In the world of financial services, understanding contractual terms is crucial. And the recent lawsuits involving White Oak Global Advisors have again highlighted why this is so important.

The well-known investment company White Oak was the target of severe accusations of wealth mismanagement and illegal activity.

This case serves as a clear reminder to all investors, whether individuals or institutions, of the need to carefully read the fine language in their contracts.

Financial services contracts are legally enforceable agreements that specify the rights and obligations of each party, not merely formalities.

Significant financial losses and legal issues may result from clients’ ignorance or disregard of these provisions.

For example, the White Oak case resulted in a substantial fine of more than $96 million due to the alleged misbehavior and lack of openness.

Moreover, understanding these terms can help investors make informed decisions, protect their investments from financial crimes, and avoid potential pitfalls. It also ensures that financial advisors and firms are accountable for their actions.

Therefore, being thorough with contractual terms is not just about compliance; it’s about safeguarding your financial future. And that is exactly what I will talk about in this article! So, keep on reading till the end to learn more…

Overview of White Oak

White Oak Global Advisors has been around since 2007 and is quite a brand in the United States. This SEC-registered investment advisor is popular for being a trusted organization providing financial solutions. Or so people thought!

White Oak Global Advisors is a prominent investment firm that provides credit financing to small and medium-sized enterprises (SMEs). Over the years, the firm has built a reputation for its direct lending and private credit expertise.

Furthermore, White Oak offers various financial services, including asset-based lending, equipment financing, and working capital solutions. Their goal is to support businesses in achieving growth and stability through tailored financial solutions.

However, White Oak’s reputation has recently come under scrutiny due to a significant lawsuit. The firm is embroiled in several accusations, including mismanagement of assets and engaging in prohibited transactions.

What is the White Oak Global Advisors Lawsuit About?

Financial mismanagement, deceptive investment techniques, and fiduciary violations are all alleged in the White Oak Global Advisors complaint.

White Oak, a famous investment company specializing in direct lending and private credit, in trouble. It is facing accusations of mishandling customer money and omitting important information regarding investment opportunities and hazards.

Furthermore, plaintiffs have accused the company of giving investors false information that led them to make ill-informed choices.

Specific claims in the lawsuit include:

- Negligence in due diligence.

- Misrepresentation of investment risks and returns.

- Prioritizing the firm’s interests over those of its clients.

If proven, such claims might lead to harsh financial fines, compensation for impacted investors, and long-term harm to White Oak’s image.

A settlement or a full trial are possible outcomes of the current legal dispute. Either outcome might lead to heightened regulatory oversight throughout the financial sector, focusing on accountability and transparency.

This case may have serious financial, operational, and reputational ramifications for White Oak and its stakeholders that might undermine investor confidence and the company’s chances for future expansion.

The case also emphasizes how crucial strict governance and ethical standards are to investment management.

Allegations in the White Oak Global Advisors Lawsuit

The lawsuit against White Oak Global Advisors has been a wake-up call for the financial industry, spotlighting key issues that every investor should understand.

At the heart of the case were allegations of mismanagement and a breach of critical responsibilities, such as fiduciary duties and transparent disclosures.

Here’s a breakdown of the major allegations and what they mean for investors and financial service providers.

Breach of Contract

Firstly, one of the primary accusations against White Oak was a breach of contract. Contracts in financial services lay out the roles, responsibilities, and expectations between clients and advisors.

In this case, White Oak has failed to uphold its agreed-upon obligations, according to the plaintiffs. The New York State Nurses Association (NYSNA) Pension Plan alleged that White Oak didn’t follow prudent investment practices as promised.

Eventually, this led to significant financial losses for thousands of nurses relying on these funds for their retirement security.

For investors, this underscores the importance of reading and understanding contractual terms. A clear, detailed contract should outline expected returns and highlight the advisor’s responsibilities in managing risks and providing ongoing transparency.

Breach of Fiduciary Duty

Secondly, the plaintiffs have also challenged White Oak’s actions as a violation of fiduciary duties. A fiduciary is legally bound to act in the best interests of their clients, which involves loyalty, care, and good faith.

Under the Employee Retirement Income Security Act (ERISA), investment managers like White Oak must prioritize their clients’ financial well-being above all else.

The court found that White Oak failed to meet these high standards. The firm allegedly mismanaged investments ignored its client’s specific needs (the NYSNA Pension Plan) and acted in ways that created conflicts of interest.

For instance, undisclosed negotiations related to a key executive raised questions about whether White Oak’s decisions were influenced by self-interest rather than client welfare.

This serves as a reminder to investors to work with firms that demonstrate integrity and a transparent decision-making process.

Failure to Disclose Risks

White Oak’s inadequate disclosure of investment risks was another major accusation. Additionally, financial advisors must disclose any pertinent risks for customers to make educated decisions.

Being transparent is not just morally right; it is required by law. In this instance, however, White Oak is accused of giving inadequate information regarding the dangers associated with its investment strategy.

Clients may make ignorant judgments that endanger their financial destiny due to this lack of openness. Additionally, always ensure your advisor discusses each investment option’s trade-offs in detail and is honest about any possible dangers.

Misrepresentation of Investment Performance

Lastly, the lawsuit included claims that White Oak misrepresented its investment performance.

Accurate reporting of performance metrics is crucial for maintaining trust. Investors depend on these figures to evaluate whether their funds are effectively managed.

White Oak was accused of inflating or misrepresenting its investment outcomes, creating a false sense of security among its clients. Such misrepresentation undermines the foundation of trust and accountability in financial services.

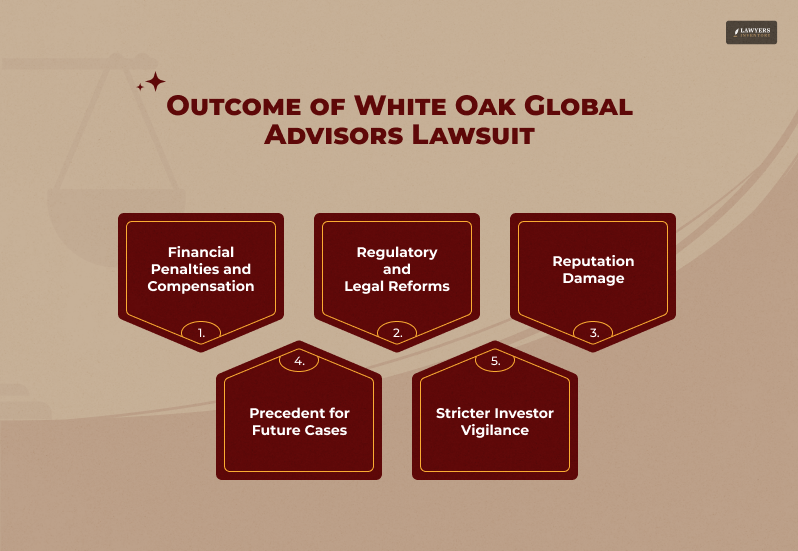

White Oak Global Advisors Lawsuit: What are the Possible Outcomes?

The White Oak Global Advisors lawsuit has brought serious attention to issues like mismanagement and breach of fiduciary duties in financial services.

The case has already resulted in significant consequences, but broader potential outcomes could reshape financial firms’ operations.

Financial Penalties and Compensation

First, White Oak has already been ordered to pay substantial damages, including $96 million, to the New York State Nurses Association (NYSNA) Pension Plan.

Such financial penalties compensate the affected parties and serve as a deterrent for other firms.

This payout highlights how costly fiduciary duty and transparency breaches can be for any financial institution.

Regulatory and Legal Reforms

Secondly, this lawsuit will likely influence stricter regulatory oversight across the financial industry.

Lawmakers and regulatory bodies could implement new compliance requirements, particularly on transparency, risk management, and fiduciary obligations.

Enhanced monitoring could ensure investment firms act in their clients’ best interests, avoiding conflicts of interest.

Reputation Damage

Beyond financial losses, White Oak’s reputation has taken a hit. Rebuilding trust will require compliance reforms and a demonstration of ethical practices.

Other firms are watching closely and may proactively adopt better transparency measures to avoid similar reputational risks.

Precedent for Future Cases

This lawsuit sets a legal precedent for how breaches of fiduciary duties are handled. It emphasizes the accountability of financial advisors under laws like ERISA, shaping future lawsuits and judicial interpretations.

Stricter Investor Vigilance

Finally, for investors, the case serves as a wake-up call. They will likely demand better transparency and thoroughly vet contracts and advisors before committing funds. Moreover, this could lead to a healthier, more accountable financial ecosystem.

Which Lawyer Should You Seek in a Similar Case?

Now that you know the legal issues related to White Oak Global Advisors, let me tell you what you can do if facing a similar scenario. Yes, you heard that right!

Choosing the right lawyer can significantly affect the outcome if you find yourself in a situation similar to the White Oak Global Advisors lawsuit.

Cases involving financial mismanagement, breach of fiduciary duty, or contractual disputes are complex, so hiring a lawyer with the right expertise is essential.

But who should you go to? How to pick the right lawyer for your case? Here are a few things that you need to do:

Expertise in Financial Law

First, seek an attorney experienced in financial services law. These professionals understand the intricate regulations governing investment firms and financial institutions, including laws like the Employee Retirement Income Security Act (ERISA). Furthermore, they can build a strong case around breaches of fiduciary duty, misrepresentation, or failures in transparency.

Specialization in Contract Law

If the dispute involves a breach of contract, choose a lawyer skilled in contract law. They will help you analyze the fine print, identify violations, and argue how the other party failed to meet their obligations. Additionally, their attention to detail ensures no clause or term is overlooked during litigation.

Litigation Experience

Not all lawyers are equipped to handle court proceedings. Hire a litigator with a proven track record in similar lawsuits for cases likely to escalate to arbitration or trial. Their experience can provide a strategic advantage, from evidence collection to courtroom arguments.

Knowledge of Regulatory Compliance

Lawsuits against financial advisors often involve regulatory violations. Besides, attorneys familiar with federal regulations and compliance requirements can help identify and present breaches effectively in court.

A Client-Centric Approach

Lastly, find a lawyer who communicates clearly and prioritizes your interests. Financial lawsuits can be stressful and having someone who simplifies the process while keeping you informed can make a big difference.

White Oak Global Advisors Lawsuit: How Has It Impacted the Financial Sector

In conclusion, the White Oak Global Advisors lawsuit has sent ripples through the financial industry, emphasizing the importance of accountability, transparency, and ethical practices. Its outcomes have affected White Oak and reshaped the broader sector.

One of the most immediate impacts is increased scrutiny of fiduciary duties. The lawsuit highlighted the consequences of failing to prioritize client interests, as investors found White Oak to have mismanaged investments and breached its fiduciary responsibilities.

This case has reminded investment firms of their legal obligation to act in their client’s best interests, encouraging more stringent internal controls.

Furthermore, regulators are also paying closer attention. The case has led to calls for stricter oversight, with financial institutions facing more robust audits and compliance checks. Firms are pressured to disclose risks transparently and follow ethical investment practices.

The lawsuit has also influenced client behavior. Investors are now more cautious, demanding clearer contracts and more detailed information about investment strategies. This shift fosters a culture of accountability, where trust and transparency are pivotal.

Finally, it serves as a cautionary tale, encouraging the industry to avoid conflicts of interest and adhere strictly to contractual terms. The financial sector is now moving toward greater accountability to rebuild client confidence.

Read Also:

- 72 Sold Lawsuit Exposed the Deceptive Marketing Strategies of Real Estate Agents!

- Smoothstack Lawsuit: Beware of Unlawful Wage Scheme and Employment Contracts

- Why $100 Million Settlement Fund from Verizon Wireless Class Action Lawsuit is All Over the News!

0 Reply

No comments yet.