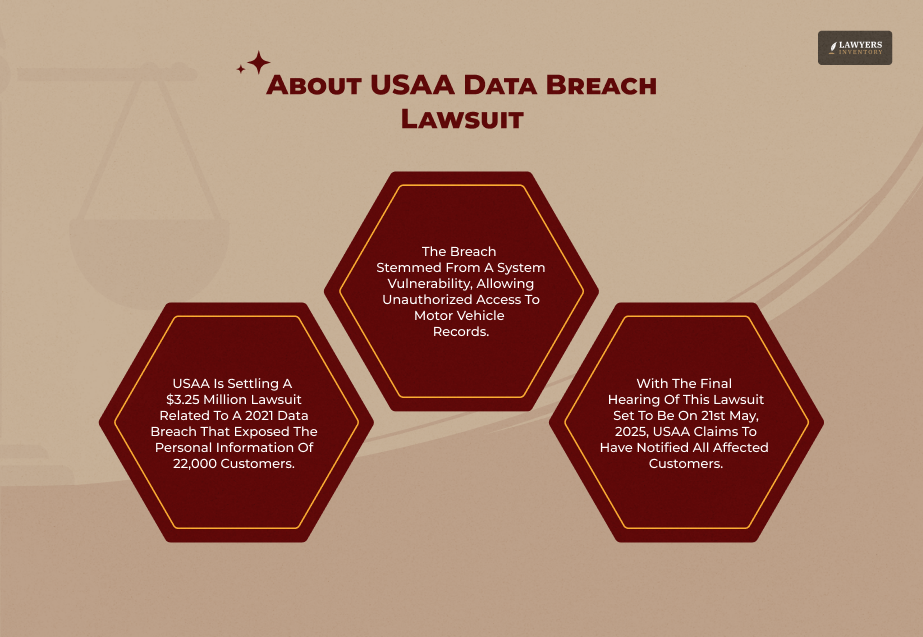

USAA will pay $3.25 million in a class action settlement in response to allegations that the company did not take adequate preventative measures for a data breach which impacted their customers’ sensitive personal information in 2021.

The settlement provides for the persons whose data have been accessed, stolen, or compromised in the breach that took place on or about May 6, 2021.

The complaint alleges that USAA failed to put in place the correct security measures for customer data. As a result, Consumer Affairs reports that the hackers were able to break into it.

Therefore, the personal and financial information of thousands of individuals was made available to the wrong people.

In this article, we will be talking about the following things:

- What was the USAA Data Breach incident?

- What are the major legal allegations?

- Timeline of the USAA Data Breach incident and lawsuit.

- How much is the USAA Data Breach Settlement?

- Eligibility and deadline to claim your money in the USAA Data Breach settlement.

Therefore, if these are a few things that you want to know, keep on reading this blog till the end…

What Happened: The USAA Data Breach Incident Explained

So, let us find out more on the USAA Data Breach Settlement, beginning with the most important facts concerning the real breach.

What Happened In The May 2021 USAA Data Breach?

The case, captioned In re USAA Data Security Litigation, was based on a data security breach in about May 2021. The crux of the matter was the manner USAA handled certain personal information.

Plaintiffs claimed USAA relied on automatic population of data from motor vehicle reports in violation. This process allegedly caused the unauthorized exposure or disclosure of confidential customer data.

What Data Was Exposed And Who Was Affected?

The breach largely exposed sensitive identifying data. These included driver’s license numbers and other identifiable data pertaining to motor vehicle records. The USAA Data Breach lawsuit claimed that the data security of the company was inadequate.

Moreover, the settlement includes potentially thousands of customers whose personal information was compromised through the breach.

Legal Case- Claims And USAA’s Response

The road to the USAA Data Breach Settlement was not smooth as far as legal arguments were concerned.

Legal Theories Asserted Against USAA

The class action complaint asserted numerous legal theories against the company.

- Negligence: Plaintiffs argued that USAA failed to use reasonable standards of security for a bank and an insurance firm.

- Breach of Contract: The lawsuit alleged USAA breached its contractual requirement to protect customer data.

- Statutory Violations: Numerous state and federal consumer protection and data privacy laws were invoked under.

The main grievance was that USAA’s alleged failure left customers directly vulnerable to future identity theft and financial fraud.

USAA’s Denial Of Wrongdoing

Observe that USAA staunchly denies all wrong. The company says it agreed to settle the suit in order not to incur the expense and hassle of continued litigation.

This is typical practice in large class actions. In spite of its denial of fault, USAA settled the 3.25$ million USAA Data Breach Settlement to pay its harmed members.

Settlement Terms- Eligibility And The Claim Filing Process

If you received an official notice of the USAA Data Breach Settlement, then you probably qualify. You must act by the deadline.

USAA Data Breach Settlement Timeline

Here’s a quick look at the timeline of events that eventually led to the current USAA Data Breach settlement:

- May 6, 2021: The data incident took place, resulting in the exposure of various pieces of personal information, such as driver’s license numbers, due to a security vulnerability in the USAA insurance quotation system.

- December 11, 2024: A request for preliminary approval of the $3.25 million settlement was made in a federal court in New York.

- April 7, 2025: This date marked an important occasion for members of the class related to filing a claim for a monetary award. After this date, no claims were accepted.

- May 21, 2025: The Final Approval Hearing was set up at the U.S. District Court for the Southern District of New York where the court would decide whether to grant the final approval of the settlement.

- At Present: Eligible members can claim their part.

Who Is Eligible For The USAA Data Breach Settlement?

The class members of the USAA Data Breach Settlement are defined in general terms. Generally, you are in if you received notice from USAA that your data was compromised in the data security breach in May 2021.

You’ll be included automatically if the settlement administrator can locate you.

The USAA Data Breach Settlement Claim Filing Process

In order to receive any settlement, you must file a USAA Data Breach Settlement Claim unless you received an automatic payment.

- Get Your Claim Code: You will be asked to present a special Notice ID or Claim ID, usually found in the original email or postal mail notice you received.

- Go to the Official Website: Claims must be filed using the official settlement website run by the court-appointed administrator.

- File by Deadline: Claim for deadline is normally April 7, 2025. Not filing within the deadline excludes you from receiving any payment from the USAA Data Breach Settlement.

Compensation And Payment Scheme

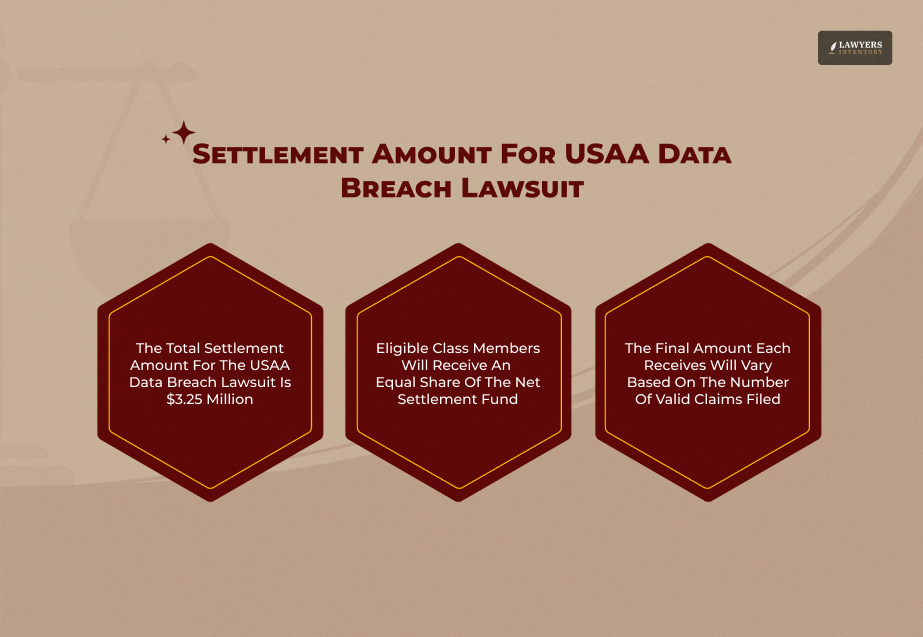

The settlement fund is $3.25 million. This amount caters to administration costs and attorney’s fees first. Whatever remains from the net fund is distributed to eligible Class Members who properly filed a valid USAA Data Breach Settlement Claim.

- Payout Logic: Payments are typically calculated on a pro rata basis. What this implies is the money is divided equally among all legitimate claimants.

- Estimated Payout: The actual payment per person is based on how many legitimate claims come in. The more people submitting, the less payment per person.

Estimates suggest payments maybe in the tens of dollars, but this is only an estimate until everyone submits their claims.

Read Also: AT&T Data Breach: What Affected Customers of This $13 Million Class Action Should Know

Key Dates And What’s Coming Next

You must closely monitor the deadlines announced by the authorities regarding the USAA Data Breach Settlement Filing.

- Claim Deadline (April 7, 2025): The deadline to submit your USAA Data Breach Settlement Claim form to be eligible for payment.

- Final Approval Hearing (May 21, 2025): The court holds this hearing to decide whether to give final approval to the settlement as fair and reasonable. Payments are only made after the court grants final approval and any appeal window has passed.

- Payment Timeline: Payments usually become available several months following the Final Approval Hearing (i.e., late 2025 or early 2026).

Consumer Advice And Guarding Yourself

The USAA Data Breach Settlement is a prime example of the real-life risk of data exposure. You must act above simple claim filing.

How To Verify The Settlement Notice And Avoid Scams?

Be very careful of phishing scams. Data breach notices are a popular technique adopted by scammers to ensnare victims.

- Official Sources Only- Use only the official settlement administrator website or court documents.

- Never Pay a Fee- You should never be requested to pay a fee to receive a settlement payment. Any request for payment is a red flag.

- Check the Docket- Double-check facts with the case docket (In re USAA Data Security Litigation) (Claim Depot).

Post-Breach Identity Protection

If your data was breached in the USAA Data Breach, you must take some security measures:

1. Watch Accounts: Review your financial statements and credit reports on a regular basis for anything out of the ordinary.

2. Credit Freeze: Temporarily put a freeze on your credit reports to prevent unauthorized accounts from being opened in your name.

3. Change Passwords: Update passwords and enable Two-Factor Authentication (2FA) on all your accounts.

Doing these things matters because risk due to identity theft can last for years after a USAA Data Breach or other data exposure incident.

Read Also: Google Incognito Lawsuit: Can You Really Fight Against Big Companies Over Data Privacy?

USAA Data Breach Settlement Frequently Asked Questions:

The USAA Data Breach Settlement offers compensation to the data security breach victims. Follow the right procedures to submit your USAA Data Breach Settlement Claim before the deadline and protect your identity in the future.

Firstly, you should be one of the USAA customers who lost their personal details during the data security breach.

Next, you probably have an official notice by USAA which clearly states that you will receive payment. However, you still have to file the USAA Data Breach Settlement Claim according to the court order.

You will need to visit the official settlement site, complete the online claim form. Remember to give details from your Claim ID or Notice ID.

The USAA Data Breach Settlement Filing deadline is on April 7, 2025.

Remember that the USAA Data Breach has led to exposing of sensitive information like driver’s license numbers, bank details and more. Keep your credit reports under constant monitoring, change passwords, and free credit cards with the three agencies namely, Experian, Equifax, and TransUnion to avoid identity theft.

![Understanding The Pay Transparency Law Of Massachusetts [2026 Guide]](https://lawyersinventory.com/wp-content/uploads/2026/02/massachusetts-pay-transparency-law-100x100.png)

0 Reply

No comments yet.